BP quarterly gains soar to $8.2 billion amid renewed calls for windfall taxes

Bernard Looney, main govt officer of BP Plc, gestures although speaking for the duration of a information conference in London, U.K., on Wednesday, Feb. 12, 2020.

Bloomberg | Getty Images

Oil and gas giant BP on Tuesday reported more powerful-than-envisioned third-quarter revenue.

The British electricity major posted underlying alternative charge revenue, made use of as a proxy for web earnings, of $8.2 billion for the 3 months by way of to the conclusion of September. That when compared with $8.5 billion in the preceding quarter and a web revenue of $3.3 billion over the exact same period of time a year earlier.

The world’s biggest oil and gas majors have claimed bumper earnings in current months, benefitting from surging commodity selling prices next Russia’s invasion of Ukraine.

Examine the complete tale listed here.

– Sam Meredith

CNBC Professional: This Chinese electric powered carmaker’s stock could rally by far more than 260%, Citi claims

Citi has picked a big electrical automobile maker as a person of its “top” get thoughts among the Chinese shares.

It expects shares in the automaker to increase by much more than 260% in excess of the following 12 months as EV revenue soar.

CNBC Professional subscribers can browse far more here.

— Ganesh Rao

China’s manufacturing unit exercise shrank for a third consecutive thirty day period in October, private study states

The Caixin producing Buying Managers’ Index for Oct confirmed that factory action contracted for the third month in a row.

The looking through came in at 49.2, in comparison with anticipations for a print of 49. In September, the production PMI was at 48.1, underneath the 50-point mark that separates progress from contraction.

PMI readings look at exercise from thirty day period to thirty day period.

Formal details from the Countrywide Bureau of Stats arrived in at 49.2 on Monday, lacking anticipations for a print of 50.

— Abigail Ng

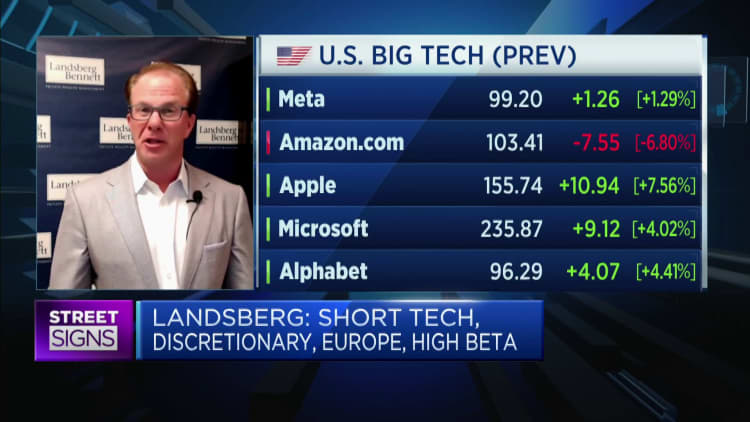

CNBC Pro: What traders should really obtain in this ‘short lived’ rally, according to a person analyst

Just after October’s inventory sector rally, traders are debating irrespective of whether stocks have strike the base or if it is really an additional brief-lived bounce.

Michael Landsberg, main financial investment officer at Landsberg Bennett Personal Prosperity Management, is in the latter camp, arguing the rally, as soon as once more, appears momentary.

He explained to CNBC what he thinks investors need to obtain — and shorter.

CNBC Professional subscribers can browse far more here.

— Weizhen Tan

Hong Kong’s economic climate shrank by 4.5% in the 3rd quarter

Hong Kong’s gross domestic product or service fell by 4.5% in the third quarter of the 12 months when compared with the identical period a 12 months back, advance estimates from the Census and Figures Division showed Monday.

That’s the worst contraction considering that the 2nd quarter of 2020. Analysts polled by Reuters envisioned .7% progress, although GDP lessened 1.3% in the next quarter.

“The worsened external surroundings and continued disruptions to cross-boundary land cargo flows dealt a really serious blow to Hong Kong’s exports,” the assertion stated, incorporating the drop in GDP was “mostly attributable to the weak overall performance in exterior desire during the quarter.”

Fixed funds formation, or expense, lessened by 14.3%, when exports and imports also fell.

— Abigail Ng

CNBC Professional: Neglect Tesla? Citi and HSBC title 2 alternatives to participate in the EV growth

Tesla may be an investor favorite for exposure to the EV business, but Citi and HSBC identify two alternatives to play the increasing need for electric powered motor vehicles.

Professional subscribers can study a lot more here.

— Zavier Ong

European markets: Right here are the opening phone calls

European markets are heading for a optimistic start out to the trading session on Tuesday with world-wide traders focusing on the U.S. Federal Reserve’s coverage assembly, which starts currently. The central lender is envisioned to hike fascination charges by 75 basis details on Wednesday when its assembly concludes.

As for Europe’s opening calls, here they are:

London’s FTSE index is anticipated to open up 31 details better at 7,135, Germany’s DAX up 80 factors at 13,348, France’s CAC up 31 factors at 6,304 and Italy’s FTSE MIB up 178 factors at 22,696, in accordance to knowledge from IG.

European marketplaces shut better Monday irrespective of euro zone GDP and inflation details pointing to even more pain forward for the 19-member bloc, with client value inflation soaring to a document higher in October and progress slowing markedly in the third quarter.

Earnings occur from BP, Fresenius and DSM on Tuesday. Details releases incorporate production acquiring managers’ index figures from the Netherlands, Eire and Sweden for Oct.

— Holly Ellyatt