Purple pedestrian crossing signs exterior a Credit rating Suisse Team AG financial institution branch in Basel, Switzerland, on Tuesday, Oct. 25, 2022.

Stefan Wermuth | Bloomberg | Getty Illustrations or photos

Talks about rescuing Credit score Suisse rolled into Sunday as UBS sought $6 billion from the Swiss federal government to deal with costs if it ended up to invest in its battling rival, a individual with know-how of the talks stated.

Authorities are scrambling to take care of a crisis of confidence in the 167-12 months-old Credit Suisse, the largely globally substantial bank caught in the turmoil spurred by the collapse of U.S. creditors Silicon Valley Bank and Signature Lender more than the past 7 days.

similar investing news

Even though regulators want a resolution before markets reopen on Monday, a single supply cautioned the talks are encountering sizeable road blocks, and 10,000 careers may well have to be slice if the two banking companies combine.

The guarantees UBS is seeking would go over the cost of winding down pieces of Credit Suisse and possible litigation costs, two men and women informed Reuters.

Credit history Suisse, UBS and the Swiss government declined to comment.

The frenzied weekend negotiations follow a brutal 7 days for banking stocks and efforts in Europe and the U.S. to shore up the sector. U.S. President Joe Biden’s administration moved to backstop purchaser deposits while the Swiss central bank lent billions to Credit Suisse to stabilise its shaky balance sheet.

UBS was under pressure from the Swiss authorities to acquire over its neighborhood rival to get the disaster under command, two folks with expertise of the matter stated. The plan could see Credit rating Suisse’s Swiss organization spun off.

Switzerland is making ready to use crisis actions to rapid-observe the offer, the Economical Times claimed, citing two persons common with the problem.

U.S. authorities are involved, working with their Swiss counterparts to help broker a deal, Bloomberg Information documented, also citing all those acquainted with the matter.

Berkshire Hathaway‘s Warren Buffett has held conversations with senior Biden administration officials about the banking crisis, a source advised Reuters.

The White House and U.S. Treasury declined to comment.

British finance minister Jeremy Hunt and Bank of England Governor Andrew Bailey are also in regular contact this weekend more than the destiny of Credit history Suisse, a supply acquainted with the issue said. Spokespeople for the British Treasury and the Lender of England’s Prudential Regulation Authority, which oversees loan providers, declined to remark.

Forceful reaction

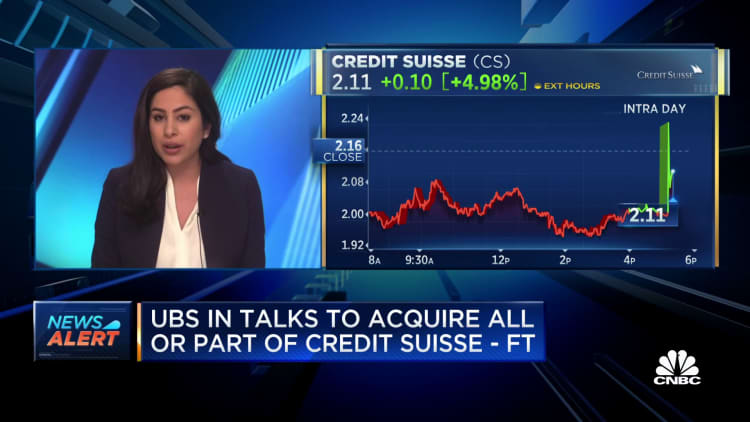

Credit score Suisse shares dropped a quarter of their benefit in the last 7 days. The financial institution was forced to tap $54 billion in central lender funding as it attempts to get well from a string of scandals that have undermined the self-confidence of buyers and clientele.

It ranks between the world’s largest prosperity administrators and is regarded one particular of 30 world wide systemically important banking companies – the failure of any would ripple through the overall financial program.

There were a number of reports of curiosity for Credit history Suisse from other rivals. Bloomberg noted that Deutsche Lender was taking into consideration buying some of its assets, when U.S. economical large BlackRock denied a report that it was participating in a rival bid for the financial institution.

Fascination amount possibility

The failure of California-based Silicon Valley Bank brought into aim how a relentless marketing campaign of curiosity level hikes by the U.S. Federal Reserve and other central banking companies – such as the European Central Financial institution on Thursday – was pressuring the banking sector.

SVB and Signature’s collapses are biggest financial institution failures in U.S. historical past guiding the demise of Washington Mutual all through the worldwide financial crisis in 2008.

Initial Citizens BancShares is assessing an supply for SVB and at the very least just one other suitor is significantly thinking of an give, Bloomberg Information reported on Saturday.

Banking stocks globally have been battered given that SVB collapsed, with the S&P Banks index falling 22%, its biggest two-week reduction due to the fact the pandemic shook marketplaces in March 2020.

Massive U.S. banks threw a $30 billion lifeline to scaled-down lender 1st Republic. U.S. banking companies have sought a document $153 billion in emergency liquidity from the Federal Reserve in new times.

The Mid-Dimensions Financial institution Coalition of America asked regulators to increase federal insurance policy to all deposits for the subsequent two many years, Bloomberg Information noted on Saturday, citing a letter from the coalition.

In Washington, emphasis has turned to higher oversight to make certain that financial institutions and their executives are held accountable.

Biden known as on Congress to give regulators greater power in excess of the sector, which includes imposing better fines, clawing again resources and barring officers from unsuccessful banking institutions.

The swift and dramatic occasions could mean big banking institutions get larger, smaller financial institutions could strain to preserve up and a lot more regional lenders may possibly shut.

“People are truly relocating their dollars around, all these banks are going to look fundamentally distinctive in 3 months, 6 months,” stated Keith Noreika, vice president of Patomak World-wide Associates and a Republican former U.S. comptroller of the currency.