Tap emergency resources

Reach out to the Federal Emergency Management Agency, Disaster Assistance Improvement Program and the American Red Cross, as well as state and local governments, for emergency assistance. You may also find help in your community.

“Disasters bring people together,” McClanahan said. “People are really good at helping people.

“If you have the ability to help, do it,” she added. “It may be you who needs help one day.”

Contact mortgage and other lenders if you may have trouble making loan payments.

Prepare for insurance claims

If you’re going to file an insurance claim, inventory the damage before you start cleaning up.

Make temporary repairs to prevent further damage, but hold off on permanent repairs until you’ve gotten approval for reimbursement. Keep a written record of the name of everyone you talk to about your claim, including the date of the conversation and summary of what was said. And keep all receipts.

Understand your flood benefits

Floods, including those from a storm surge, are not covered by most standard insurance policies. Coverage for floods requires a separate policy, either from the federally based National Flood Insurance Program or a private insurer. There is a 30-day waiting period before flood coverage is effective.

Flood insurance for autos is an option under the comprehensive portion of a policy.

Know your deductible

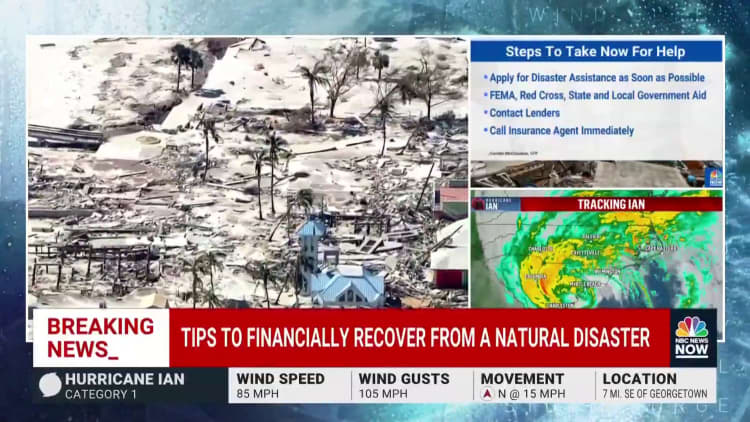

An aerial view of Fort Myers Beach, Florida, during a Coast Guard flight after Hurricane Ian, on Oct. 2, 2022

Miami Herald | Tribune News Service | Getty Images

Many property owners in Florida will face a “hurricane deductible,” which is different than the standard insurance deductible. It’s typically a percentage of the property value.

“If you have a $300,000 house, you could have a $15,000 hurricane deductible before the insurance starts paying,” said Bob Rusbuldt, CEO of the Independent Insurance Agents and Brokers of America.

After Hurricane Ian, Rusbuldt predicts, it will be difficult for consumers to find property insurance.

Many will now be facing even higher premiums and deductibles and may have to find a new insurance company if theirs pulls out. Many Florida property owners already have insurance through Citizens, Florida’s state-run insurer of last resort.