CNBC’s Jim Cramer on Friday warned investors to exercise caution when approaching mega-cap tech stocks that got hammered this year.

“If we see these stocks creeping back up to their old levels. … Let’s remember that prices do matter, and we don’t want to get burned the next time they go too high,” he said. “Right now, we want cheap stocks of companies that make things or do stuff at a profit and return some of those profits to shareholders.”

related investing news

Stocks rose Friday but were still down for the week as investors continue to worry about a potential recession.

Tech stocks have been hammered this year by persistent inflation, the Federal Reserve’s interest rate hikes and Covid shutdowns in China. Before this year, mega-cap tech names soared to stratospheric heights and were largely responsible for the market’s strength.

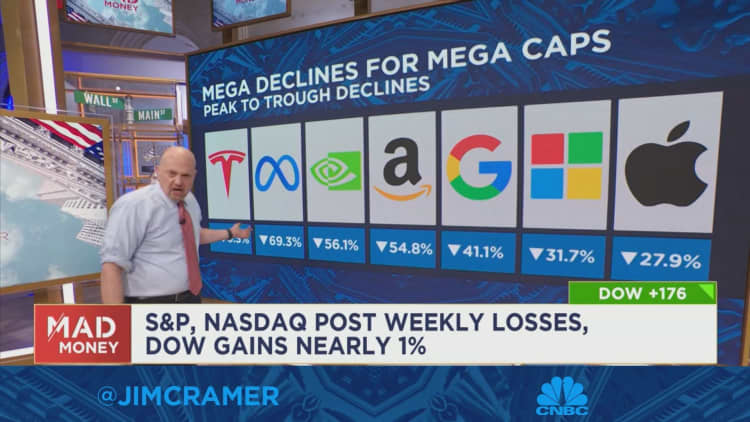

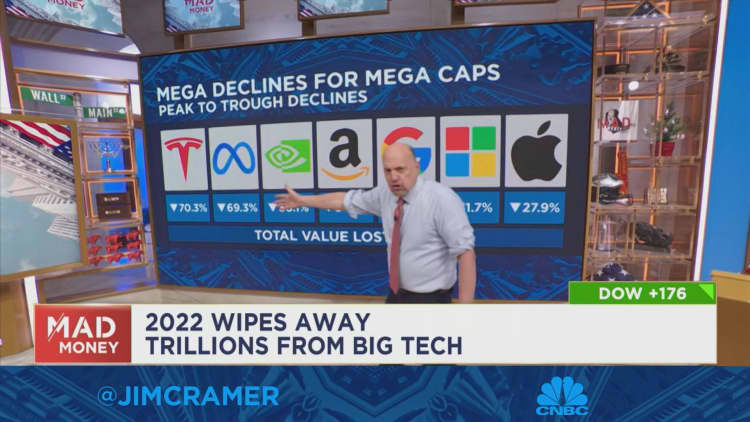

Tesla, Meta Platforms, Nvidia, Amazon, Alphabet, Microsoft and Apple — all major stocks in the S&P 500 — lost a combined $5.4 trillion in value, according to Cramer.

He said that while he doesn’t blame investors for betting on those stocks this year, he does believe that investors need to learn from their mistakes in 2023.

“They’ll be able to bounce the next time we get a nice rally in the broader index, and I think we’re going to have one. I think you should use that chance to pare back on mega-cap tech,” he said. “I bet you’ll get a chance to buy them a little lower.”

Disclaimer: Cramer’s Charitable Trust owns shares of Meta Platforms, Amazon, Alphabet, Microsoft and Apple.