VMware at the NYSE, Dec. 14, 2021.

Resource: NYSE

The compliance main at a Chinese payment processor was charged by the SEC and New York federal prosecutors with violating insider investing guidelines just after sneaking on to to his girlfriend’s laptop to see meetings between investment decision bankers and businesses.

Steven Teixeira, who served as chief compliance officer for the U.S. arm of China’s LianLian Worldwide, pleaded responsible to the federal fees underneath a cooperation arrangement. The SEC fees stay superb, the company claimed on Thursday.

Teixeira allegedly acquired insider facts, like advance knowledge of Broadcom’s introduced $65 billion acquisition of VMware from 2022, and shared it with an affiliate for income. The SEC states Teixeira acquired the information and facts from the Outlook calendars and documents of his girlfriend, who was used as an executive assistant at an unnamed New York-centered financial investment bank.

The non-general public details incorporated expression sheet knowledge and deal organizing by a host of know-how corporations, which includes for the VMware offer and Thoma Bravo’s prepared buy of Proofpoint, allegedly permitting Teixeira to accumulate in excess of $730,000 in profit.

Teixeira’s girlfriend, who was not named in the grievance, requested him “to check out her do the job electronic mail whilst she was absent all through the workday, and to notify her if she acquired email messages that essential her attention.”

Proofpoint was taken non-public in 2021 by personal fairness business Thoma Bravo in a $12.3 billion offer, within just the timeframe that Teixeira was allegedly investing on insider data. Teixeira procured alternatives on Proofpoint inventory on April 22, 2021, days forward of the announcement. Broadcom’s offer for VMware has been delayed by regulators.

Teixeira allegedly shared the insider information with his affiliate, Jordan Meadow, who is also billed with violating federal insider investing laws.

Meadow applied the facts in his operate as an financial investment advisor, steering his clients in the direction of lucrative prospects and gaining “hundreds of 1000’s” of dollars in commissions, the SEC alleged.

Meadow also faces federal costs, which ended up unveiled on Thursday, in the Southern District of New York.

“Our criticism alleges brazen betrayals of have confidence in by Teixeira, who misappropriated facts from his girlfriend’s notebook to make a rapid buck, and by industry-veteran Meadow, who was all far too keen to use the data to line his pockets,” Scott Thompson, SEC’s Philadelphia associate regional director, stated in a press launch.

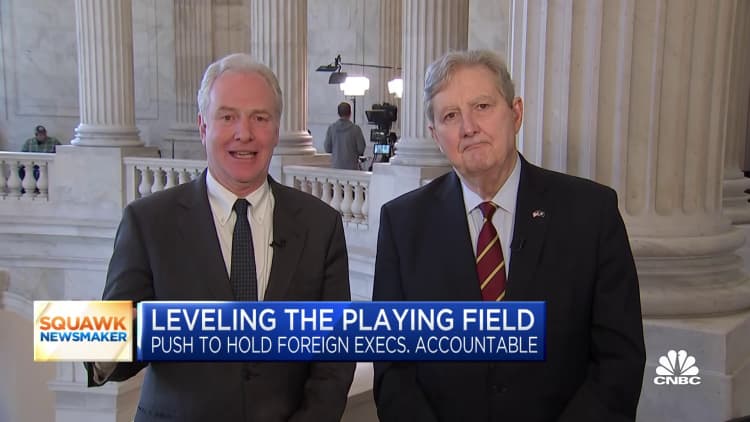

View: Sens. Kennedy and Van Hollen introduce bill to block foreign executives from insider investing