A person shelters from the rain underneath an umbrella as he walks previous the Euro forex indication in front of the former European Central Financial institution (ECB) building in Frankfurt am Primary, western Germany.

Kirill Kudryavtsev | Afp | Getty Photos

The European Central Bank is established to hold interest costs at their latest document superior following its financial plan meeting on Thursday — whilst investors are hungry for steering on possible fee cuts.

They might be unhappy.

“The January ECB meeting this Thursday is, as usual, not likely to produce any plan changes or key policy messages, involving as a substitute a reflection on the yr forward,” economists at Société Générale mentioned in a Tuesday note.

Minutes from the ECB’s December conference, released final 7 days, showed that the central bank is hugely unlikely to hike premiums again, but that any discussion of easing is thought of untimely. The minutes suggest a status quo until at minimum June, Société Générale reported.

Marketplaces are however pricing in all around a 60% chance of the to start with fee cut having spot in April, according to a Reuters investigation of LSEG information. Large expectations for a March lower have been pushed back in new months, but April pricing is being put inspite of a lot of ECB officials arguing that trims may perhaps be premature.

Dutch Central Financial institution President Klaas Knot explained to CNBC at the Entire world Economic Discussion board in Davos last 7 days that existing market place bets could be “self-defeating,” simply because “the much more easing the market place has presently finished for us, the significantly less most likely we will lower rates.”

ECB President Christine Lagarde instructed Bloomberg that she agreed with individuals who see a summertime slice as probably, but pressured at the time that she remained “reserved” and details dependent in her last outlook.

Headline euro location inflation ticked larger in December, growing to 2.9% from 2.4%, largely due to base results from the vitality current market. Core inflation fell to 3.4%, from 3.6%.

Cost rises have cooled speedier than some central bank officers expected, even as they emphasize that the career is not nonetheless carried out. Quite a few see threats from geopolitical volatility and the labor sector, along with the have to have to wait until eventually late spring for European wage negotiations to conclude.

Spring lower?

“Decrease inflation and far more well balanced inflation threats” make the scenario for a plan pivot in April and cuts amounting to 125 foundation points this calendar year, economists at BNP Paribas said in a take note out previous 7 days.

“The ECB will advise on 25 January that it is nearer to commencing its normalisation cycle, we expect, but devoid of signalling an imminent fee reduce, nor declaring victory in the inflation fight,” they explained.

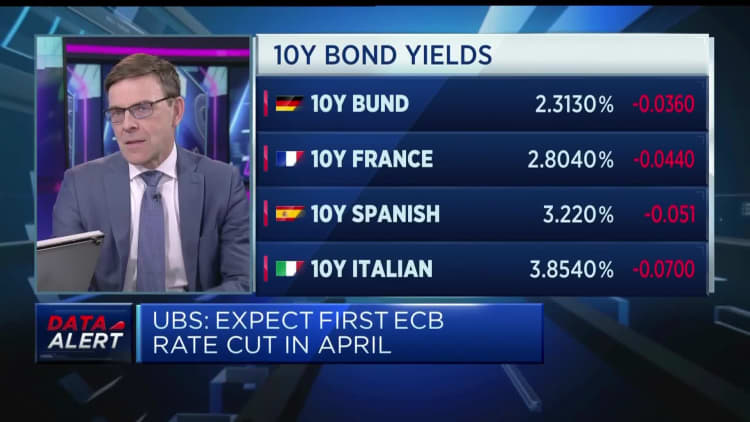

UBS is calling an April reduce — but not with assurance, Reinhard Cluse, chief European economist at UBS, explained to CNBC’s “Avenue Indicators Europe” on Wednesday.

“I consider you can not be extremely self-confident about an April level lower. We previously anticipated June, but then introduced it forward to April,” he stated, noting the will need for further knowledge releases.

“Now, without a doubt, with the hawkish commentary, especially in Davos, we have signaled that the risks to our phone that the initially reduce will currently come in April has certainly amplified,” Cluse mentioned, incorporating that the ECB’s March meeting would be much more major than January’s because of to the release of new workers projections on wages and advancement.

Economists at Berenberg disagree with recent pricing for a 25-basis-position cut in April and nearly 150 basis factors of level trims throughout 2024. The require to hold out for wage facts in April and May possibly, as very well as for a full set of development and inflation workers projections at the finish of the first quarter, helps make it far more real looking that cuts will get location in June, rather than in April, the analysts said in a Tuesday observe.

Berenberg expects inflation to reaccelerate future 12 months and for labor shortages to protect against a sustained slide in wage inflation, capping the ECB’s potential to ease coverage.

Société Générale economists are using an even a lot more careful method.

“We have moved our 1st rate minimize from December to September, but there is large uncertainty as regards the data, implying that no cuts this 12 months is also a risk,” they said Tuesday.

The remarks echo those people of ECB arch-hawk Robert Holzmann, who reported at Davos that he “are unable to imagine that we’ll talk about cuts however, because we must not talk about it. All the things we have noticed in new weeks factors in the opposite way, so I may perhaps even foresee no slash at all this yr.”