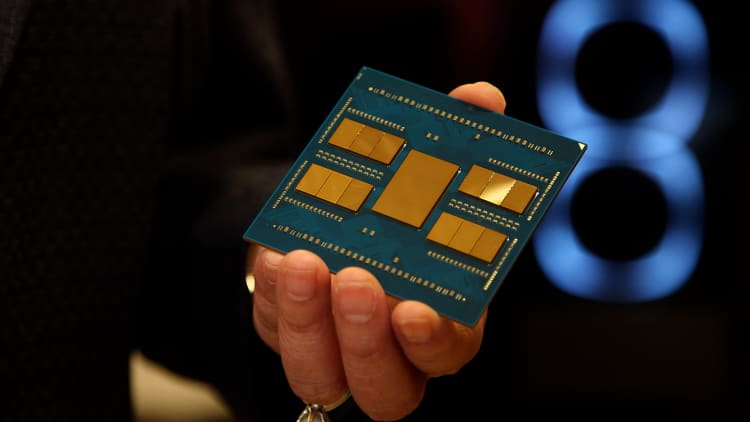

Semiconductors have been dragged in the center of the U.S.-China rivalry. Washington has been attempting to convince allies to again its chip export constraints to China.

Wong Yu Liang | Moment | Getty Visuals

The European Union has agreed a landmark plan to boost its chip business.

The initiative, dubbed the European Chips Act, seeks to help the bloc contend with the U.S. and Asia on tech, and safe manage over a essential little bit of technology at the rear of the world’s electronics products and products.

The EU Parliament and 27 member states attained a deal on the legislation on Tuesday. In a assertion, they stated the new rules would intention to double the EU’s global market share in semiconductors from 10% to 20% by 2030.

“This settlement is of utmost significance for the eco-friendly and digital changeover even though securing the EU’s resilience in turbulent situations,” Ebba Busch, the Swedish energy minister, claimed Tuesday.

“The new rules characterize a authentic revolution for Europe in the vital sector of semiconductors.”

What is in the Chips Act?

The European Chips Act is a significant, 43-billion-euro ($47 billion) offer of public and non-public investments that aims to secure its source chains, avert shortages of semiconductors in the foreseeable future, and market expense into the industry.

The Chips Act has 3 principal aims:

- Building substantial-scale capability and innovation.

- Make sure the EU is self-ample.

- Get ready the EU for potential future offer crises.

The EU Chips Act will spend 6.2 billion euros to encourage industrialization of innovative systems, build competence centers for ability improvement, and guarantee accessibility to finance, the European Commission, the EU’s government arm, reported in a statement.

It will also incentivize investments in producing amenities and deliver a framework for integrated generation amenities and open EU foundries for security of offer.

Member states will also coordinate to keep track of supply and forecast any shortages, the fee reported. Since initially asserting the approach final 12 months, the EU has currently captivated among 90 billion and 100 billion euros of general public and non-public commitments for industrial deployment.

Why does it matter?

Chips are correctly the brains of electronic equipment. They’re utilized in all the things from smartphones to gaming consoles — but also solutions you wouldn’t assume them in, like cars and refrigerators.

Semiconductors, and the mainly East Asia-dependent provide chain driving them, have develop into a thorny concern for entire world governments after a international lack led to source complications for significant automakers and electronics manufacturers.

The Covid-19 pandemic exposed an overreliance on producers from Taiwan and China for semiconductor factors. That dependency has become fraught with tensions among China and Taiwan on the rise.

TSMC, the Taiwanese semiconductor big, is by significantly the major producer of microchips. Its chipmaking prowess is the envy of lots of created Western nations, which are getting steps to improve domestic manufacturing of chips.

Europe has been in search of to regulate additional of its source chain to cut down its reliance on overseas industry players. The go is aspect of a drive from the EU to obtain “electronic sovereignty,” which refers to the notion that they have a lot more management around significant technologies.

“A swift implementation of present day agreement will transform our dependency into market management our vulnerability into sovereignty our expenditure into investment,” Busch claimed. “The Chips act places Europe in the 1st line of chopping-edge technologies which are important for our inexperienced and electronic transitions.”

Won’t be able to go it by itself

At the similar time, the bloc has recognized it won’t be able to obtain this output ramp up by yourself — there are no European firms that can manufacture leading-edge chips.

The EU desires to catch the attention of funding from foreign companies into its market place. U.S. chipmaking big Intel is amid the corporations upping its investments in Europe, and has fully commited around 33 billion euros to boost chipmaking throughout the EU.

In the U.K., chip companies have been threatening to depart the U.K. thanks to a lack of comparable aid from the federal government.

Europe is dwelling to a titan in the semiconductor house — Dutch organization ASML. ASML’s intense ultraviolet lithography machines are utilised to etch microscopic functions into silicon wafers. But the company would not deliver its possess chips.

Officials want much more semiconductors to be designed inside of Europe, so they do not encounter the possibility of a massive shortage, or threats to nationwide safety.

Check out: How AMD grew to become a chip big and finally caught Intel