CNBC’s Jim Cramer on Friday told investors that they should watch for stocks to add as earnings season winds down.

“There’s plenty to buy, as long as you buy companies that are making money and returning some of that money to shareholders via buybacks and dividends,” he said. “Still too soon, by the way, to pick at high-growth stocks with little in the way of earnings, though.”

Stocks were mixed on Friday, with the S&P 500 closing up slightly as it notched its worst weekly performance in nearly two months. All three major indexes ended down for the week.

Cramer reassured investors that the market’s declines this week don’t mean that it’s headed for bear market territory. “Right now, we’re witnessing classic bull market behavior. A bull market has moments where the despair is thick.”

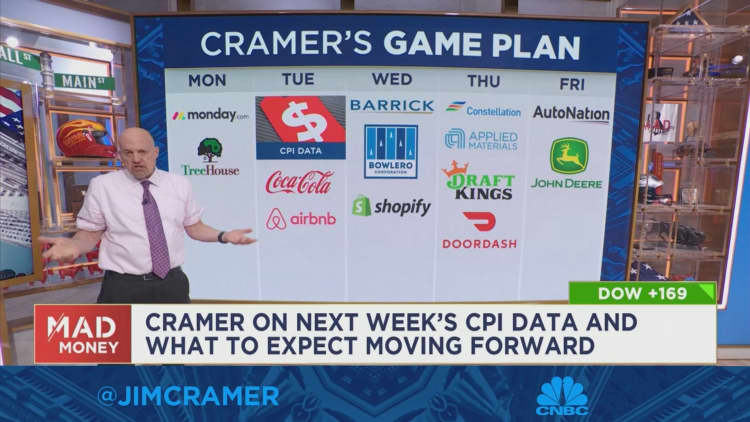

In addition to corporate earnings reports, he said that he’s keeping an eye out for the January consumer price index report on Tuesday.

All estimates for earnings, revenue and economic data for the week are courtesy of FactSet.

Monday: TreeHouse Foods

- Q4 2022 earnings release at 6:55 a.m. ET; conference call at 8:30 a.m. ET

- Projected EPS: 98 cents

- Projected revenue: $1 billion

“To date, we have not seen much trade down of any size at the supermarket. … But once it starts happening, that will be a huge win in the fight against inflation,” he said.

Tuesday: Coca-Cola, Airbnb

Coca-Cola

- Q4 2022 earnings release at 6:55 a.m. ET; conference call at 8:30 a.m. ET

- Projected EPS: 45 cents

- Projected revenue: $10 billion

Cramer said he expects a solid quarter from the beverage giant.

Airbnb

- Q4 2022 earnings release at 4:05 p.m. ET; conference call at 4:30 p.m. ET

- Projected EPS: 25 cents

- Projected revenue: $1.86 billion

“I’ve been adamant that this company is undervalued, but I just don’t know when it can break out to the upside,” he said.

Wednesday: Bowlero, Shopify

Bowlero

- Q2 2023 earnings release after the close; conference call at 4:30 p.m. ET

- Projected EPS: 16 cents

- Projected revenue: $257 million

Cramer predicted the company will deliver a great set of numbers.

Shopify

- Q4 2022 earnings release after the close; conference call at 5 p.m. ET

- Projected loss: 1 cent per share

- Projected revenue: $1.65 billion

The company must show that it can pivot toward profitability, he said.

Thursday: Constellation Energy, Applied Materials, DraftKings, DoorDash

Constellation Energy

- Q4 2022 earnings release at TBA time; conference call at 10 a.m. ET

- Projected EPS: 26 cents

- Projected revenue: $3.63 billion

“I’d stick with this one as long as a Democrat is in the White House,” he said.

Applied Materials

- Q1 2023 earnings release at 4 p.m. ET; conference call at 4:30 p.m. ET

- Projected EPS: $1.93

- Projected revenue: $6.69 billion

Cramer said he’s betting the company will report a weak quarter.

DraftKings

- Q4 2022 earnings release after the close; conference call on Friday at 8:30 a.m. ET

- Projected loss: 61 cents per share

- Projected revenue: $798 million

“I do like DraftKings. I like the CEO. … But I don’t like the legislative road map,” he said.

DoorDash

- Q4 2022 earnings release at 4:05 p.m. ET; conference call at 5 p.m. ET

- Projected loss: 67 cents per share

- Projected revenue: $1.77 billion

He said the company needs a plan to become profitable since the market only cares about companies that can deliver solid earnings.

Friday: Deere

- Q1 2023 earnings release at 6:45 a.m. ET; conference call at 10 a.m. ET

- Projected EPS: $5.54

- Projected revenue: $11.34 billion

Deere stock is the best way to play the long-term bull market in agriculture, according to Cramer.