Federal Reserve Chair Jerome Powell on Friday referred to as for extra vigilance in the combat versus inflation, warning that supplemental curiosity amount improves could be still to arrive.

Although acknowledging that progress has been made, the central lender chief stated inflation is nonetheless higher than where by policymakers really feel snug. He famous that the Fed will continue being flexible as it contemplates further more moves, but gave minimal sign that it is really ready to begin easing up at any time shortly.

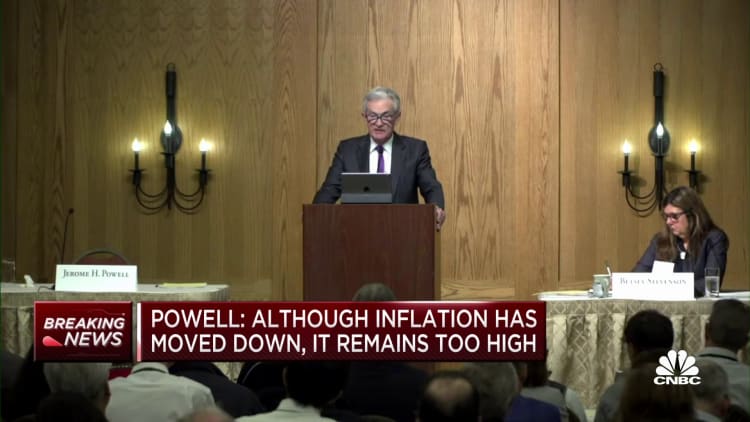

“Despite the fact that inflation has moved down from its peak — a welcome development — it stays much too high,” Powell explained in geared up remarks for his keynote handle at the Kansas Town Fed’s yearly retreat in Jackson Gap, Wyoming. “We are ready to raise prices further if acceptable, and intend to hold plan at a restrictive amount right until we are self-confident that inflation is relocating sustainably down towards our objective.”

The speech resembled remarks Powell made very last calendar year at Jackson Hole, for the duration of which he warned that “some discomfort” was possible as the Fed continues its attempts to pull runaway inflation again down to its 2% purpose.

But inflation was managing very well forward of its existing speed back again then. Irrespective, Powell indicated it is too before long to declare victory, even with info this summertime working mainly in the Fed’s favor. June and July each saw easing in the pace of cost will increase.

“The reduce every month readings for core inflation in June and July were being welcome, but two months of fantastic info are only the commencing of what it will just take to construct self-confidence that inflation is going down sustainably towards our target,” he explained.

Powell acknowledged that risks are two-sided, with challenges of carrying out both of those far too much and too tiny.

“Undertaking as well minimal could allow for previously mentioned-target inflation to come to be entrenched and in the end require financial policy to wring extra persistent inflation from the overall economy at a superior expense to work,” he mentioned. “Undertaking also much could also do unneeded harm to the financial system.”

“As is frequently the case, we are navigating by the stars underneath cloudy skies,” he extra.

Markets ended up volatile right after the speech, with the Dow Jones Industrial Ordinary off its highs of the session and Treasury yields soaring. In 2022, shares plunged next Powell’s Jackson Gap speech.

“Was he hawkish? Certainly. But provided the jump in yields recently, he wasn’t as hawkish as some had feared,” stated Ryan Detrick, main industry strategist at the Carson Group. “Keep in mind, last yr he took out the bazooka and was way much more hawkish than any individual expected, which observed heavy selling into Oct. This time he strike it a lot more down the middle, with no main modifications in upcoming hikes a welcome indicator.”

A have to have to ‘proceed carefully’

Powell’s remarks adhere to a collection of 11 fascination charge hikes that have pushed the Fed’s vital desire amount to a goal assortment of 5.25%-5.5%, the highest amount in much more than 22 years. In addition, the Fed has reduced its balance sheet to its lowest degree in extra than two decades, a system which was found about $960 billion really worth of bonds roll off due to the fact June 2022.

Marketplaces of late have been pricing in very little possibility of one more hike at the September conference of the Federal Open up Market place Committee, but are pointing to about a 50-50 prospect of a remaining maximize at the November session.

Powell furnished no distinct indicator of which way he sees the conclusion going.

“Offered how much we have occur, at upcoming conferences we are in a posture to continue carefully as we evaluate the incoming data and the evolving outlook and risks,” he said.

Having said that, he gave no indicator that he’s even thinking of a price cut.

“At approaching meetings, we will assess our development dependent on the totality of the information and the evolving outlook and risks,” Powell said. “Based mostly on this assessment, we will progress cautiously as we determine regardless of whether to tighten more or, alternatively, to hold the coverage level consistent and await further info.”

He observed the chance of sturdy economic growth in the experience of widespread economic downturn expectations.

Obtaining into aspects

While final year’s speech was unusually short, this time all around Powell offered a minimal more depth into the variables that will go into policymaking.

Particularly, he broke inflation into 3 essential metrics and stated the Fed is most concentrated on main inflation, which excludes unstable foods and electricity selling prices. He also reiterated that the Fed most carefully follows the own usage expenses rate index, a Commerce Department measure, somewhat than the Labor Department’s consumer rate index.

The 3 “broad elements” of which he spoke entail goods, housing services this kind of as rental prices and nonhousing providers. He observed progress on all 3, but mentioned nonhousing is the most tricky to gauge as it is the the very least sensitive to curiosity rate changes. That class incorporates this kind of issues as wellbeing care, food solutions and transportation.

“Twelve-month inflation in this sector has moved sideways because liftoff. Inflation calculated more than the earlier a few and 6 months has declined, nevertheless, which is encouraging,” Powell explained. “Supplied the dimensions of this sector, some additional progress right here will be vital to restoring price stability.”

No change to inflation intention

In addition to the broader plan outlook, Powell honed in some locations that are crucial both equally to current market and political concerns.

Some legislators, especially on the Democratic aspect, have advised the Fed raise its 2% inflation target, a go that would give it additional plan versatility and may well prevent further more fee hikes. But Powell rejected that strategy, as he has accomplished in the earlier.

“Two % is and will keep on being our inflation target,” he explained.

On one more concern, Powell selected mostly to stay away from the debate in excess of what is the for a longer period-run, or all-natural, fee of desire that is neither restrictive nor stimulative – the “r-star” level of which he spoke at Jackson Hole in 2018.

“We see the existing stance of coverage as restrictive, putting downward tension on economic exercise, hiring, and inflation,” he reported. “But we can’t discover with certainty the neutral charge of interest, and consequently there is generally uncertainty about the precise amount of monetary coverage restraint.”

Powell also famous that the earlier tightening moves probably have not designed their way as a result of the procedure but, delivering even further warning for the long run of plan.