“What’s unclear for us is how much of these banking stresses are primary to a widespread credit score crunch. And then that credit crunch, just as you mentioned, would then gradual down the economy,” Minneapolis Fed President Neel Kashkari said in an interview with CBS’ Deal with The Nation.

John Lamparski | Getty Photos Amusement | Getty Photos

“It surely provides us closer ideal now” — that was Minneapolis Fed President Neel Kashkari’s response to a concern, throughout a CBS “Face The Nation” job interview, on whether or not the hottest turmoil in the banking sector could provide the U.S. closer to a economic downturn.

“What is unclear for us is how considerably of these banking stresses are main to a common credit crunch. And then that credit rating crunch, just as you reported, would then slow down the overall economy,” he reported.

similar investing news

Kashkari extra that Fed officers are checking the impact from the fallout of the banking sector “really, very carefully,” and the existing method has the “complete help” of the Federal Reserve.

“The banking system has a potent money placement and a good deal of liquidity and has the complete help of the Federal Reserve and other regulators standing powering it,” he said.

“The U.S. banking process is resilient, and it’s seem,” said Kashkari, when questioned about the security of the banking system’s capability to manage additional dangers viewed in California and New York.

Kashkari’s text echoed that of officers at the Economic Steadiness Oversight Council, which held a closed conference past week as Fed information confirmed U.S. customers withdrew just about $100 billion from banks for the 7 days ended March 15, even though this is a tiny portion of the whole.

Individually, sources instructed CNBC that the movement of deposits from scaled-down banking institutions to large institutions, this sort of JPMorgan Chase and Wells Fargo, has slowed to a trickle in current days.

Kashkari described the growth as “optimistic” and a indicator of restored religion.

“There are some about symptoms, the favourable indication is deposit outflows appear to have slowed down. Some self-assurance is becoming restored amid more compact and regional banks,” he stated.

Too before long to know

Kashkari said it really is as well early to predict what any of this implies for the up coming Federal Open up Marketplace Committee meeting in May. The Fed lifted charges by 25 foundation points final week.

“It is really much too soon to make any forecasts about the next curiosity charge meeting that we have, the following FOMC meeting,” he explained, incorporating that the strain in the banking sector would be “the things that are heading to be most centered on.”

He additional that banking difficulties may well make it a lot easier for the central financial institution to obtain its aim of managing inflation.

“On one particular hand, this sort of strains could then carry down inflation, so we have to do less work with the federal money fee to deliver the economic system into stability,” he stated.

“But ideal now, it truly is unclear how considerably of an imprint these banking stresses are heading to have on the financial state. But it is really anything to observe quite diligently,” he extra.

‘Safe haven’ Asia

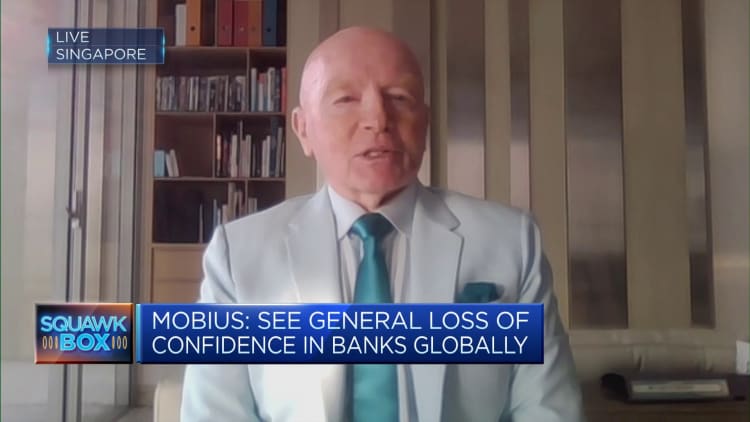

The banking fears in the United States and Europe appear to be considerably less pronounced in the Asia-Pacific area, Mark Mobius, founding companion of of Mobius Money Associates, instructed CNBC.

“The banking companies below are a great deal, significantly much more cautious, significantly more cautious, creating absolutely sure that they have a robust balance sheet,” Mobius said on CNBC’s “Squawk Box Asia” on Monday.

“I imagine this is in some ways, type of a secure haven. Financial institutions in Singapore, banking institutions in Thailand and so forth are in really superior shape,” he explained.

Mobius’ responses come following shares of Deutsche Bank fell on Friday, marking a 3rd consecutive day of losses, soon after the cost of insuring against any default by the German establishment spiked.

About the weekend, Intercontinental Monetary Fund main Kristalina Georgieva emphasised that risks to economical steadiness have greater.

— CNBC’s Jeff Cox and Hugh Son contributed to this report