The European Central Lender on Thursday held curiosity premiums unchanged, and reiterated it would hold them significant for a “sufficiently lengthy length” to convey inflation to concentrate on.

The central financial institution is keeping regular for the third straight meeting, just after hiking its deposit level to 4% in September.

It explained that the latest info had “broadly confirmed” its previous medium-term inflation outlook and that, regardless of base level energy outcomes, a declining craze in underlying inflation had ongoing.

In spite of this, ECB President Christine Lagarde said during a push briefing, the consensus of the central bank’s Governing Council was that it was “premature to discuss amount cuts.”

It will keep on to be knowledge dependent alternatively than “fixated on any calendar,” she extra.

The Governing Council’s “upcoming decisions will be certain that its plan costs will be set at adequately restrictive degrees for as extended as needed,” the ECB said in a assertion, echoing its prior language.

The central financial institution is going through a sluggish euro area economic climate and fragile financial security, but it is also targeted on bringing inflation down to 2% from 2.9% at present. The ECB is hugely worried with reducing rates too soon and undoing some of the outcomes of the present tightening.

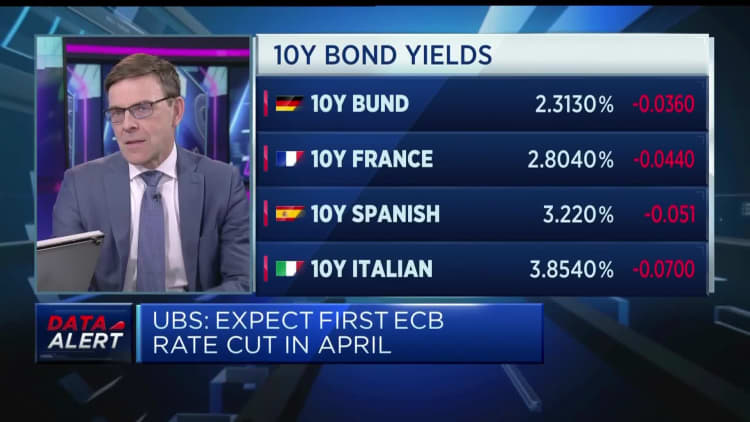

Some ECB officials have spent the month pushing back from marketplace anticipations for price cuts in the spring, stressing the want to hold out for very first-quarter wage information. On Thursday early morning, marketplaces have been factoring in a 62% probability of an April slash, in accordance to LSEG info.

The euro traded marginally bigger towards the U.S. greenback and British pound next the announcement, while European stocks ended up tiny changed, reflecting investors’ anticipations for restricted fresh new direction from the ECB. European bond yields ended up marginally decrease.

The announcement meant the ECB “reiterating its reluctance to commence producing cuts regardless of the at any time mounting force to do so,” Richard Carter, head of mounted curiosity investigation at Quilter Cheviot, reported in a notice.

“Inflation had been slipping constantly in the Eurozone but saw an undesirable uptick to 2.9% in December, including gasoline to the ECB’s reasonably hawkish placement.”

Vincent Chaigneau, head of investigation at Generali Investments, famous the ECB retained its language around staying sufficiently restrictive with financial coverage for a long plenty of time, while removing it would have been viewed as dovish.

“What is marginally beneficial, I suppose, from a sector point of watch, is that the perception on domestic inflation force seems to be a notch lower. They are no for a longer period talking about elevated domestic inflation pressures,” he instructed CNBC.

“But of class, it displays the pretty rapid drop in inflation. So it can be not quite astonishing,” he additional.