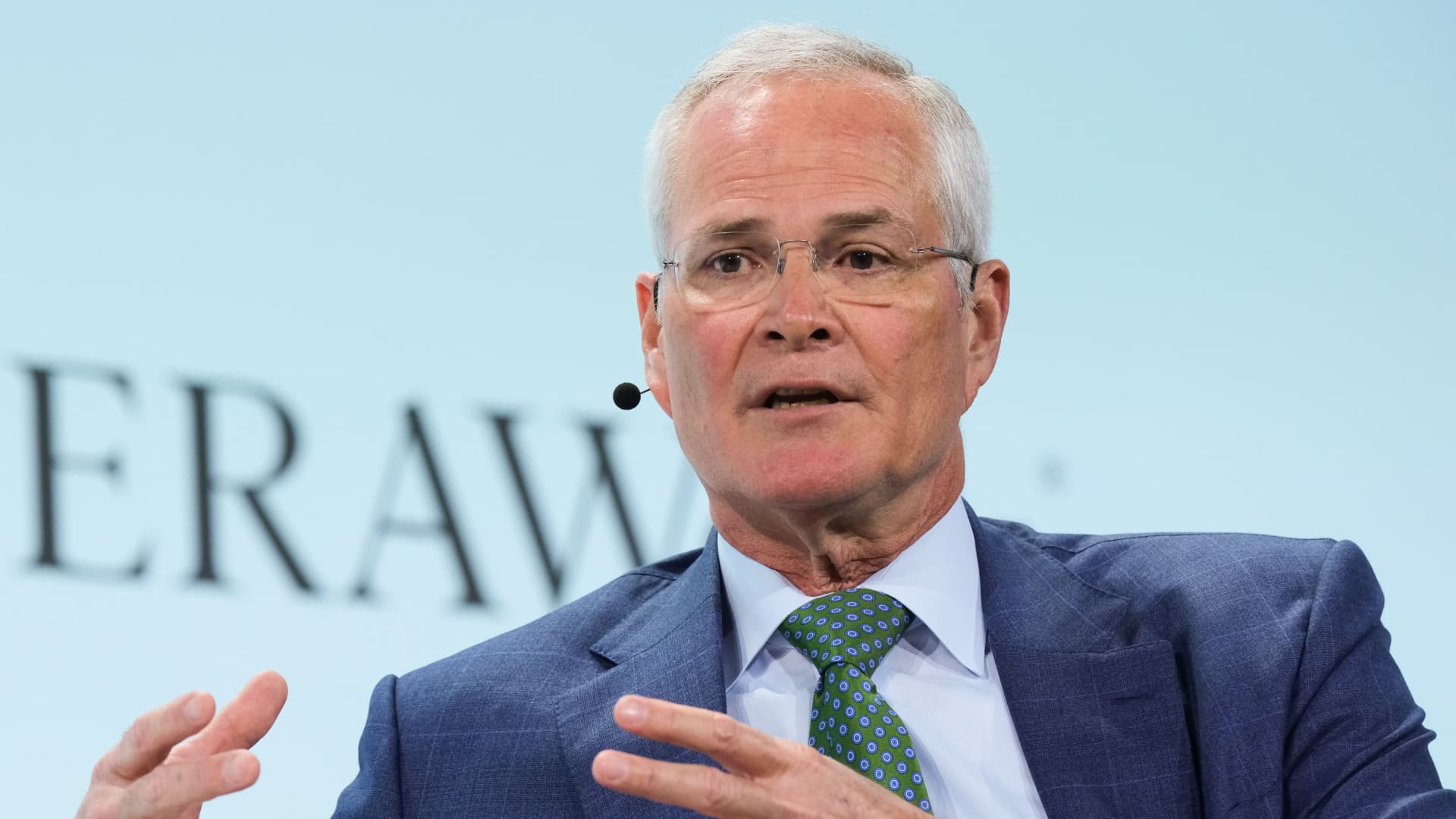

Darren Woods, chairman and chief govt officer of Exxon Mobil Corp, speaks for the duration of the 2024 CERAWeek by S&P Worldwide conference in Houston, Texas, US, on Monday, March 18, 2024.

F. Carter Smith | Bloomberg | Getty Pictures

Exxon CEO Darren Woods said Monday that the dispute with Chevron in excess of Hess Corporation‘s oil belongings in Guyana likely will not be solved until 2025.

“My see is it will go into 2025,” Woods instructed CNBC’s David Faber at the Milken Institute’s International Convention in Los Angeles. Hess had earlier indicated that the scenario could drag into upcoming year.

“This is an important arbitration clearly not only for Exxon Mobil but for Chevron and Hess,” Woods mentioned. “What we need to have to do is take our time to do what is actually right to make guaranteed that we do all the owing diligence and we get to the solution — the ideal remedy.”

Exxon is proclaiming a appropriate of first refusal on Hess’ property in Guyana underneath a joint operating agreement that governs a consortium that is acquiring the South American nation’s prolific oil means. The oil main submitted for arbitration in March at the International Chamber of Commerce in Paris.

Woods said the panel of arbitrators is still being selected and then the procedure will go into discovery. The CEO has consistently expressed self-assurance that Exxon will prevail in the dispute, indicating Exxon wrote the settlement that governs the consortium.

Chevron has rejected Exxon’s claims that the settlement applies to its pending all-stock deal to get Hess, valued at $53 billion.

The arbitration courtroom will finally determine the timeline of the proceedings, but Hess has questioned the panel to listen to the merits of the scenario in the third quarter with an final result in fourth quarter. Chevron CEO Mike Wirth advised analysts through the company’s first-quarter earnings contact in April that this timeline really should permit the corporations “to near the transaction soon thereafter.”

“We see no reputable reason to hold off that timeline,” Wirth explained.

If Exxon prevails in the circumstance, Chevron’s deal with Hess would crack. Woods has said Exxon is not earning a perform to buy Hess, but would like to protect its ideal in the curiosity of shareholders and discover out what benefit is getting placed on Hess’ Guyana assets.

Hess has a 30% stake in an oil patch identified as the Stabroek block off the coastline of Guyana. Exxon prospects the project with a 45% stake though China National Offshore Oil Company maintains 25% stake.