European marketplaces jumped on Thursday afternoon soon after October’s studying of U.S. customer prices provided hope that inflation stateside has peaked.

The pan-European Stoxx 600 shut 2.8% larger after the CPI print was posted. Tech shares ended up 7.6%, major gains as the the greater part of sectors and all important bourses closed in optimistic territory. Oil and gasoline stocks were being the sole outlier by the shut of perform, ending down .4%.

The U.S. buyer selling price index — a broad evaluate of inflation — rose by .4% in October from a thirty day period ago. On a calendar year-around-year foundation, the CPI rose 7.7%. Economists polled by Dow Jones experienced projected a every month incline of .6% and an once-a-year increase of 7.9%.

Handle of the U.S. Home and Senate was even now up in the air Wednesday, as states across the state tallied votes in neck-and-neck midterm election races.

Whilst Republicans are expected to acquire regulate of the Household, they’re established to gain less seats than at first imagined. Meanwhile, Democrats have so much obtained a person Senate seat.

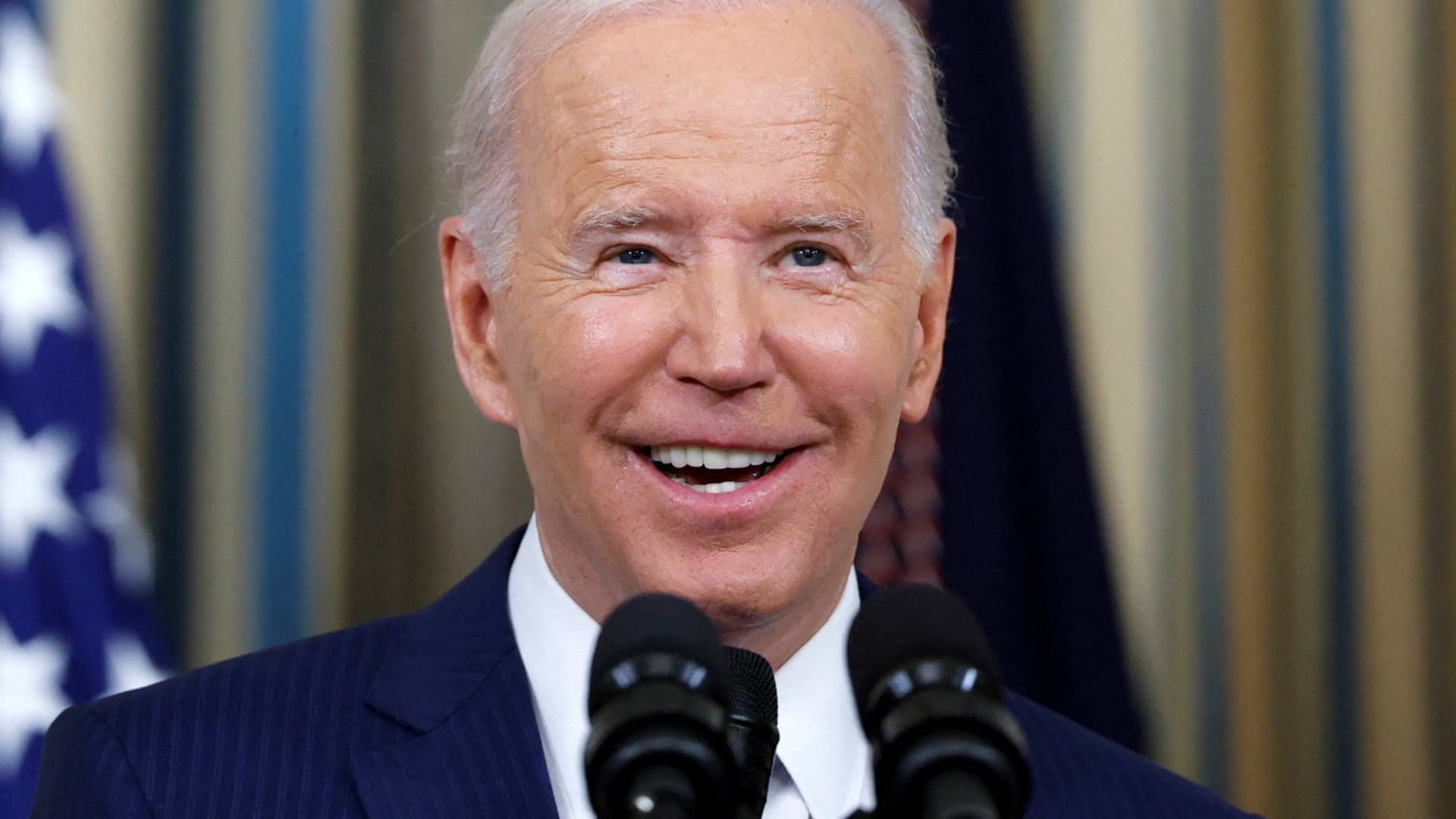

President Joe Biden explained his Democratic Celebration defeat back expectations of a potent Republican general performance on Election Working day.

“It didn’t take place,” the president mentioned of predictions of a “purple wave” that would guide to the GOP holding a powerful grip on the Home and Senate.

Biden stated he is “organized to function” with Republicans if they get command of 1 or both equally chambers of Congress. He additional that he expects to discuss shortly to Property Minority Leader Kevin McCarthy, the most most likely upcoming Residence speaker if the GOP flips the Residence.

World investors are also awaiting new inflation details out of the U.S. on Thursday, which will be an crucial marker for the Federal Reserve in advance of its upcoming coverage meeting in December.

U.S. shares soared in early morning trade subsequent the October inflation report.

Shares in Asia-Pacific shut in blended territory earlier in the day as information uncovered that China’s annualized producer prices fell in October for the to start with time since December 2020.

— CNBC workers contributed to this markets blog.