It’s been a brutal stretch for the crypto market, and a hard time for cryptocurrency investors to keep their emotions in check.

The sector’s market cap collapse was led by terraUSD, one of the most popular U.S. dollar-pegged stablecoins, which imploded virtually overnight. But bitcoin and ethereum, too, saw massive price declines from their recent bull market highs.

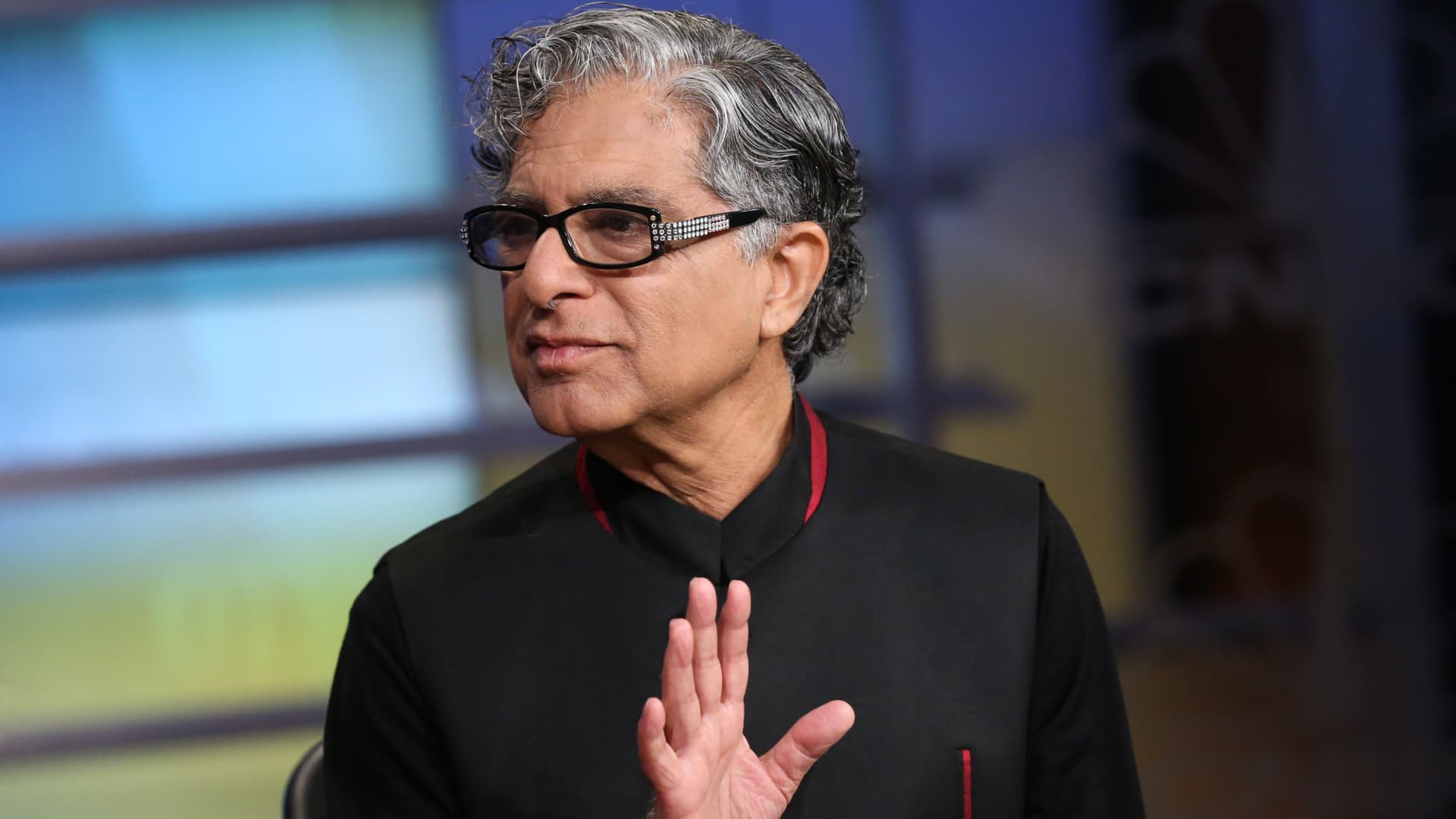

A cultural icon known for being in touch with emotions — and for his recent foray into the NFT space — Deepak Chopra says investors can’t ignore the recent crypto market meltdown, but they should be able to see beyond it.

“The crypto world is in crisis, having lost trillions of dollars. We’re in a bear market,” Chopra recently told CNBC at Gary Vaynerchuk’s “VeeCon” in Minneapolis.

“Right now is the time to think long-term in these financial markets, including crypto. I think emergence happens when you have maximum diversity of people hanging in there creatively, complimenting each other’s strengths and having some kind of a spiritual and emotional ecosystem where they can help each other and that’s happening right now in the crypto community,” Chopra said.

Deepak Chopra, co-founder of the Chopra Center for Wellbeing and the founder of the Chopra Foundation.

Adam Jeffery | CNBC

It is unclear whether the recent rout marks the next “crypto winter” — a multiyear bear market that occurs on a cyclical basis for the crypto asset class — though dropping trading volumes on crypto exchanges is one sign that we may be headed in that direction. The last so-called crypto winter ran from 2018 into the fall of 2020 as the value of cryptocurrencies plunged and layoffs were rife.

There are more than 19,000 cryptocurrencies in existence and dozens of blockchain platforms, the underlying technology that cryptocurrencies are built upon. Not all will survive, and some crypto industry leaders expect a period of “creative destruction” wiping out many players.

Mark Cuban, who has become a big investor in blockchain-based technologies, recently compared the crypto crash to “the lull that the internet went through” during the dotcom bubble. He tweeted that there are too many imitators out there. “The chains that copy what everyone else has, will fail,” Cuban tweeted. “We don’t need NFTs or DeFi on every chain.”

Earlier this year, Chopra’s foundation partnered with crypto crowdfunding platform EarthFund to launch a collection of NFT tokens aimed at helping people achieve mental and emotional health. Token holders can earn rewards that allow them to “crowdfund a treasury and decide as a community which mental well-being projects get the funding they need to make a difference,” according to a March statement.

The Chopra Foundation has also participated in Hollywood actress Emilia Clarke’s SameYou NFT initiative launched in November 2021, which aims to provide better treatment of those recovering from the injuries of brain stroke and injury.

“We’re using artificial intelligence to talk to people who are feeling mentally challenged and if they need counseling, we have a token with EarthFund so that we can democratize well-being all over the world,” Chopra said. “This is the future. We want to create global communities of attention, affection, appreciation and acceptance, where people are there to support each other and have each others backs.”

NFTs are a type of digital asset created to track ownership of a virtual item using blockchain technology. Earlier this week, U.S. prosecutors announced that they’re pursuing an insider trading charge involving these digital assets for the first time.

“I hope people don’t get sucked into the melodrama [of NFTs], because the markets always reflect the fickle human mind. One day it’s up, one day it’s down, one bit of news and we’re in a bull market, the next day there’s bad news and we’re in a bear market,” Chopra said.

“Ultimately, history has shown that economic development will happen because we are creative human beings, but we have to hang in there and support each other. It’s not a time for competition right now, but cooperation,” he added.