CNBC’s Jim Cramer on Friday advised investors to take any chance to sell stocks next week as the busy earnings season continues.

“The market’s dominated by the tick, tick, tick of bonds, oil and the dollar. So, remember, if we have a big up day like yesterday, that is a chance to do some [selling] because there probably won’t be any follow-through,” he said.

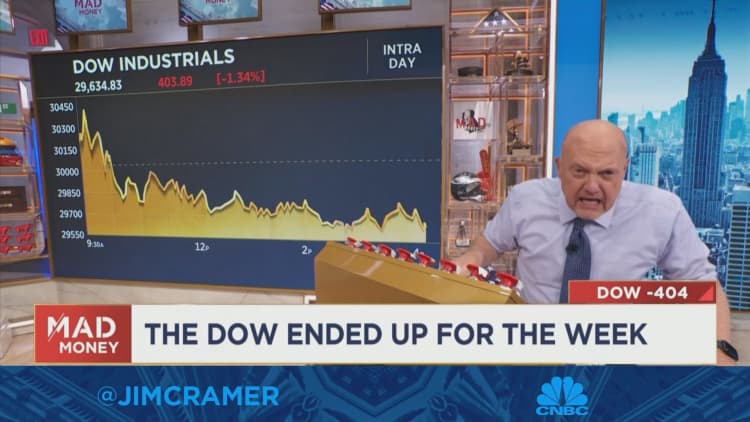

Cramer’s comments come after stocks fell on Friday to end a volatile week of trading, just one day after the market snapped a six-day losing streak with a historic intraday reversal.

He also previewed next week’s slate of earnings. All earnings and revenue estimates are courtesy of FactSet.

Monday: Bank of America

- Q3 2022 earnings release at 6:45 a.m. ET; conference call at 8:30 a.m. ET

- Projected EPS: 78 cents

- Projected revenue: $23.54 billion

Cramer said he expects the bank to report a great number, but that it might have no effect on the stock if bonds, oil or the dollar goes haywire the same day.

Tuesday: Goldman Sachs, Johnson & Johnson, Netflix

Goldman Sachs

- Q3 2022 earnings release at 7:30 a.m. ET; conference call at 9:30 a.m. ET

- Projected EPS: $7.75

- Projected revenue: $11.42 billion

Calling the stock “crazy cheap,” Cramer said he’s looking for a solid bottom line from the company in its latest quarter.

Johnson & Johnson

- Q3 2022 earnings release between 6:25 and 6:40 a.m. ET; conference call at 8:30 a.m. ET

- Projected EPS: $2.48

- Projected revenue: $23.36 billion

The stock remains one of his favorites, Cramer said.

Netflix

- Q3 2022 earnings release at 4 p.m. ET; conference call at 6 p.m. ET

- Projected EPS: $2.14

- Projected revenue: $7.84 billion

He said he expects to hear more about the company’s new ad-supported tier and has faith that the company will roll it out without going overboard with the number of commercials.

Wednesday: Procter & Gamble, Tesla, IBM, Lam Research

Procter & Gamble

- Q1 2023 earnings release at 6:55 a.m. ET; conference call at 8:30 a.m. ET

- Projected EPS: $1.55

- Projected revenue: $20.35 billion

The company’s stock will go up even if the quarter is bad because so many short-sellers are betting against it, Cramer predicted.

Tesla

- Q3 2022 earnings release between 4:05 and 5 p.m. ET; conference call at 5:30 p.m. ET

- Projected EPS: $1.01

- Projected revenue: $22.14 billion

He said that buyers will likely support the company’s stock no matter what the quarter looks like.

IBM

- Q3 2022 earnings release at 4:05 p.m. ET; conference call at 5 p.m. ET

- Projected EPS: $1.79

- Projected revenue: $13.53 billion

It’s unclear whether the company will be able to post results that’ll excite the market, Cramer said.

Lam Research

- Q1 2023 earnings release at 4:05 p.m. ET; conference call at 5 p.m. ET

- Projected EPS: $9.58

- Projected revenue: $4.93 billion

“If Lam says they’re seeing cutbacks similar to what we heard from Applied Materials, AMAT, this week, then the whole semiconductor world is going to have another move down,” he said.

Thursday: AT&T

- Q3 2022 earnings release at 7 a.m. ET; conference call at 8:30 a.m. ET

- Projected EPS: 61 cents

- Projected revenue: $29.84 billion

Cramer said that while he hopes AT&T won’t have a disappointing quarter, he’s skeptical the company will be able to pull it off.

Friday: Verizon

- Q3 2022 earnings release at 7:30 a.m. ET; conference call at 8:30 a.m. ET

- Projected EPS: $1.29

- Projected revenue: $33.78 billion

Verizon’s stock performance suggests the company is struggling due to competition from T-Mobile, Cramer said.

Disclaimer: Cramer’s Charitable Trust owns shares of Johnson & Johnson and Procter & Gamble.