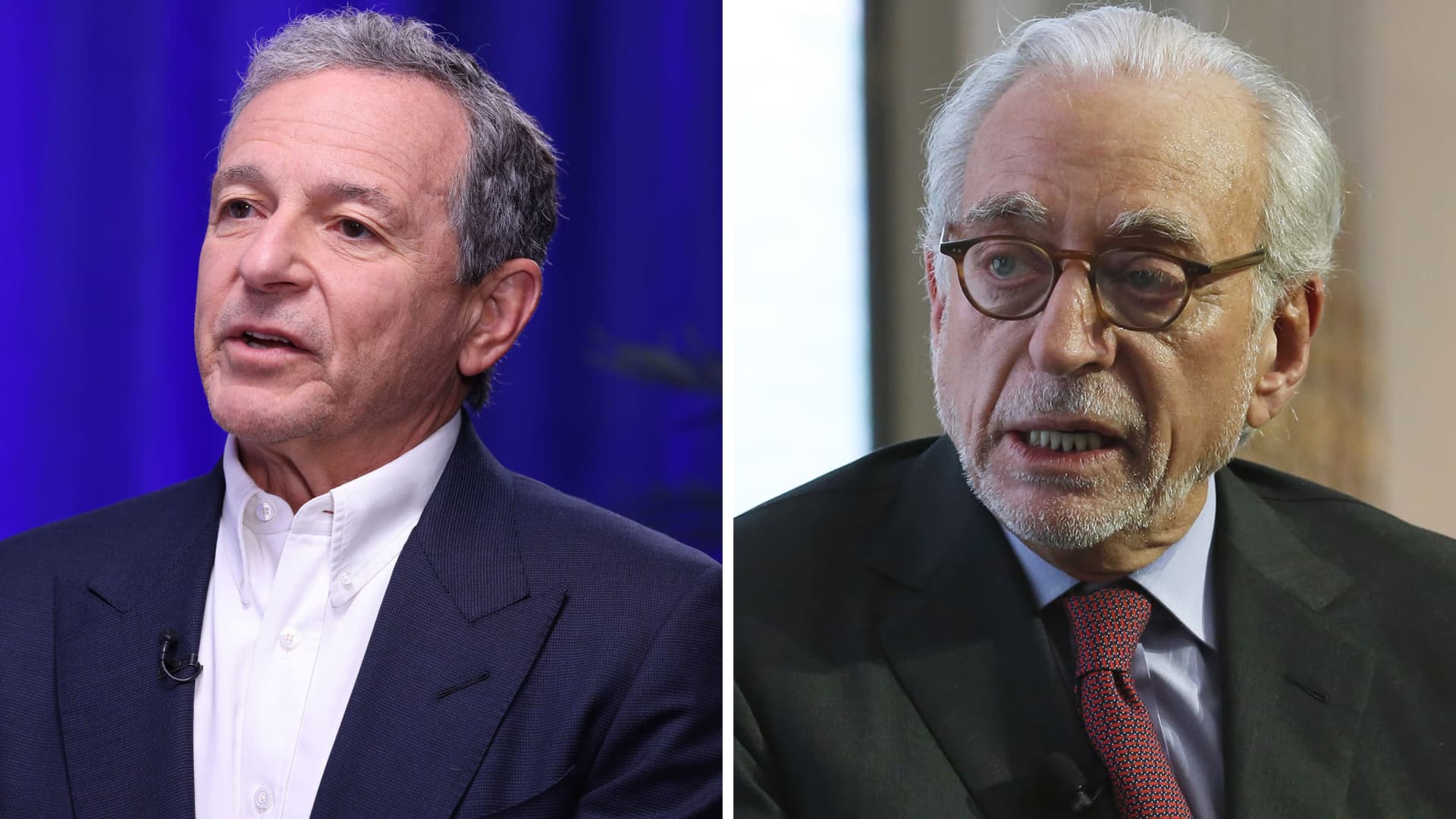

Bob Iger and Nelson Peltz.

CNBC

In 2015, Nelson Peltz’s Trian Associates was defeated in an activist campaign towards chemical business DuPont, mainly simply because the leading a few institutional shareholders voted in opposition to his slate. Just about a 10 years later, these identical institutional buyers — Vanguard, Point out Avenue and BlackRock — are the a few premier shareholders in Disney. And they could make or split Peltz’s marketing campaign versus the board that is backing Disney CEO Bob Iger.

