European Central Bank to hold rates amid debate over time of cuts

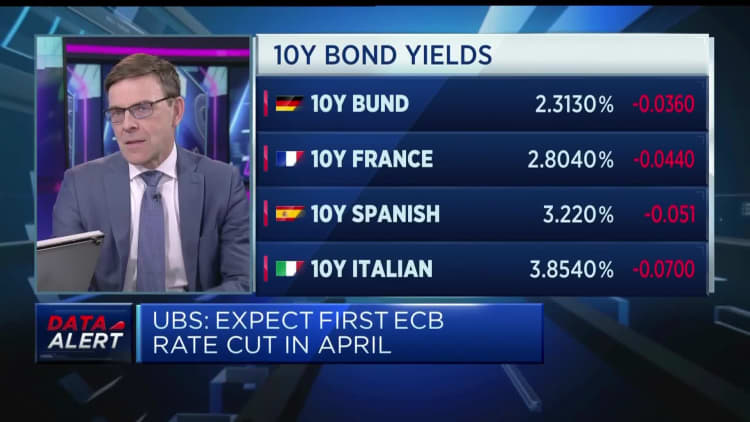

The European Central Bank is set to hold interest rates at their current record high after its monetary policy meeting on Thursday — while investors are hungry for guidance on possible rate cuts.

They may be disappointed.

“The January ECB meeting this Thursday is, as usual, unlikely to deliver any policy changes or major policy messages, involving instead a reflection on the year ahead,” economists at Société Générale said in a Tuesday note.

Minutes from the ECB’s December meeting, released last week, showed that the central bank is highly unlikely to hike rates again, but that any discussion of easing is considered premature. The minutes suggest a status quo until at least June, Société Générale said.

Markets are nonetheless pricing in around a 60% probability of the first rate cut taking place in April, according to a Reuters analysis of LSEG data. High expectations for a March cut have been pushed back in recent weeks, but April pricing is staying put despite numerous ECB officials arguing that trims may be premature.

Read the full story here.

— Jenni Reid

U.S. stocks open higher

The three major indexes were up as Wednesday’s trading session began.

The Dow was up more than 100 points, or about 0.3%, shortly after 9:30 a.m. ET. The S&P 500 added 0.6%. The Nasdaq Composite climbed 0.8%, helped by a rally in Netflix.

— Alex Harring

UK PMI data points to growth uptick

The U.K.’s services and manufacturing PMI data beat expectations Thursday, with the January headline number rising to the highest level in seven months.

Services PMI came in at 53.8, higher than the 53.2 expected, while manufacturing PMI came in at 47.3, above the 46.7 forecast.

The data should reassure policymakers that inflation is easing ahead of the Bank of England’s interest rate meeting next week, though it may not hasten its path to rate cuts.

— Karen Gilchrist

Abrdn shares down 2.5% after worse than expected outflows

The abrdn office in Edinburgh, U.K. on Thursday, Nov. 11, 2021.

Jonne Roriz | Bloomberg | Getty Images

Shares of British asset manager Abrdn fell 2.5% after announcing plans reduce its headcount as part of wider cost-cutting measures on the back of worse than expected outflows.

The Edinburgh-based company said in a pre-close trading update that it had net outflows of £12.4 billion ($15.75 billion) in the second half of 2023, more than double the £5.2 billion reported in the first half of the year.

It also confirmed media reports on Tuesday, including from Reuters, that it would shed 500 roles, or about 10% of its total workforce, as part of a £150 million cost reduction plan.

— Karen Gilchrist

Euro zone PMI data shows improved economic activity

Euro zone economic activity improved at the start of the year, falling at its slowest rate in half a year, the latest purchasing managers’ survey showed Wednesday.

The HCOB Flash Eurozone Composite PMI Output Index, which gauges activity in the manufacturing and services sectors, rose to 47.9 in January from 47.6 in December, according to the data. It marks a slight shortfall on the 48.0 expected by economists.

HCOB chief economist Cyrus de la Rubia said the data points to “a widespread easing of the downward trajectory” seen over 2023.

The euro zone’s largest economies, France and Germany, both posted a decline in their index, while the wider bloc returned to growth following five months of decline.

— Karen Gilchrist

Stocks on the move: Siemens Energy up 10%, Ericsson falls 4.6%

Shares of German tech company Siemens Energy jumped 11% in early deals after the release of forecast-beating first-quarter results.

German software company SAP also rose 7.7% after the company released its latest financial results and announced plans to restructure 8,000 jobs in a push toward artificial intelligence growth.

On the other end, Ericsson shares fell 4.6% after the telecom company said it forecasts declining demand for 5G gear despite beating fourth-quarter operating profit expectations.

— Karen Gilchrist

CNBC Pro: This Swiss auto parts maker’s stock could soar by 75%, Vontobel says

A Switzerland-listed car parts manufacturer’s share price could increase by over 70% in the next year, according to Vontobel.

The company makes lightweight auto components for car makers such as BMW, Ford, Renault, Mercedes, GM and Volvo.

Vontobel is forecasting a rise in profit margins and free cash flow at the company.

CNBC Pro subscribers can read more here.

— Ganesh Rao

CNBC Pro: Goldman Sachs names 4 battery stocks to buy right now – giving one 120% upside

Electric vehicle automakers like Tesla and BYD have been making headlines over the last few weeks – but Goldman Sachs is now keeping watch on a corner of the market.

That is the battery sector – which includes lithium, nickel and electrolyte batteries that are key inputs in the manufacture of EVs.

The investment bank noted that the sector – and stocks – look attractive amid higher adoption of EVs and a reduction in battery prices.

CNBC Pro subscribers can read more here.

— Amala Balakrishner

European markets: Here are the opening calls

European markets are set to open higher Wednesday.

The U.K.’s FTSE 100 index is expected to open 15 points higher at 7,508, Germany’s DAX up 92 points at 16,724, France’s CAC up 36 points at 7,421 and Italy’s FTSE MIB up 188 points at 30,395, according to data from IG.

Earnings come from Swedbank, Easyjet, SAP, Alstom and a trading update comes from J D Wetherspoon.

— Holly Ellyatt