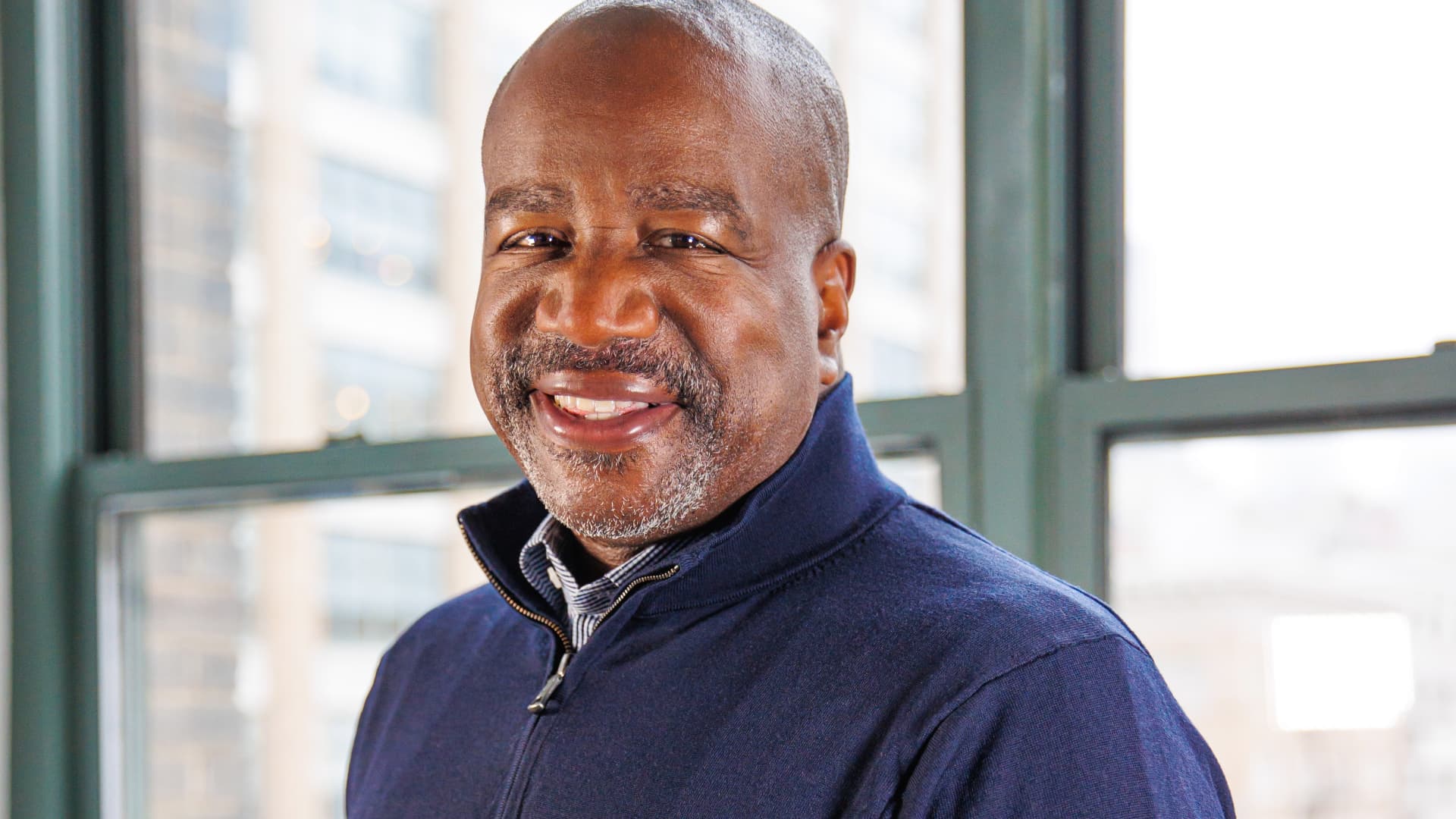

Orlando Ashford has been appointed chief people officer of Michael Rubin’s sports business platform Fanatics.

Source: Fanatics

Orlando Ashford, known for holding senior level HR roles at Fortune 500 companies like Marsh & McLennan, Coca-Cola and Motorola, is joining Fanatics in a newly created role as companywide chief people officer, the sports business conglomerate announced Thursday.

Ashford will report directly to both CEO Michael Rubin and CFO Glenn Schiffman.

At Fanatics, he will be tasked with managing global human resources, which includes matters that range from talent development to diversity and inclusion efforts, the company said.

“As we continue to grow and expand, it becomes even more important to double down on organizational development, and I can’t think of a better person to lead this charge than Orlando,” Rubin stated in a press release.

Each of the three Fanatics’ businesses — commerce, collectibles, betting & gaming — have heads of HR that report to those respective business CEOs. Ashford will be working closely with these leaders across verticals, while he reports to both Rubin and Schiffman. He will be Rubin’s sixth direct report.

Prior to joining Fanatics, Ashford was a strategic advisor to private-equity firm Sycamore Partners. He also previously served as president of Carnival-owned Holland America Line. He’s currently the chairman of the board of pharmaceutical company Perrigo, and sits on the board of Syndio — a private, venture-backed HR tech company.

The creation of Ashford’s role comes at a critical time, as corporate leaders face an avalanche of workplace issues with no easy answers. The scramble to find workers, offer pay and benefits to keep them from quitting, and increase diversity in the workforce, all while navigating a new remote-hybrid-in person work arrangement is unfamiliar territory for most chief executives.

“Fanatics is a special company, one that I’ve long admired, where I can take my energy and expertise to further establish a diverse, platform-wide company culture comprised of the best and brightest people,” Ashford said in the release.

Fanatics has established itself as the leader for sports merchandise and commerce, with exclusive licensing deals ranging from the NFL and NBA to the International Olympic Committee. It’s now looking to expand its sports industry reach even further, setting its sights on digital collectibles, sports betting, and trading cards.

The company, most recently valued at $27 billion, ranked No. 21 on this year’s CNBC Disruptor 50 list.

Last week, Fanatics announced it hired Andrea Ellis to be the chief financial officer of its betting and gaming division, which is expected to launch in January.