Shari Redstone, president of Countrywide Amusements and Vice Chairman, CBS and Viacom speaks at the WSJTECH live convention in Laguna Beach, California, U.S. October 21, 2019.

Mike Blake | Reuters

David Ellison’s Skydance Media and its financial backers are discovering a offer to choose private all of Paramount International, people today acquainted with the matter told CNBC.

Skydance, the movie and Tv studio operate by Ellison, has exchanged preliminary facts with Paramount, stated the persons, who questioned not to be named due to the fact the deal talks are personal. Full because of diligence hasn’t commenced, the men and women said.

Skydance has been doing work with personal fairness corporations RedBird Cash Partners and KKR & Co. on a offer to invest in Countrywide Amusements, the holding company owned by Shari Redstone. It controls 77% of Paramount’s voting stock.

But that deal is contingent on merging Skydance with Paramount, and the most likely framework for a merger would be a entire get personal of the bigger media business, mentioned the men and women.

Redstone is looking at marketing as the media landscape shifts away from traditional Tv towards streaming. Though Paramount Worldwide has run a financially rewarding enterprise for many years, it is scaled-down than Netflix, Google’s YouTube, Apple, Amazon, and other larger sized streamers that have more substantial balance sheets to manage sports activities and amusement content.

No acquisition is certain, and talks could fall aside.

It is unclear if Redstone would demand from customers a distinctive high quality for providing Nationwide Amusements than the remaining shareholders of Paramount International would receive.

Skydance would want supplemental funds to acquire Paramount, which has a current market capitalization of $8.2 billion and about $15 billion of personal debt. Some of that funding could come from Skydance’s non-public fairness partners and Larry Ellison, the billionaire co-founder of Oracle and David Ellison’s father. Skydance hasn’t achieved out for outdoors funding however, as it hasn’t resolved if it wishes to shift ahead with a deal, mentioned the individuals.

Skydance isn’t interested in a offer exactly where it would only acquire National Amusements but not all of Paramount, mentioned the men and women. Whilst this kind of a deal would give Skydance handle of Paramount, it wouldn’t address Paramount’s troubles as a publicly traded organization, which incorporate working Paramount+, a money-getting rid of streaming support, and working declining linear cable belongings these types of as MTV, VH1, Comedy Central and Nickelodeon.

Spokespeople for RedBird, Skydance, Paramount International and Nationwide Amusements declined to remark.

Warner Bros. Discovery has also had preliminary conversations about obtaining Paramount Global, according to individuals common with the subject. If Redstone sells to Skydance, just one motivating component would be her fear that Warner Bros. Discovery would like to merge with Comcast‘s NBCUniversal, a person of the persons said.

Puck first described Skydance’s fascination in getting National Amusements. The Wall Road Journal claimed last week that Skydance was interested in a two-part offer that would involve merging Skydance and Countrywide Amusements.

Disclosure: Comcast NBCUniversal is the mother or father business of CNBC.

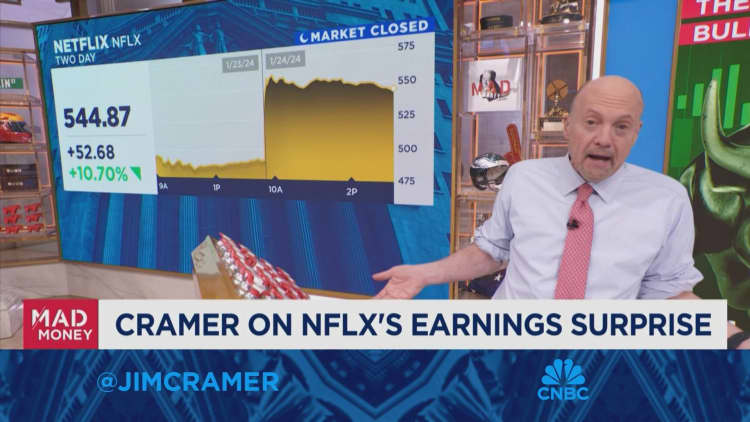

Watch: Mad Revenue on Netflix’s earnings surprise