Mark Zuckerberg for the duration of Metaverse conversation on CNBC

Supply: CNBC

Sixteen months after Facebook crossed $1 trillion in marketplace cap, signing up for an distinctive club consisting of Apple, Microsoft, Alphabet and Amazon, its guardian enterprise Meta is really worth significantly less than Household Depot and scarcely additional than Pfizer and Coca-Cola.

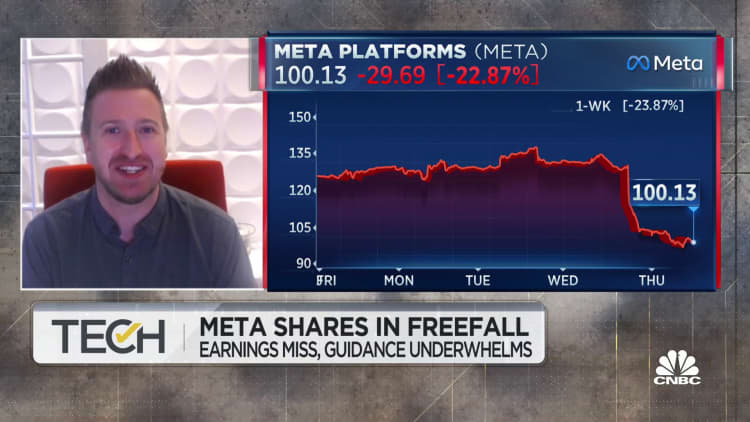

Far from Facebook’s Massive Tech times, Meta is no for a longer time amongst the 20 most important U.S. companies immediately after the stock sank 23% on Thursday. The business has lose 70% of its value this 12 months and 74% since the inventory peaked in September 2021, totaling in excess of $730 billion in sector cap misplaced. It really is trading at its least expensive considering the fact that early 2016, when Barack Obama was still president.

The stunning collapse of Meta’s share rate is reminiscent of the dot-com bust times, but considerably bigger in terms of price erased from a one company. The slide commenced late past calendar year as indications of a sputtering economic system begun to emerge, and accelerated in early 2022 immediately after the corporation reported Apple’s privateness transform to iOS would final result in a $10 billion revenue hit this calendar year.

Founder and CEO Mark Zuckerberg has been not able to prevent the bleeding and only would seem to be earning issues worse. Due to the fact switching the organization name to Meta a yr back Friday, Zuckerberg has stated its potential is the metaverse, a virtual universe of function, enjoy and schooling. But investors just see it as a multibillion-greenback cash pit, though the core marketing business shrinks — Fb is forecasting a third consecutive drop in income for the fourth quarter.

A to some degree perplexed Zuckerberg acknowledged on Wednesday’s earnings call that “there are a lot of points going on suitable now in the small business and in the globe.”

“You can find macroeconomic challenges, you will find a ton of competitors, you can find ads troubles particularly coming from Apple, and then you will find some of the longer-phrase issues that we’re having on charges simply because we think that they are likely to supply bigger returns more than time,” Zuckerberg explained. “I respect the persistence and I believe that individuals who are affected individual and devote with us will be rewarded.”

Meta now trades for just three situations profits, fewer than one-third of its five-12 months typical. It is now really worth 50 % as a lot as Berkshire Hathaway and has a smaller sized sector cap than corporations which include UnitedHealth, Chevron, Eli Lilly, Procter & Gamble, Financial institution of The united states and AbbVie.

The other four tech organizations that propelled earlier the trillion-greenback mark are all nonetheless there and remain the four most useful U.S. enterprises, even nevertheless they’ve taken major hits this yr as perfectly together with the relaxation of the current market.

Within tech, the other two firms Meta has fallen at the rear of are Tesla and Nvidia. Following on the checklist would be Oracle, which is presently valued at just over $200 billion, or $70 billion down below Meta.

Observe: This is a accurate bet-the-enterprise instant for Zuckerberg