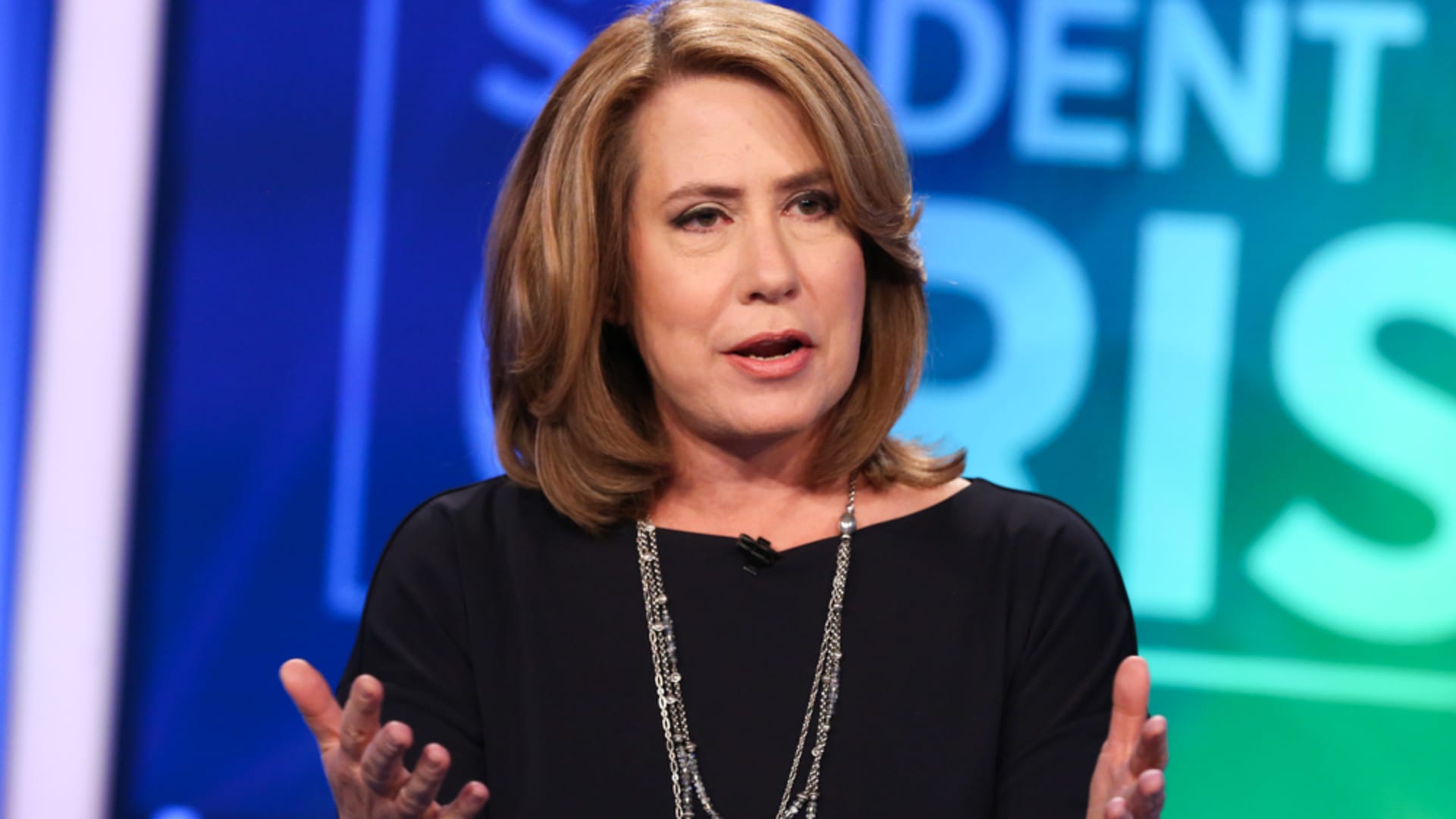

Market optimism more than the prospective for curiosity price cuts upcoming year is dangerously overdone, in accordance to previous FDIC Chair Sheila Bair.

Bair, who ran the FDIC all through the 2008 fiscal crisis, suggests Federal Reserve Chair Jerome Powell was irresponsibly dovish at very last week’s coverage assembly by building “irrational exuberance” among the investors.

“The aim even now requirements to be on inflation,” Bair told CNBC’s “Speedy Revenue” on Thursday. “You will find a extensive way to go on this battle. I do worry they’re [the Fed] blinking a little bit and now attempting to pivot and fear about economic downturn, when I don’t see any of that risk in the info so much.”

Soon after holding fees continuous Wednesday for the 3rd time in a row, the Fed established an expectation for at least three charge cuts upcoming calendar year totaling 75 foundation details. And the marketplaces ran with it.

The Dow hit all-time highs in the remaining three times of very last week. The blue-chip index is on its longest weekly acquire streak considering the fact that 2019 whilst the S&P 500 is on its longest weekly earn streak considering that 2017. It is now 115% previously mentioned its Covid-19 pandemic very low.

Bair believes the market’s bullish reaction to the Fed is on borrowed time.

“This is a error. I consider they have to have to preserve their eye on the inflation ball and tame the market place, not boost it with this … dovish dot plot,” Bair claimed. “My issue is the prospect of the substantial decreasing of prices in 2024.”

Bair even now sees prices for services and rental housing as critical sticky places. In addition, she concerns that deficit spending, trade limits and an ageing population will also produce significant inflation pressures.

“[Rates] ought to stay set. We’ve received good pattern lines. We need to be affected individual and check out and see how this performs out,” Bair stated.

Disclaimer