Japan is “very, pretty near” to intervening in the yen, Steven Englander, head of Global G10 Fx research and North The usa macro method at Standard Chartered Bank, informed CNBC as the forex languishes at multi-10 years lows.

“I believe we’re really very, really shut to them [Japanese authorities] jumping in … they’ve already mentioned the political outcomes and nobody’s sitting down there asking for a weaker yen,” Englander told CNBC’s “Squawk Box Asia” on Thursday.

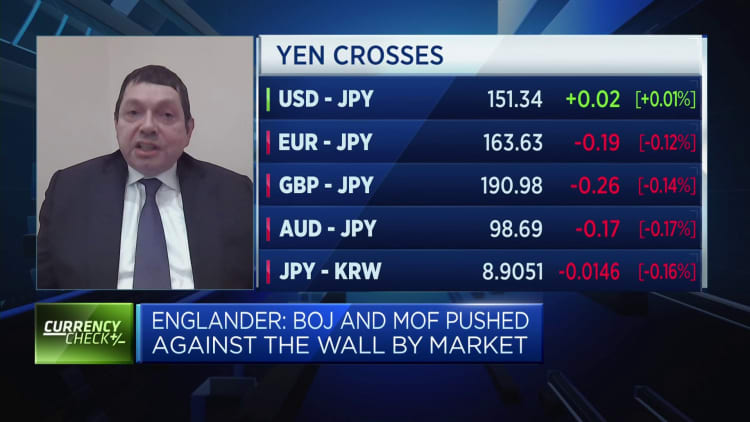

The Japanese yen traded all around 151.47 against the U.S. greenback on Thursday after slipping to its weakest stage in 34 a long time at 151.97 in the previous session.

These multi-decade lows have prompted current market speculation more than possible intervention of the forex.

Japan’s finance minister Shunichi Suzuki experienced indicated this 7 days that actions to “reply to disorderly Fx moves” ended up not off the table. The vice finance minister for international affairs, Masato Kanda, reportedly claimed on Wednesday that the yen’s moves have been becoming watched closely and urgently.

Chief Cupboard Secretary Yoshimasa Hayashi claimed on Thursday that authorities will not rule out any measures to counter abnormal forex moves, Reuters claimed, echoing other customers of administration that currency moves were being staying enjoy with a higher perception of urgency.

Conventional Chartered’s Englander claimed probable intervention in the yen would be aimed at buying time for Japanese authorities right up until the U.S. Federal Reserve starts reducing fascination premiums or until finally the Bank of Japan hikes its fees a little far more.

He more mentioned that when Japanese authorities final intervened in the yen in 2022, it “labored out really effectively,” even nevertheless buyers have been to begin with skeptical of the usefulness of these types of currency intervention.

The Bank of Japan ended its routine of unfavorable interest charges in a historic shift past 7 days and abolished its produce curve command coverage, which did tiny to prevent the yen from weakening.

The Fed, on the other hand, held its benchmark price steady as anticipated very last Wednesday and signaled plans for several amount cuts in advance of the close of the calendar year.