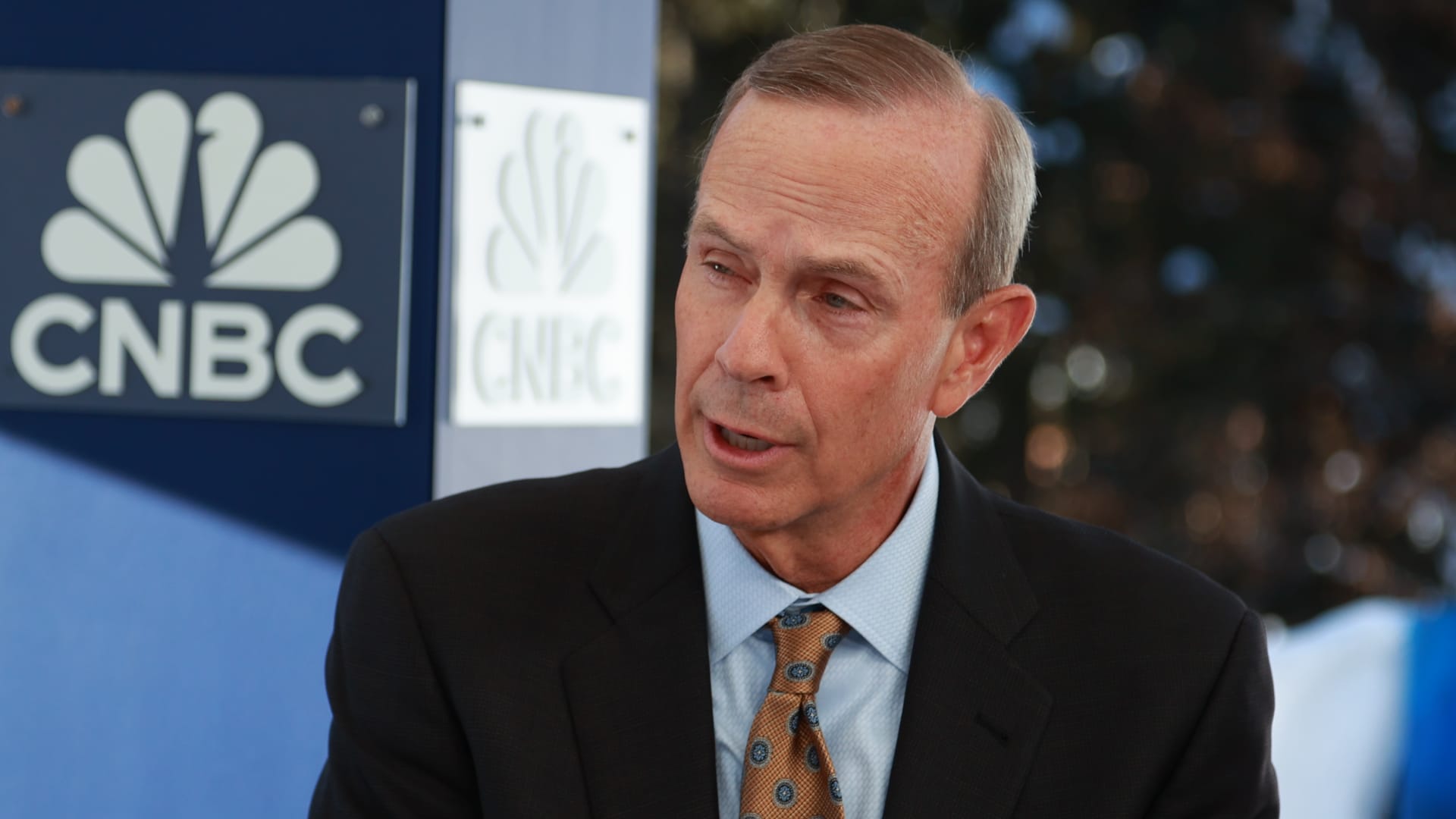

The crisis in the Pink Sea poses significant hazards to oil flows and prices could change promptly if tensions direct to a main supply disruption in the Center East, Chevron CEO Michael Wirth instructed CNBC on Tuesday.

“It really is a incredibly critical condition and appears to be getting even worse,” Wirth explained in an interview at the Earth Economic Forum in Davos, Switzerland.

The Chevron CEO explained he was amazed that U.S. crude oil was investing beneath $73 a barrel for the reason that the “risks are incredibly actual.”

“So significantly of the world’s oil flows as a result of that area that ended up it to be lower off, I assume you could see issues improve incredibly swiftly,” Wirth explained.

Chevron has continued transporting crude as a result of the location as the business works carefully with the U.S. Navy’s Fifth Fleet, Wirth said. The CEO cautioned that circumstance is evolving.

“We really have to enjoy really thoroughly,” Wirth explained to CNBC.

Shell suspends Red Sea shipments

The British oil key Shell has suspended shipments by means of the Crimson Sea, individuals common with the make a difference informed The Wall Street Journal Tuesday. Shell declined to comment in response to a request from CNBC.

Shell’s conclusion to halt shipments as a result of the crucial trade chokepoint arrives about a month right after BP paused transits by way of the Pink Sea. Quite a few big tanker corporations, which transportation petroleum items these kinds of as gasoline as nicely as crude oil, halted targeted visitors toward the Red Sea on Friday.

Houthi militants, who are primarily based in Yemen and allied with Iran, have repeatedly attacked industrial vessels in the Crimson Sea in response to Israel’s war in Gaza. The U.S. and Britain have introduced airstrikes against Houthi targets in Yemen to safe shipping and delivery through the waterway.

The Houthis have ongoing to start attacks inspite of the U.S.-led strikes. The militants on Tuesday launched an antiship ballistic missile that struck a Maltese-flagged bulk provider in the Red Sea, in accordance to U.S. Central Command. No accidents had been reported and the vessel continued to transit the waterway, according to CENTCOM.

Sullivan: Houthis are hijacking the earth

U.S. National Stability Advisor Jake Sullivan claimed nations with impact in Iran will need to choose a more robust stand to demonstrate the “entire earth rejects wholesale the concept that a group like the Houthis can generally hijack the earth as they are performing.”

The U.N. Stability Council adopted a resolution final week condemning the Houthi assaults “in the strongest achievable terms.” Long lasting council users China and Russia, which wield veto energy, abstained from the vote on the resolution.

“We expected that the Houthis would proceed to consider to maintain this essential artery at chance, and we continue to reserve the appropriate to consider additional motion, but this wants to be an all arms on deck hard work,” Sullivan explained during an job interview in Davos on Tuesday.

Oil market place and geopolitical analysts say that the biggest danger to electrical power supplies would come if Middle East tensions erupt into a regional conflict that disrupts crude oil flows out of the Strait of Hormuz.

Some 7 million barrels of crude oil and merchandise transit the Purple Sea daily, compared to 18 million barrels that transit the Strait of Hormuz, in accordance to facts from the trade analytics company Kpler.

Goldman Sachs has warned that a prolonged disruption in the Strait of Hormuz could double oil costs, even though the financial investment financial institution views that state of affairs as unlikely.

Wirth stated Chevron had two ships attacked by the Iranian Navy final year, one particular of which was hijacked by commandos and taken to an Iranian port and the other took hearth for four hours until the U.S. Navy intervened.

Iran seized an oil tanker very last week in the Gulf of Oman. The Marshall Islands-flagged tanker St. Nikolas was formerly included in a dispute among the U.S. and Iran above sanctioned crude.