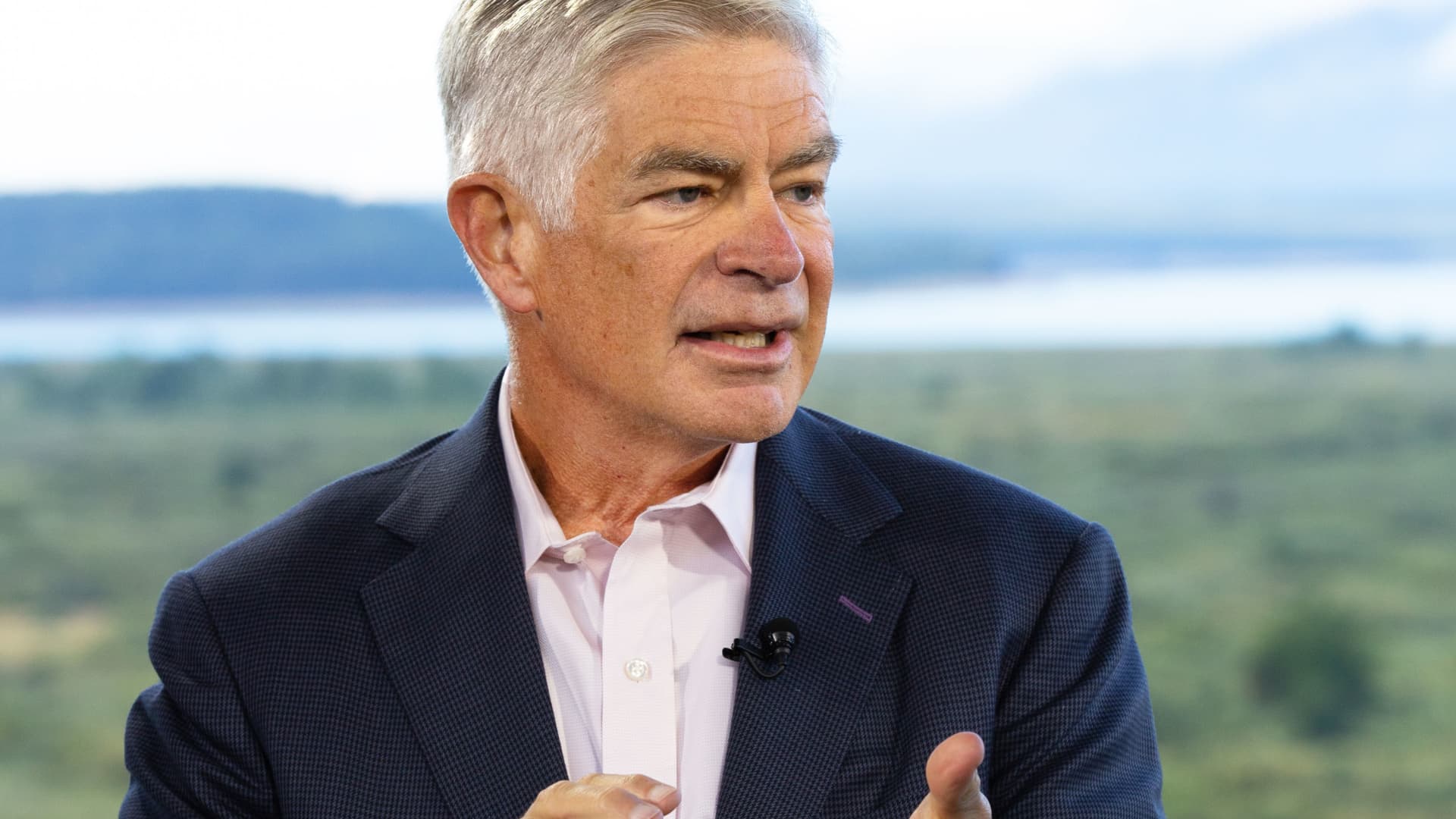

Philadelphia Federal Reserve President Patrick Harker on Thursday explained increased desire charges have carried out tiny to continue to keep inflation in look at, so a lot more improves will be required.

“We are heading to continue to keep boosting premiums for a although,” the central lender official explained in remarks for a speech in New Jersey. “Supplied our frankly disappointing lack of progress on curtailing inflation, I anticipate we will be very well above 4% by the finish of the 12 months.”

The latter remark was in reference to the fed cash price, which at this time is targeted in a vary amongst 3%-3.75%.

Markets commonly anticipate the Fed to approve a fourth consecutive .75 share point fascination amount hike in early November, adopted by an additional in December. The expectation is that the Federal Open up Market place Committee, of which Harker is a nonvoting member this 12 months, will then take rates a bit greater in 2023 just before settling in a variety about 4.5%-4.75%.

Harker indicated that those higher charges are likely to stay in area for an extended period of time.

“Someday subsequent yr, we are heading to prevent climbing charges. At that position, I feel we really should hold at a restrictive amount for a though to allow financial coverage do its get the job done,” he claimed. “It will get a although for the better price tag of capital to do the job its way by the economic climate. After that, if we have to, we can tighten more, based mostly on the data.”

Inflation is now functioning about its optimum degree in far more than 40 many years.

In accordance to the Fed’s favored gauge, headline personal consumption expenses inflation is operating at a 6.2% yearly price, although the core, excluding foodstuff and power charges, is at 4.9%, each effectively previously mentioned the central bank’s 2% focus on.

“Inflation will occur down, but it will take some time to get to our goal,” Harker stated.