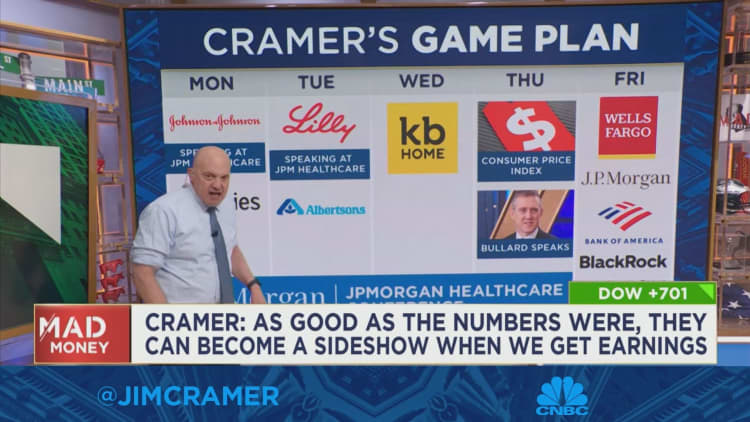

CNBC’s Jim Cramer said Friday that corporate earnings reports next week will be key in determining the market’s performance.

Stocks rose Friday after the December jobs report and an economic condition reading signaled that the Federal Reserve is making headway in its fight against inflation. The Dow Jones Industrial Average and S&P 500 recorded their best day since Nov. 30, while the Nasdaq Composite had its best day since Dec. 29.

related investing news

“As good as these macro numbers were for the market, they’ll become a sideshow when we actually start getting earnings reports, and that happens at the end of next week,” he said.

Cramer added that he’ll also have an eye out for the December consumer price index report due next week.

“If the CPI’s cooler than expected, we’ll get another good day, although not as much as today,” he said.

All estimates for earnings, revenue and economic data are courtesy of FactSet.

Monday: Jefferies Financial

- Q4 2022 earnings release after the close

- Projected EPS: 57 cents

- Projected revenue: $1.19 billion

“If they say all systems go, that means you might want to buy the big financials ahead of their earnings” later in the week, Cramer said.

Tuesday: Albertsons

- Q3 2022 earnings release before the bell; no conference call due to its merger agreement with Kroger

- Projected EPS: 65 cents

- Projected revenue: $17.81 billion

He said he’ll be watching for updates on how much prices have risen at the grocery store and how the company’s merger with Kroger is going.

Wednesday: KB Home

- Q4 2022 earnings release between 4:10 p.m. and 4:20 p.m. ET; conference call at 5 p.m. ET

- Projected EPS: $2.87

- Projected revenue: $1.99 billion

The company’s earnings report will give insight into whether housing prices are going down — which would be good news for the Fed, he said.

Friday: Wells Fargo, Bank of America, JPMorgan Chase, BlackRock, UnitedHealth

Wells Fargo

- Q4 2022 earnings release at 7 a.m. ET; conference call at 12 p.m. ET

- Projected EPS: 60 cents

- Projected revenue: $20.01 billion

Cramer said that he thinks the stock has more room to gain.

Bank of America

- Q4 2022 earnings release at 6:45 a.m. ET; conference call at 9:30 a.m. ET

- Projected EPS: 78 cents

- Projected revenue: $24.3 billion

JPMorgan Chase

- Q4 2022 earnings release at 6:45 a.m. ET; conference call at 8:30 a.m. ET

- Projected EPS: $3.11

- Projected revenue: $34.29 billion

He predicted that both Bank of America and JPMorgan Chase will deliver solid quarters.

BlackRock

- Q4 2022 earnings release at 6:15 a.m. ET; conference call at 8:30 a.m. ET

- Projected EPS: $7.87

- Projected revenue: $4.24 billion

Cramer said he expects the company to beat earnings estimates for its latest quarter.

UnitedHealth Group

- Q4 2022 earnings release at 5:55 a.m. ET; conference call at 8:45 a.m. ET

- Projected EPS: $5.17

- Projected revenue: $82.48 billion

“Maybe we can get to the bottom of the decline in UnitedHealth Group, one of my favorite stocks,” Cramer said.

Disclaimer: Cramer’s Charitable Trust owns shares of Wells Fargo.