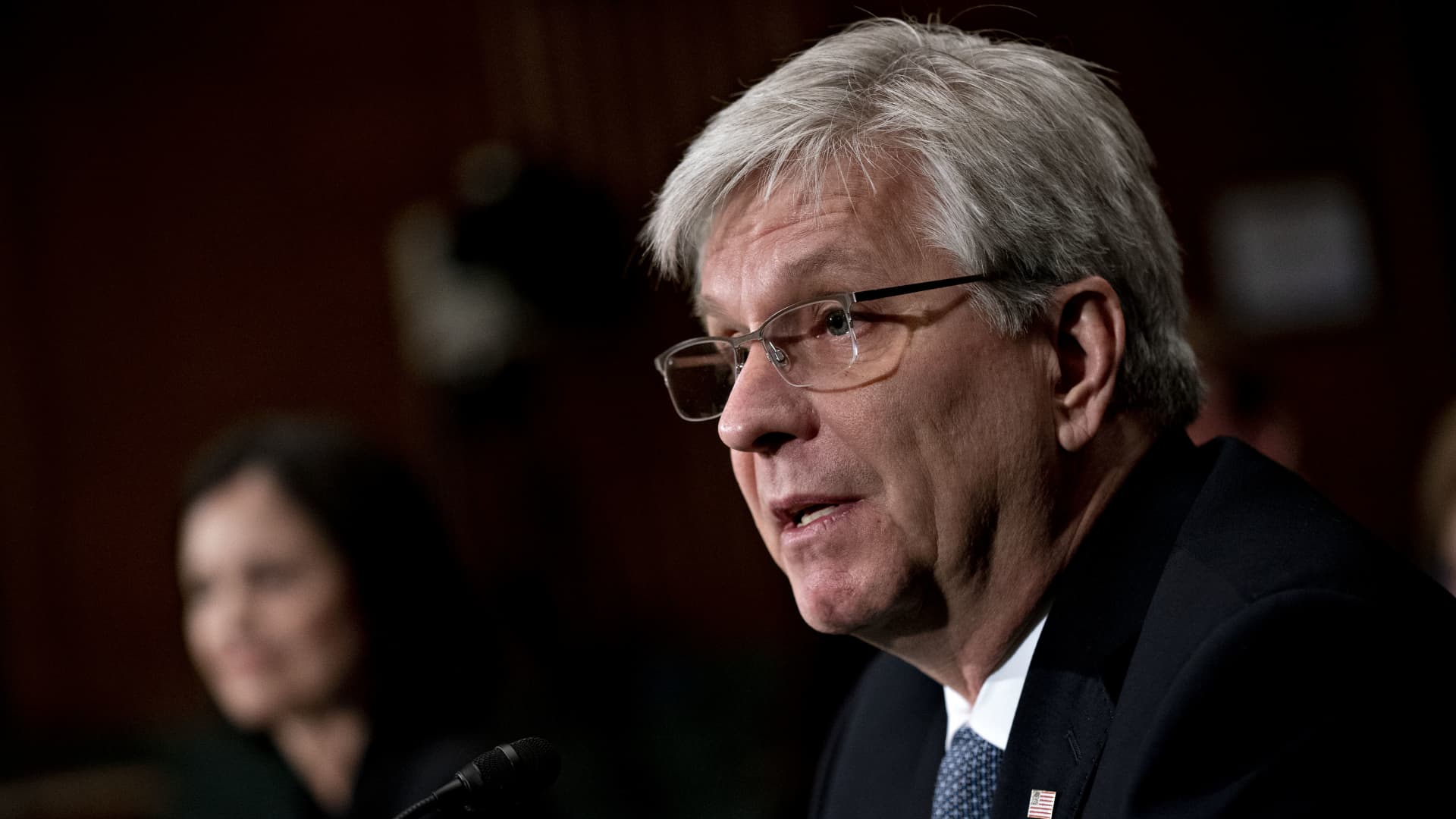

Christopher Waller, U.S. President Donald Trump’s nominee for governor of the Federal Reserve, speaks during a Senate Banking Committee confirmation hearing in Washington, D.C., U.S, on Thursday, Feb. 13, 2020.

Andrew Harrer | Bloomberg | Getty Images

Federal Reserve Governor Christopher Waller said he’s willing to consider what would be the most aggressive interest rate hike in decades at the central bank’s meeting later this month.

Waller said he supports a 75 basis point hike at the July 26-27 meeting. But he will be watching data and keeping an open mind about what the Fed should do to control inflation, which is running at its fastest pace since 1981.

The rate-setting Federal Open Market Committee approved a 75 basis point move in June, the largest one-month increase since 1994.

“I support another 75-basis point increase” at the next FOMC meeting, Waller said in remarks at an event in Victor, Idaho.

“However, my base case for July depends on incoming data,” he added. “We have important data releases on retail sales and housing coming in before the July meeting. If that data comes in materially stronger than expected, it would make me lean towards a larger hike at the July meeting to the extent it shows demand is not slowing down fast enough to get inflation down.”

Following Wednesday’s consumer price index data showing 12-month inflation at 9.1%, markets started pricing in a full percentage point, or 100 basis point, increase in the Fed’s benchmark short-term borrowing rate. The probability for that outcome stood at nearly 80% on Thursday morning but receded to 44% in the afternoon, according to CME Group data. Though he said he’s open to the larger hike, Waller said the earlier aggressive market pricing was “kind of getting ahead of itself.”

Retail sales data will be released Friday and is expected to reflect a spending increase of 0.9% in June, a month when the CPI rose 1.1%. The figures are not adjusted for inflation.

Numbers on housing starts and building permits are due July 19; starts tumbled 14.4% in May, while permits fell 7%. Permits for June are expected to edge lower, while starts are expected to go higher, according to FactSet estimates.

“If I see the incoming data the next two weeks coming in and showing me that demand is still really strong and robust, then I’m going to lean into a higher rate hike,” Waller said.

If the Fed takes the 100 basis point route, it would mark the biggest one-month increase since the early 1980s, when the central bank was trying to control runaway inflation.

Getting prices down is the paramount mission of the Fed now, said Waller, who expects still more rate hikes even after this month’s.

“I think we need to move swiftly and decisively to get inflation falling in a sustained way, and then consider what further tightening will be needed to achieve our dual mandate,” he said.

While he expressed strong concern about inflation, Waller was more optimistic about the economy.

Worries are mounting that the U.S. is headed for or already in a recession, but Waller said the strength of the jobs market has him “feeling fairly confident that the U.S. economy did not enter a recession in the first half of 2022 and that the economic expansion will continue.”

Even with the Fed tightening, he said he thinks the economy can achieve a “soft landing” that won’t include a recession. U.S. GDP contracted 1.6% in the first quarter, and the Atlanta Fed’s GDPNow tracker is indicating a 1.2% decline in Q2, meeting the rule-of-thumb definition of a recession.