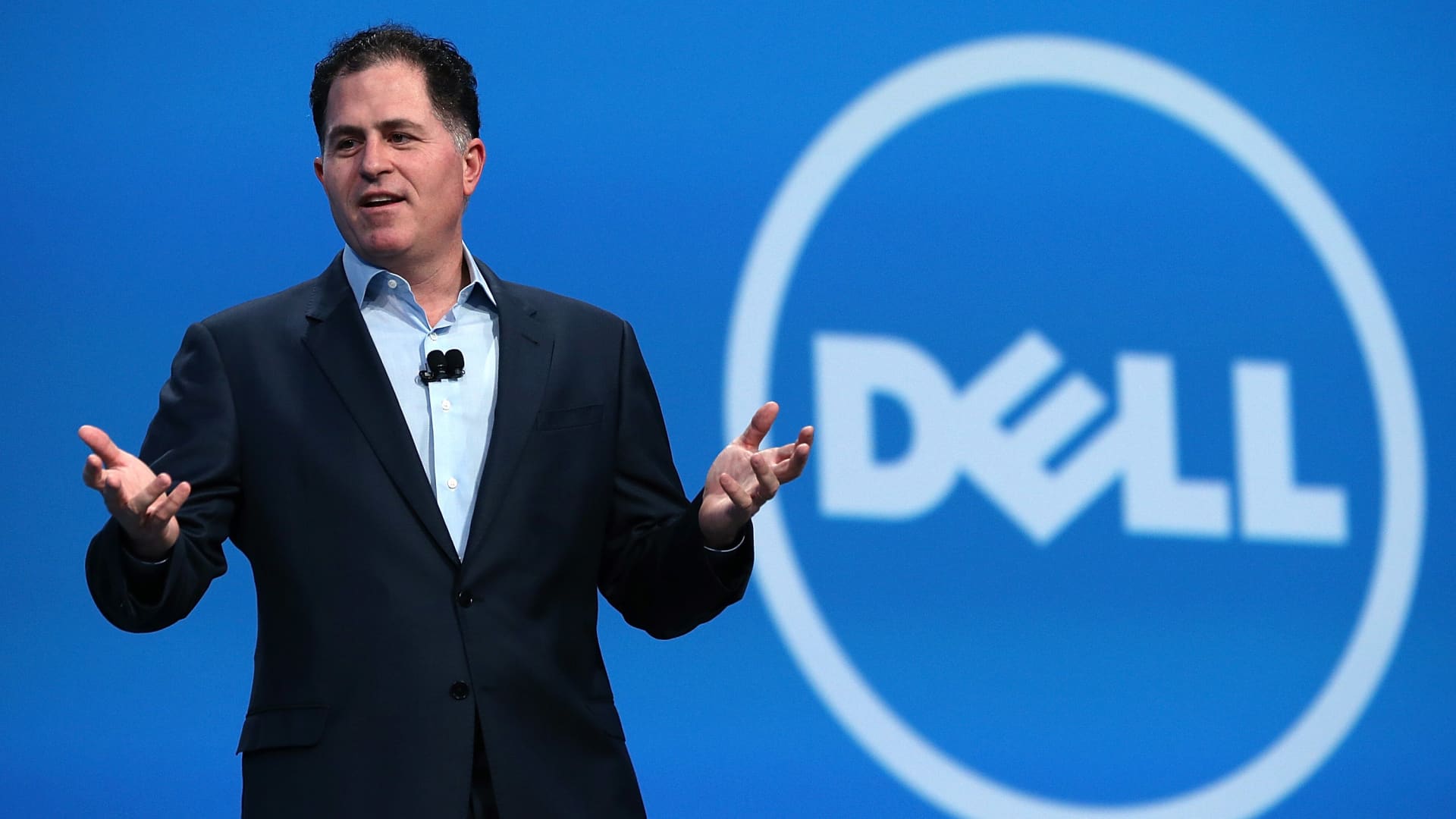

Dell CEO Michael Dell.

Getty Photographs

Dell is acquiring its best working day given that founder Michael Dell introduced the firm again to the inventory current market in 2018.

Shares of the Computer system and server maker surged 29% on Friday to $121.88, immediately after the corporation posted fiscal fourth-quarter benefits that defeat estimates. That tops the stock’s 21% get from Sept. 1, which followed a better-than-envisioned earnings report.

For the most recent quarter, Dell claimed earnings of $22.32 billion, down 11% from the 12 months-ago quarter but eclipsing the $22.16 billion analysts have been anticipating, according to LSEG, previously identified as Refinitiv. Altered earnings for each share of $2.20 surpassed analysts’ estimate of $1.73. Dell’s internet revenue of $1.16 billion marked an increase of 89% from its prior fourth quarter.

The company, demonstrating robust need for its artificial intelligence servers, also stated it really is raising its annual dividend by 20% to $1.78 for each share and expects income of in between $21 billion and $22 billion for the 1st quarter.

Dell returned to general public marketplaces in 2018 just after heading non-public in 2013. Its market cap was about $16 billion when it to start with commenced trading about 5 several years ago. It’s now worthy of shut to $86 billion.

Morgan Stanley analysts reinstated Dell as a top rated decide on Friday and lifted their selling price target to $128 from $100, composing in an investor notice that the company’s “AI server commentary stole the display.”

“The energy of AI server orders, backlog, pipeline, and increasing CSP/business shopper base clearly show DELL’s AI story is early days and gaining momentum,” they wrote.

Wells Fargo, citing Dell’s AI energy and dividend enhance, hiked its price target to $140 and preserved an over weight ranking, when Citi greater its concentrate on price tag to $125 and reiterated a get rating.

— CNBC’s Michael Bloom and Ashley Capoot contributed to this report.

Check out: Friday’s swift hearth

Really don’t skip these stories from CNBC Pro: