A shopper exits a Piraeus Lender SA bank department in Thessaloniki, Greece.

Bloomberg | Bloomberg | Getty Visuals

“They just want earnings, they do not think about folks.”

People text from Marco Oliveira, a 50-year-aged graphic designer from Portugal, underscore a deep lying annoyance in Europe with individuals bemoaning a deficiency of return on their cost savings regardless of surging interest rates.

“We are not having excellent fees,” a 56-12 months-previous Spaniard, Carlos Stilianopoulos, confirmed to CNBC.

European savers complain their financial institutions have been brief to increase home finance loan payments as the European Central Bank has pushed up its benchmark price, but have been quite gradual at expanding prices for personal savings accounts.

In purchase to carry down inflation, the ECB has lifted costs a number of times considering the fact that July 2022. This, in apply, should translate into better rates both equally on mortgages, but also on deposits. Nonetheless, data displays this is not quite the scenario.

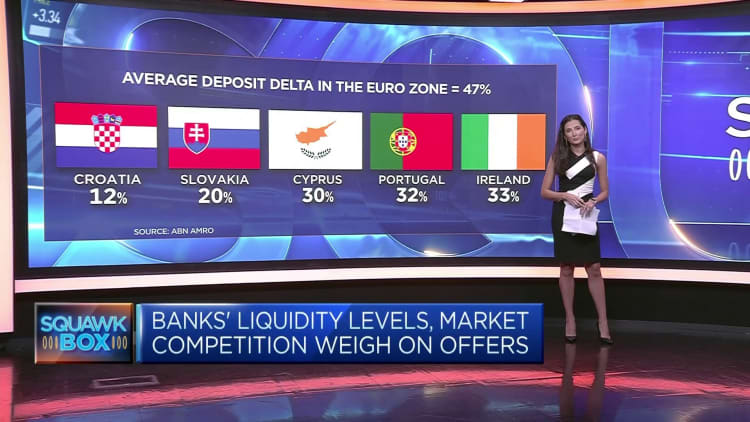

The key metric made use of by analysts is the deposit delta — which signifies the raise in policy charges that banks move via to the desire costs on deposits. The larger the figure is, the much more banking institutions are passing on.

According to Dutch loan provider ABN Amro, the ordinary deposit delta in the euro zone in June this calendar year was 47% — this means that on typical only fifty percent of the whole 4.25 percentage point raise in ECB curiosity premiums has been handed on to depositors. The ECB lifted its benchmark fee in July 2022, from -.5% to %. The level is now at at 3.75%, this means that since that initial rate hike the ECB’s key amount has risen by 4.25 proportion details.

However, the regular deposit delta across the 20 international locations that share the euro masks stark variations between individuals nations. For instance, Croatia’s deposit delta is 12%, Cyprus is 30% and Portugal stands at 32%. In France, the deposit delta is 73% and in Italy it is 62%.

Regional discrepancies

Even nevertheless euro zone nations share the same forex and they are underneath the exact financial plan conclusions, savers across the location are not making the most of the same returns on their deposits.

“There are without a doubt some stark variations amid European countries,” Marta Ferro Teixeira, analyst at ABN AMRO, instructed CNBC by using email.

“This is the result of distinctions in the structure of the banking field, character of deposits, and different expense prospects,” Teixeira mentioned.

S&P World-wide when compared how much euro zone banks ended up now passing on to that viewed in 2005, when the ECB final entered a level-mountaineering cycle. It concluded that banking companies are now considerably slower finishing this activity.

Nicolas Charnay, a primary credit analyst at S&P Global, cited a couple causes behind the discrepancy. Speaking to CNBC, he stated distinctions in banks’ liquidity levels and the different levels of current market competitiveness influence what’s on present for savers.

Supplied the minimal charges available on deposits, some retail investors have been looking for more eye-catching investments in other places. For occasion, in Portugal, government personal debt certificates have been supplying 3.5% before this calendar year and savers were pouring into this asset course. Which is right until the government decided in June to cap returns at 2.5%.

“Some say that the change was the consequence of pressure from the banking sector on the government. And indeed, Portuguese banking institutions show one of the most affordable deposit delta, remaining the fifth worst in Europe,” Teixeira claimed.

Filipe Garcia, a Portuguese economist, explained to CNBC that loan companies in his region do not really feel they want to appeal to a lot more discounts from prospects, and without the need of competitiveness within the sector, the costs provided to savers will not go up substantially.

Reputational injury

Disgruntled savers could continue to elevate troubles for the banking sector.

“Financial institutions ought to pay more for deposits with the goal to handle the romantic relationship of rely on they have with consumers,” Garcia said, including that shoppers sense defrauded provided they are shelling out more for their mortgages, but not feeling the gain on their cost savings.

“The community has not neglected the governing administration assistance to the financial institutions for the duration of the [sovereign] credit card debt crisis,” Garcia reported.

Portugal, like a handful of other European nations, had to undertake deep changes to its banking process in the wake of the worldwide money disaster of 2008 and the subsequent euro zone sovereign personal debt crisis. Inner thoughts towards the banking technique then turned even additional agitated with creditors notching balanced income.

A consumer takes advantage of an automated teller equipment exterior a Caixabank SA branch in Barcelona, Spain.

Bloomberg | Bloomberg | Getty Photos

Details gathered by S&P World-wide demonstrates that, through the very last reporting season for 25 financial institutions in Europe, 19 documented quarter-on-quarter boosts in internet interest profits. A increased web desire profits signifies banks are receiving far more income from lending than what they are shelling out on deposits.

Larger revenue are spurring a discussion about windfall taxes. Italy has become the most up-to-date country to announce a 40% levy on banks’ gains and, though the evaluate is however going through changes, it displays how some lawmakers want to tap banks’ returns.

Spain authorized a windfall tax on banks past yr and it could increase as a great deal as 3 billion euros ($3.3 billion) from it by 2024, in accordance to Reuters.

“It is a PNL [profit and loss] challenge,” Stilianopoulos from Spain claimed, incorporating that banks are savoring a “free trip” by charging more from house loan holders and not passing higher returns to savers.

He claimed, even so, that governments and regulators are not stepping in — for now — for the reason that they are extra nervous about banking companies than savers.

“When banking companies are generating income, they [government and regulators] do not need to have to preserve them,” he said, referring to the sovereign personal debt crisis.

The place are the regulators?

In truth, there are queries relating to the regulators and why they are not having much more action.

In the U.K., the Economical Carry out Authority introduced an action strategy in late July to make certain loan companies were being passing on desire price rises to savers “correctly.”

“We want a aggressive hard cash savings sector that provides improved deals for savers, where interest charges are reviewed rapidly subsequent base level modifications and corporations prompt savers to change to accounts having to pay bigger premiums,” Sheldon Mills, government director of shoppers and level of competition at the FCA, stated in a assertion.

At the time, FCA knowledge confirmed that nine of the greatest cost savings suppliers, on average, only passed by 28% of the foundation fee increase to their straightforward obtain deposits in between January 2022 to May 2023. However, for savings on a observe or set term, the exact 9 economic providers have been passing by way of 51% of the base price improve.

For its section, ECB officers have also reiterated that financial institutions need to go on these better rates to cost savings, but you can find been no comprehensive investigation or action from regulators so much.

“Remuneration of deposits must go in parallel with rate rises on the belongings facet of the banks. Premiums really should go up not only for credits but also for deposits. This is a little something we are seeking at pretty meticulously,” ECB Vice President Luis de Guindos claimed in February.