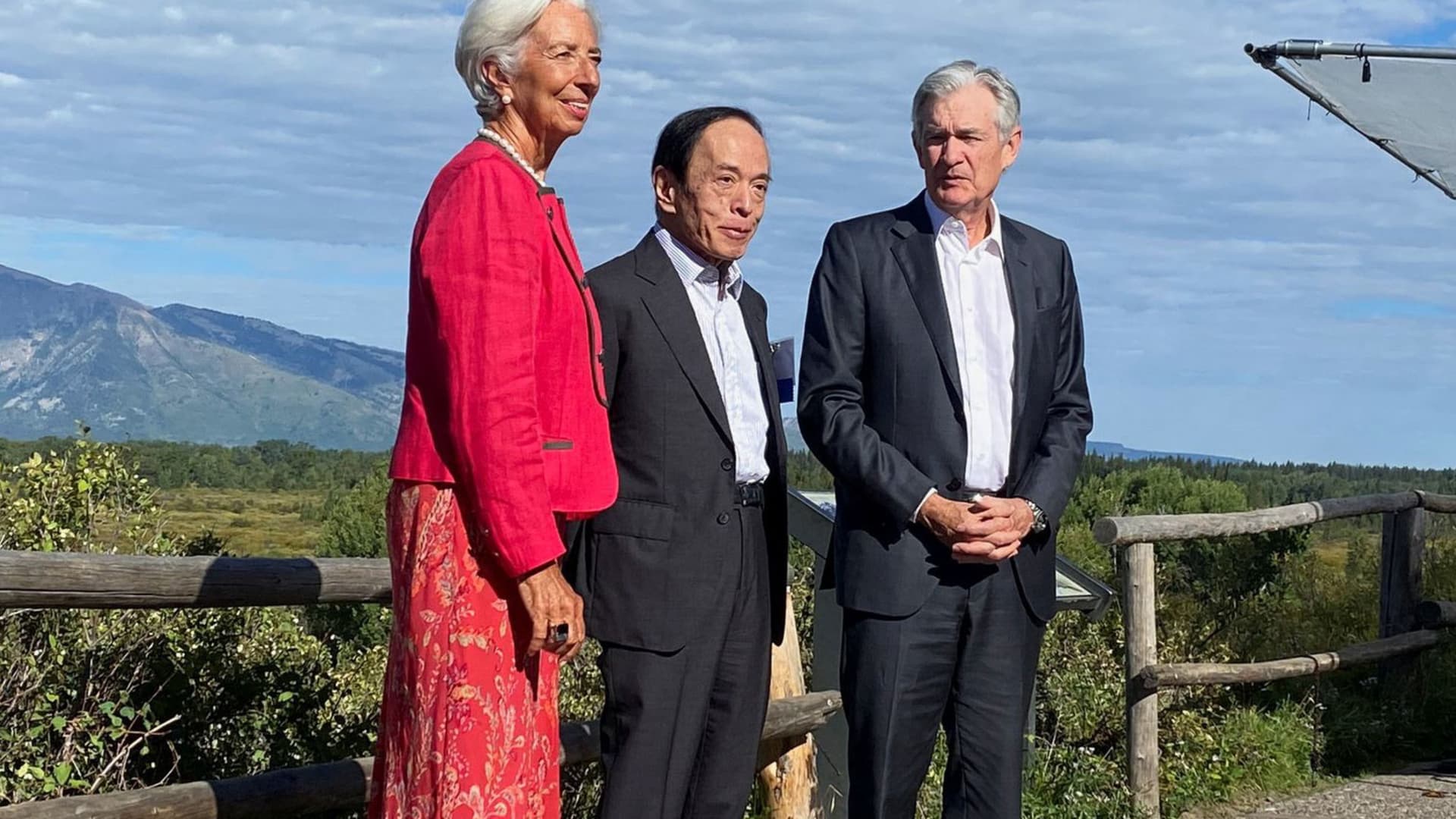

Federal Reserve Chair Jerome Powell, European Central Financial institution President Christine Lagarde, and Bank of Japan Governor Kazuo Ueda take a split outdoors while attending the Kansas Metropolis Federal Reserve Bank’s yearly Economic Plan Symposium in Jackson Hole, Wyoming, August 25, 2023.

Ann Saphir | Reuters

Curiosity premiums in the European Union will require to keep higher “as very long as required” to slow continue to-higher inflation, Christine Lagarde, president of the European Central Lender, reported Friday.

“Although progress is becoming manufactured,” she claimed, “the struggle from inflation is not however won.”

Lagarde’s remarks, at an annual conference of central bankers in Jackson Hole, Wyoming, arrived towards the backdrop of the ECB’s efforts to manage a stagnating economy with even now-significant inflation. The central bank has lifted its benchmark rate from minus .5% to 3.75% in 1 12 months — the speediest these tempo due to the fact the euro was released in 1999.

The price hikes have designed it much more expensive for people to borrow for the buy a property or a vehicle or for companies to consider out loans to broaden and make investments. Inflation in the 20 nations around the world that use the euro has dropped from a peak of 10.6% previous 12 months to 5.3%, largely reflecting sharp drops in strength rates. But inflation still exceeds the ECB’s 2% focus on.

Most of Lagarde’s speech centered on disruptions to the international and European economies that could possibly require better charges for longer than was expected before the pandemic. These troubles include things like the require to raise financial investment in renewable electricity and address climate transform, the increase in global trade barriers considering the fact that the pandemic and the difficulties established by Russia’s invasion of Ukraine.

“If we also deal with shocks that are more substantial and extra prevalent — like power and geopolitical shocks — we could see corporations passing on charge increases additional constantly,” Lagarde reported.

Her deal with followed a speech earlier Friday in Jackson Gap by Federal Reserve Chair Jerome Powell, who in the same way said the Fed was organized to more elevate rates if growth in the United States remained also robust to great inflation.

The double blow of nevertheless-substantial inflation and climbing rates has pushed Europe’s economic climate to the brink of economic downturn, however it eked out a .3% expansion in the April-June quarter from the very first three months of the year.

Lagarde has previously been noncommital on irrespective of whether the ECB would elevate premiums at its future meeting in September, nevertheless numerous analysts expect it to skip a amount hike simply because of the economy’s weakness.

On Friday, most of her speech targeted on irrespective of whether extended-phrase economic modifications will hold inflation pressures significant. She noted, for illustration, that the change absent from fossil fuels is “probable to maximize the measurement and frequency of electrical power offer shocks.”

Lagarde claimed the ECB is in search of to develop extra ahead-looking strategies to its plan to handle the uncertainty made by these improvements, relatively than relying entirely on “backward on the lookout” details.

Still, she reiterated her help for the ECB’s 2% inflation focus on.

“We don’t change the policies of the video game midway by way of,” she claimed.