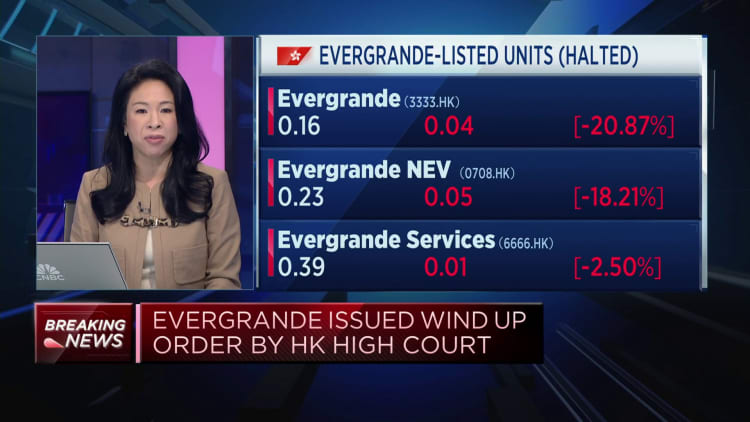

Shares of China Evergrande were halted right after plunging in excess of 20% in early investing on Monday immediately after a Hong Kong court docket ruled to liquidate the embattled assets developer.

It will come in opposition to the backdrop of a spiraling financial debt crisis in the state.

China Evergrande, which was as soon as just one of the country’s largest home developers, has in the past number of a long time been enveloped in Beijing’s debt crisis.

The Wall Street Journal previously reported that Evergrande’s overseas collectors unsuccessful to access an 11th-hour deal this weekend to restructure, which could indicate an imminent liquidation for the true estate developer.

Evergrande is the world’s most indebted property developer, which defaulted in 2021 and declared an offshore debt restructuring program in March past yr.

Containing the contagion

Policymakers in China have been scrambling to stem the debt disaster in the beleaguered property sector.

Past 7 days, the People’s Financial institution of China and the Ministry of Finance announced measures to help boost the liquidity available to home builders.

The steps, which will be valid until finally end of this 12 months, will help relieve a lingering income crunch for Chinese developers after Beijing cracked down on the sector to address bloated personal debt ranges in true estate.

NANJING, CHINA – AUGUST 18, 2023 – Aerial photograph displays a household place of Evergrande in Nanjing, East China’s Jiangsu province, Aug 18, 2023. (Image by Costfoto/NurPhoto by using Getty Visuals)

Getty Images

Evergrande’s crisis established off contagion fears that China’s house sector troubles could spill more than to other pieces of the world’s second biggest economy.

Region Backyard, also a person of China’s greatest builders, has been battling to pay off its very own personal debt. However, the developer reportedly mentioned final month that it could prevent a default on its yuan-denominated bonds.

This is producing news. Make sure you look at again for updates.