BlackRock, a 4.2% Disney shareholder, is backing management, The Wall Street Journal described Monday. T. Rowe Rate and Norway’s sovereign prosperity fund, both smaller sized shareholders but nicely-identified names, have verified to CNBC they are also backing the existing management.

It isn’t really very clear if Vanguard and State Avenue have voted, or which side they would aid.

Trian presently has fighters in its corner. Previous Marvel chairman Ike Perlmutter has entrusted Peltz with his 33 million Disney shares, the bulk of the activist’s 1.8% stake. New York City’s retirement fund, Neuberger Berman, and the California pension plan CalPERS, reported they help the activist. Peltz also gained the backing of proxy advisory corporations ISS and Egan-Jones.

The showdown in between Trian Associates and Disney touches on some of the most elaborate challenges confronting executives right now, regardless of whether it is CEO succession or the purpose of firms in confronting so-identified as “woke” social challenges.

Iger left the CEO article in 2020. His successor, Bob Chapek, was ousted in 2022, with Disney’s board inviting Iger to choose the best write-up after once again. The succession failure has been highlighted by proxy advisory firms and Trian by itself.

Disney suggests Peltz’s efforts distract from Iger’s endeavours to turn the company close to. Trian argues that Peltz’s skills would enable the company uncover a second successor to Iger and take care of its underperforming stock.

Both of those sides have built their situation to investors for months in media appearances, conferences, one particular-on-just one dinners, and conferences with best buyers. But the institutional vote will be crucial at Disney. Just 33% of shareholders are regarded retail, a considerable sum, but they are a lot less likely to vote than their institutional friends.

Vanguard is the major holder with 8% of excellent Disney shares. It can punch higher than its pounds in determining irrespective of whether to elect the dissidents to Disney’s board. That is due to the fact, like in a political election, not every single eligible voter will vote all through Disney’s shareholder meeting.

In 2021, for illustration, 63% of Disney shareholders voted their shares, in accordance to info analyzed by 13D Keep an eye on.

In a contested election, that selection is most likely to go substantially better as proxy solicitors on both equally sides canvass shareholders, 13D Monitor’s Ken Squire claimed.

“With the introduction of the universal proxy card, you ought to get improved turnout as properly,” Squire advised CNBC.

Disney has employed Innisfree M&A for their solicitation. Trian is splitting the load concerning Okapi Companions and D.F. King.

Courting the massive-name establishments and retail traders

Site visitors in entrance of the Cinderella Castle at Tokyo Disneyland in Tokyo, Japan on Jan. 17, 2023.

Bloomberg | Bloomberg | Getty Photographs

Retail buyers have viewed ads or gained mailers or cell phone calls urging them to vote for either Disney, the white proxy card, or Trian, the blue proxy card. Additional than half of the vote in the struggle has previously been counted as of Monday, in accordance to The Wall Road Journal.

“Shareholders can improve their thoughts, but not like most institutional investors, particular person shareholders start off voting as soon as they receive the proxy. As this kind of, most personal votes are previously accounted for,” John Ferguson, senior husband or wife at proxy solicitation business Saratoga Proxy Consulting, instructed CNBC.

The solicitors are tasked with pitching retail shareholders, even though courting and winning institutional buyers is a even larger priority. Advisors on the two sides have tried to gain support from Vanguard, Blackrock and State Avenue.

It would be a major vote of confidence in Iger’s stewardship of Disney if he ended up to earn the backing of undecided Vanguard or Point out Avenue.

But if Peltz manages to safe support from these traders, it would be a obvious sign to Wall Road that the activist’s considerations at Disney — the failed succession procedure, an apparent distraction from storytelling in favor of “messaging,” and an high-priced M&A and expense system — hold some advantage.

The possibilities that institutional buyers would be swayed by Peltz’s arguments were buoyed when proxy advisor ISS came out in partial aid of Peltz in March.

Proxy advisors support shareholders choose how to vote their shares on a specific issue, by examining a firm’s financials and meeting with their advisors. As with the institutional traders, their help is seriously courted by advisors on each sides.

Glass Lewis, the other main proxy advisory company, announced it would support Iger and the existing board.

ISS explained shareholders really should vote for Peltz and withhold their support from Maria Elena Lagomasino, a single of two current Disney directors whom Trian is attempting to unseat. ISS did not assist the other Trian nominee, former Disney CFO Jay Rasulo.

View: ISS states Disney shareholders really should elect Nelson Peltz to board