The Earth Bank’s “Simplicity of Undertaking Company” report tracked and encouraged advancements in the organization climate close to the planet. Then it got canceled.

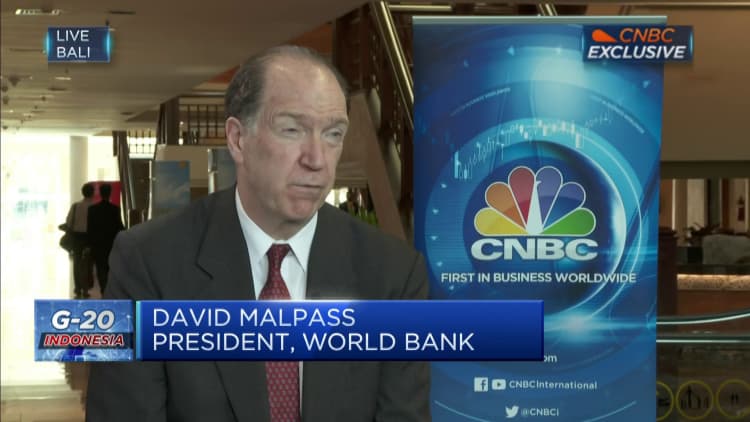

Bloomberg | Bloomberg | Getty Pictures

The Globe Lender is trying to get to vastly increase its lending capability to address local weather modify and other worldwide crises and will negotiate with shareholders ahead of April conferences on proposals that involve a cash enhance and new lending resources, according to an “evolution roadmap” viewed by Reuters on Monday.

The roadmap document – sent to shareholder governments – marks the commence of a negotiation method to alter the bank’s mission and fiscal means and shift it absent from a place- and venture-certain lending model employed considering that its creation at the stop of Planet War Two.

The Planet Bank administration aims to have precise proposals to alter its mission, operating design and economical potential prepared for acceptance by the joint Globe Lender and Intercontinental Monetary Fund Advancement Committee in Oct, in accordance to the document.

A Entire world Lender spokesman said that the doc aimed to present particulars on the scope, solution, and timetable for the evolution, with standard updates for shareholders and selections later on in the calendar year.

AAA ranking to remain

The advancement loan company will examine solutions like a opportunity new funds enhance, variations to its capital framework to unlock much more lending and new financing tools such as guarantees for personal sector financial loans and other approaches to mobilize additional non-public cash, in accordance to the document.

But the Planet Bank Team (WBG) is not all set to bow to demands from some non-income businesses to abandon its longstanding prime-tier credit score score to improve lending, stating: “Management will investigate all solutions that boost the potential of the WBG even though preserving the AAA ranking of the WBG entities.”

U.S. Treasury Secretary Janet Yellen has known as for the Earth Lender and others to revamp their enterprise styles to raise lending and harness private money to fund investments that a lot more broadly reward the entire world, these types of as serving to center-revenue international locations changeover away from coal energy.

A U.S. Treasury spokesperson declined comment on the Globe Bank doc.

The bank reported proposals below thought include things like better statutory lending boundaries, decrease fairness-to-bank loan necessities and the use of callable funds – revenue pledged but not paid in by member governments – for lending.

Growth industry experts say this change would considerably improve the total of lending when compared to the present-day money composition, which only makes use of compensated-in money.

“The worries the globe is dealing with phone for a substantial move up in the worldwide community’s aid,” the financial institution explained in the document. “For the WBG to keep on to perform a central position in growth and weather finance, it will need to have a concerted energy by both of those shareholders and management to phase up WBG funding potential.”

Inadequate funding

The roadmap document cautions that a build-up of lending for climate alter, wellbeing care, foodstuff safety and other desires may possibly call for a funds maximize to strengthen the capability of the Globe Bank’s center-earnings lending arm, the International Lender for Reconstruction and Improvement (IBRD).

IBRD’s $13 billion funds raise in 2018 “was developed to be prepared for one particular mid-sized disaster a 10 years, and not numerous, overlapping crises” including the COVID-19 pandemic, the war in Ukraine and the effects of accelerating local weather improve, the document stated. IBRD’s crisis buffers will most likely be depleted by mid-2023, it explained.

A further selection, in accordance to the roadmap, is for Earth Lender shareholder nations to move up periodic contributions to the lender’s fund for the world’s poorest international locations, the International Improvement Association (IDA), which have declined in modern yrs despite increasing demands.

The roadmap also features the selection of generating a new concessional lending have confidence in fund for middle-cash flow nations that would aim on world-wide public goods and be comparable in framework to IDA, with regular funding replenishments that would be independent from the bank’s capital construction.

“Such a fund may perhaps bring in donor bilateral methods independent from shareholder price range lines supporting the WBG, and probably include donors past shareholders,” these types of as private foundations, the financial institution explained.

The bank claimed that the evolution of its mission to increase local weather lending whilst sustaining very good improvement results will need added workers and finances methods, which have declined 3% in serious phrases more than the earlier 15 decades.