The worldwide leader in sports still has some juice.

ESPN operating income surged 16% from a year ago to $987 million in Disney‘s fiscal fourth quarter — the first time Disney has ever broken out the sports division’s finances. Revenue in the segment grew 1% year-over-year to $3.8 billion.

Disney also revealed ESPN+ was profitable in the quarter, generating $33 million. That compares to Disney+ and Hulu, Disney’s other streaming services, which lost $420 million in the quarter.

While Disney’s other linear network revenue fell 9%, ESPN’s gains in both operating income and revenue suggest the business isn’t foundering — even as sports rights makes up 40% of Disney’s overall content spend. That should come as a giant relief for investors.

Disney CEO Bob Iger said last year that “linear TV and satellite is marching towards a great precipice and it will be pushed off,” declaring that traditional TV will eventually die off completely. The ESPN results suggest the sports network may not be in as dire shape as the rest of the linear universe.

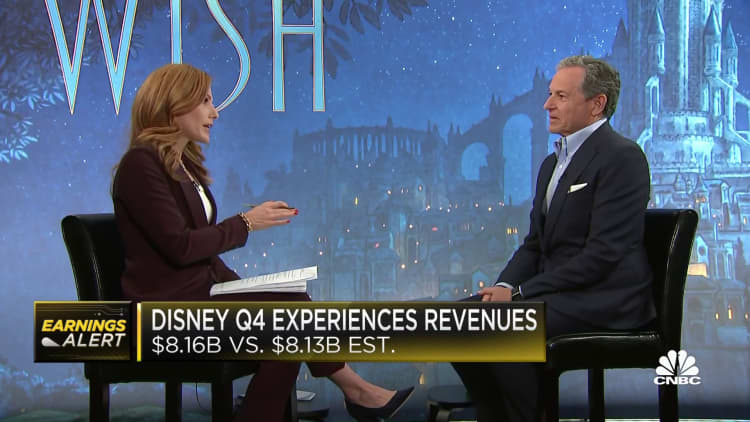

“It’s on a great trajectory,” Iger said about ESPN, in an interview with CNBC’s Julia Boorstin on Wednesday. “And the ratings are actually very strong, too. ESPN had one of the strongest years ratings wise, I think, in the last four or fiveyears in 2023. That’s a great thing. We obviously are planning to take ESPN out on a direct to consumer basis. We feel great about that.”

While Disney is still a year away from breaking even in its streaming business, according to the company’s own estimates, ESPN+ already turns a profit. While linear network advertising fell, ESPN advertising had a “modest increase” in the quarter, Disney said in its earnings statement.

None of this erases ESPN’s existential crisis of surviving in a streaming-first world rather than the cable bundle. But it does suggest that ESPN isn’t as much in crisis mode as some investors have may feared.

Disney has held discussions with the four major U.S. professional sports leagues — the National Football League, the National Basketball Association, the National Hockey League and Major League Baseball — about them potentially taking minority equity stakes in ESPN, CNBC reported in July. Disney has also had discussions with other technology companies “that can add either marketing support, technology support or possibly content support,” Iger said in a CNBC interview Wednesday.

Disney wants to transform ESPN into the preeminent digital sports distribution platform in the coming years, said Iger, who told CNBC that ESPN’s direct-to-consumer offering will launch no later than 2025.

“ESPN is the No. 1 brand on TikTok with about 44 million followers, which is an incredible statistic,” Iger said during Disney’s earnings conference call. “We feel leaning into it is the smart thing to do because of its unique quality, how popular it is, and how profitable it’s been.”

WATCH: Watch CNBC’s full interview with Disney CEO Bob Iger after fiscal fourth quarter earnings.