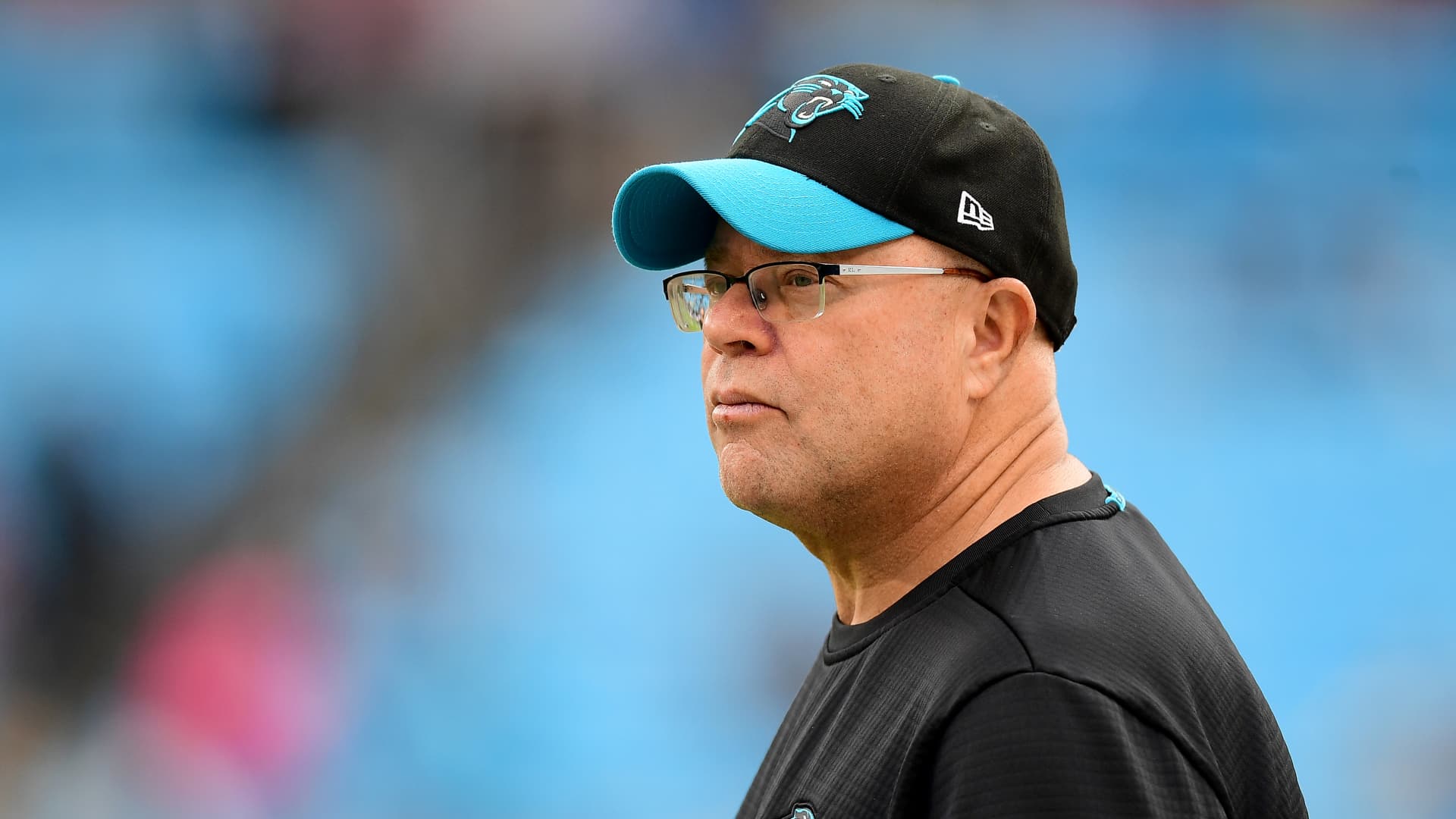

David Tepper’s Appaloosa Administration exited modest positions in various large identify organizations in the course of the 3rd quarter as the hedge fund continued to pull back from stocks. Appaloosa exited positions in Kohl’s and Occidental Petroleum that had been truly worth $66.9 million and $51.5 million, respectively, at the finish of June, in accordance to a securities submitting released Monday . The fund also zeroed out a stake in Micron Engineering valued at $31.8 million and positions in Netflix and Disney that were worth fewer than $10 million. Appaloosa even trimmed some of its most important holdings, these as Amazon and Alphabet , when accounting for the Google-parent’s stock split in July. The fund’s most significant posture is now the Baltimore-primarily based utility Constellation Electricity . It is unclear if Tepper, a billionaire who also owns the the NFL’s Carolina Panthers, redistributed the proceeds from the inventory income to other belongings. The submitting produced on Monday does not display fastened money positions or derivatives. The latest moves echoed a equally system in the next quarter, when Appaloosa also slice its equity holdings . Tepper has stated multiple periods this year that there are factors to be careful on the stock market place, telling CNBC’s Scott Wapner in May that central banks have a believability issue . He also advised Jim Cramer in June that buyers really should perform it protected .