Ethereum underwent a enormous community update known as the merge which proponents say will make transactions considerably much more energy efficient. Following the merge, ether selling prices have dropped subsequent a huge run up in advance of the party.

Jakub Porzycki | Nurphoto | Getty Photos

Ether has fallen more than bitcoin due to the fact the cryptocurrency’s underlying technologies, the Ethereum network, underwent a big improve known as the merge.

Ethereum is a blockchain technological innovation that properly allows builders to construct applications on best of it. Ether is the native cryptocurrency that operates on Ethereum.

associated investing information

The merge is an enhance to Ethereum that improvements the validation system for transactions from a proof-of-do the job strategy to proof-of-stake. Proponents say this will make validating transactions on Ethereum significantly much more energy economical and has been eagerly-anticipated by the crypto local community.

Irrespective of the improve occurring productively, ether has fallen much more than bitcoin.

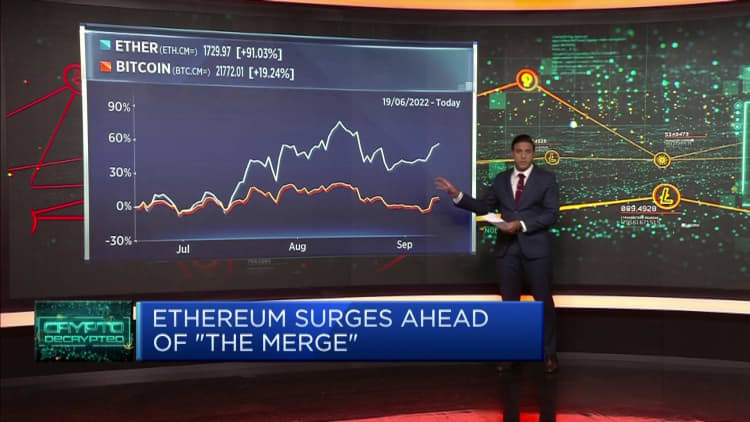

Since Sept. 15, the day the merge was accomplished, to all over 4:30 a.m ET on Tuesday, ether is down all over 15%. Bitcoin has dropped close to 3% in the exact same time period.

Ahead of the network upgrade, the rate of ether around doubled from the lows of the yr in June, far outpacing bitcoin’s gains.

Vijay Ayyar, vice president of company enhancement and intercontinental at crypto exchange Luno, reported that the merge was currently “priced in” for ether and the “actual function was a ‘sell the news’ problem.”

Traders are also shifting investments from ether and other substitute digital cash again into bitcoin, in accordance to Ayyar, “because the expectation is that Bitcoin will outperform for a couple of months from here on.”

Traders are also questioning irrespective of whether the regulatory standing of ether may adjust immediately after the merge just after U.S. Securities and Trade Commission Chair Gary Gensler indicated previous 7 days that cryptocurrencies that get the job done on the evidence-of-stake model, which applies to Ethereum, could be classed as a safety. That would provide it beneath the purview of the regulators.

Gensler’s, whose feedback were being claimed by quite a few information retailers, did not title ether precisely. The proof-of-stake model involves investors “staking” or locking up their ether and earning returns for accomplishing so.

“For Ethereum, there is one more issue: PoS (proof-of-stake) crypto might slide less than SEC’s scrutiny,” stated Yuya Hasegawa, crypto market place analyst at Japanese crypto exchange Bitbank.

Level hikes nonetheless in focus

Crypto buyers are also on edge in advance of an envisioned fascination level rise from the U.S. Federal Reserve this 7 days.

Central banking companies all over the world have been raising desire premiums to deal with rampant inflation. But that has hurt possibility belongings this sort of as stocks. Cryptocurrencies have been closely correlated with U.S. stock markets, in particular the tech-hefty Nasdaq. With shares remaining beneath force, crypto has also felt the heat.

Inflation in the U.S. in August arrived in bigger than predicted, which hit shares and crypto.

“From a macro standpoint as well, inflation did arrive in larger, and consequently caused a promote off throughout all markets, but ethereum and altcoins did provide off more durable, given they are alongside the extra risky part of the crypto spectrum,” Ayyar stated.

Bitcoin has been buying and selling in a selection of about $18,000 to $25,000 considering the fact that June, a amount at which traders are buying in, according to Ayyar.

But any “change in the macro environment in phrases of inflation of desire fee surprises, is surely result in for problem,” he stated, incorporating that if bitcoin falls beneath $18,000, the cryptocurrency could test concentrations as very low as $14,000.