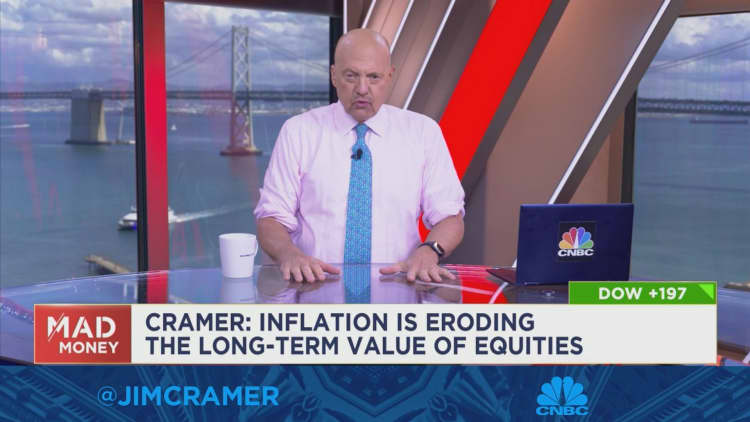

CNBC’s Jim Cramer on Monday made available 3 good reasons why tech corporations, which includes businesses with solid equilibrium sheets, are looking at agony in the stock marketplace.

The “Mad Income” host, who is filming the display from San Francisco this 7 days, reiterated his warning towards unprofitable corporations from earlier this 12 months but acknowledged that even corporations with sturdy financials have been emotion the heat.

He gave three causes why this could possibly be the scenario:

- The robust U.S. greenback and the Europe power crisis are earning businesses a lot more frugal with their purchases. “The underlying firms make products that their clients can dwell without having in an increasingly tricky global overall economy,” Cramer explained.

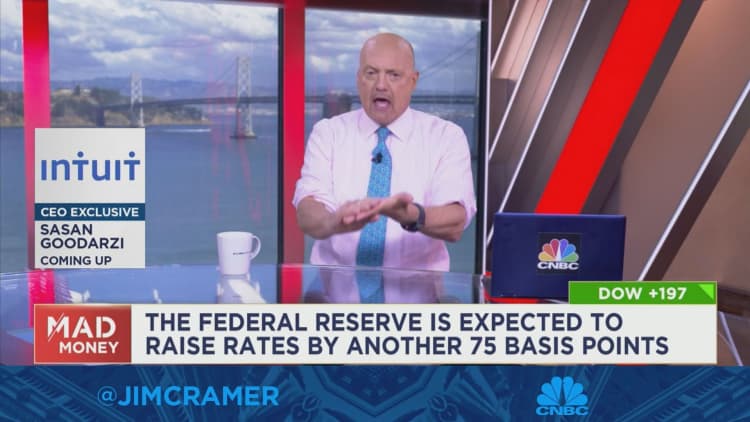

- The Federal Reserve may well want shares down. The central financial institution requirements inflation to occur down by any implies important, which usually means the current market could get uglier, Cramer stated.

- The firm’s personal performances could have been missing. “I take place to think Adobe’s a terrific corporation, but its business has been slowing,” he explained.

Cramer extra that the jury’s however out on whether or not tech will remain crushed, or if this is an prospect to purchase the dip.

“Has the offer-off gone also considerably, however, or is this basically a rolling nightmare that’s not heading to conclusion whenever quickly? I necessarily mean, that’s the problem,” he reported.