Pink pedestrian crossing symptoms outside a Credit score Suisse Team AG lender branch in Basel, Switzerland, on Tuesday, Oct. 25, 2022.

Stefan Wermuth | Bloomberg | Getty Pictures

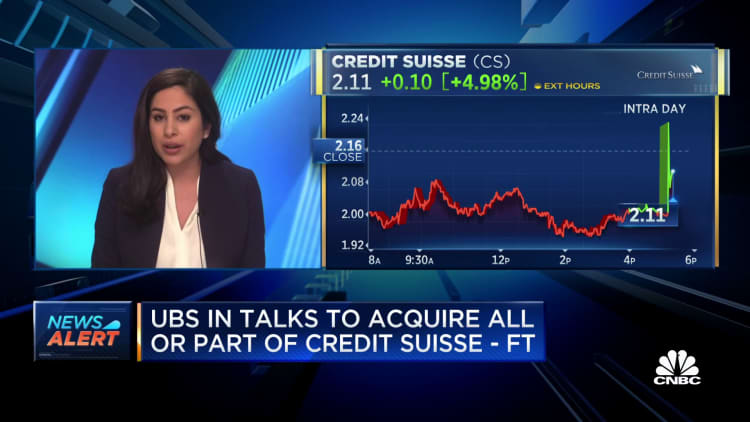

Talks over rescuing Credit rating Suisse rolled into Sunday as UBS sought $6 billion from the Swiss governing administration to address expenses if it ended up to invest in its having difficulties rival, a human being with information of the talks explained.

Authorities are scrambling to resolve a crisis of self-assurance in the 167-12 months-old Credit Suisse, the mainly globally considerable lender caught in the turmoil spurred by the collapse of U.S. loan providers Silicon Valley Financial institution and Signature Financial institution around the previous week.

related investing news

While regulators want a resolution prior to marketplaces reopen on Monday, one particular source cautioned the talks are encountering considerable road blocks, and 10,000 employment might have to be minimize if the two financial institutions combine.

The guarantees UBS is looking for would deal with the expense of winding down components of Credit Suisse and likely litigation fees, two persons informed Reuters.

Credit score Suisse, UBS and the Swiss authorities declined to remark.

The frenzied weekend negotiations adhere to a brutal week for banking shares and efforts in Europe and the U.S. to shore up the sector. U.S. President Joe Biden’s administration moved to backstop client deposits though the Swiss central bank lent billions to Credit rating Suisse to stabilise its shaky stability sheet.

UBS was under pressure from the Swiss authorities to choose above its area rival to get the disaster below command, two people with understanding of the subject claimed. The system could see Credit Suisse’s Swiss organization spun off.

Switzerland is making ready to use crisis actions to quick-monitor the offer, the Fiscal Moments noted, citing two persons common with the situation.

U.S. authorities are involved, doing work with their Swiss counterparts to enable broker a deal, Bloomberg News documented, also citing those acquainted with the subject.

Berkshire Hathaway‘s Warren Buffett has held conversations with senior Biden administration officers about the banking crisis, a supply advised Reuters.

The White Property and U.S. Treasury declined to comment.

British finance minister Jeremy Hunt and Bank of England Governor Andrew Bailey are also in regular contact this weekend around the destiny of Credit Suisse, a supply common with the matter explained. Spokespeople for the British Treasury and the Bank of England’s Prudential Regulation Authority, which oversees loan companies, declined to remark.

Forceful response

Credit Suisse shares dropped a quarter of their value in the past 7 days. The bank was compelled to faucet $54 billion in central bank funding as it tries to get well from a string of scandals that have undermined the assurance of investors and shoppers.

It ranks amongst the world’s premier wealth professionals and is deemed one of 30 world systemically crucial financial institutions – the failure of any would ripple all over the complete economic process.

There were several reports of desire for Credit history Suisse from other rivals. Bloomberg noted that Deutsche Financial institution was contemplating buying some of its belongings, while U.S. fiscal large BlackRock denied a report that it was taking part in a rival bid for the financial institution.

Fascination rate danger

The failure of California-based Silicon Valley Bank brought into target how a relentless marketing campaign of desire fee hikes by the U.S. Federal Reserve and other central banking companies – including the European Central Lender on Thursday – was pressuring the banking sector.

SVB and Signature’s collapses are most significant financial institution failures in U.S. history guiding the demise of Washington Mutual throughout the world economic crisis in 2008.

To start with Citizens BancShares is analyzing an give for SVB and at least just one other suitor is significantly thinking of an present, Bloomberg Information claimed on Saturday.

Banking shares globally have been battered since SVB collapsed, with the S&P Banking institutions index falling 22%, its greatest two-week loss since the pandemic shook marketplaces in March 2020.

Massive U.S. banking institutions threw a $30 billion lifeline to scaled-down loan company First Republic. U.S. banking companies have sought a file $153 billion in emergency liquidity from the Federal Reserve in modern times.

The Mid-Measurement Bank Coalition of The usa asked regulators to increase federal insurance policies to all deposits for the up coming two years, Bloomberg News reported on Saturday, citing a letter from the coalition.

In Washington, concentrate has turned to larger oversight to be certain that financial institutions and their executives are held accountable.

Biden named on Congress to give regulators greater energy above the sector, together with imposing better fines, clawing back funds and barring officials from failed banking institutions.

The swift and remarkable situations might mean big banking companies get more substantial, scaled-down banks may possibly pressure to continue to keep up and extra regional creditors could shut.

“People are basically relocating their dollars all over, all these banks are heading to seem basically distinctive in a few months, six months,” mentioned Keith Noreika, vice president of Patomak Worldwide Companions and a Republican previous U.S. comptroller of the currency.