SUIXI, CHINA – DECEMBER 30: An staff functions on the output line of aluminum foil at a workshop of Anhui Limu New Materials Technological innovation Co., Ltd on December 30, 2023 in Suixi County, Huaibei Metropolis, Anhui Province of China. (Picture by Li Xin/VCG through Getty Photos)

Vcg | Visual China Team | Getty Pictures

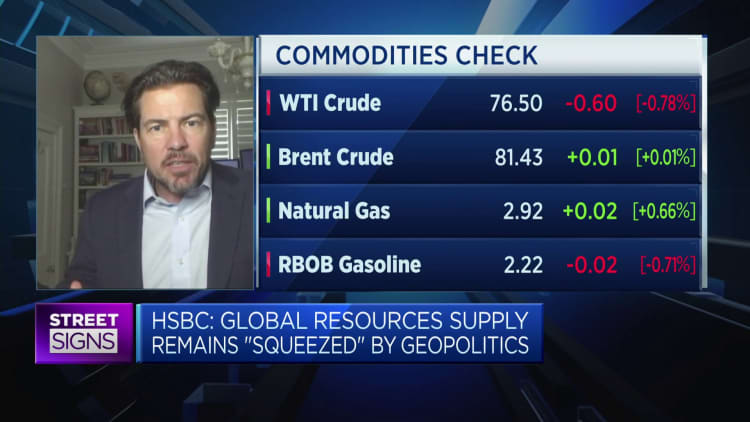

International commodity markets are in a “tremendous squeeze” amid offer disruptions and absence of expenditure — and it is only going to get worse as geopolitical and local climate risks exacerbate the problem, HSBC reported.

“For some time now we have described world commodity markets as remaining in a ‘super-squeeze,'” its main economist Paul Bloxham instructed CNBC.

A commodity “tremendous squeeze” is denoted by bigger price ranges pushed by provide constraints more than a strong expansion in desire, he defined.

“If it can be a supply constraint that’s driving substantial commodity selling prices, it can be a extremely unique tale for global development,” he told CNBC by using Zoom. Bigger prices as a final result of a super squeeze are “not as constructive.”

“We see the further ‘super-squeeze’ things on the supply-facet as nonetheless set to participate in a essential part in holding commodity rates elevated,” he said, outlining components like political uncertainties, climate adjust and the lack of investments into the environmentally friendly electrical power transition.

The tremendous squeeze could be deeper, or additional prolonged if geopolitical, local climate adjust or strength changeover similar provide disruptions are much larger than envisioned.

Paul Bloxham

HSBC main economist

Geopolitical hazards include the ongoing Israel-Hamas conflict in Gaza and the Ukraine war, which have hampered world wide trade, as observed in shipping disruptions from the recent Houthi attacks in the Pink Sea.

Another reason is climate adjust, which disrupts supply chains as properly as commodities source, specifically in the agricultural space.

“The tremendous squeeze could be deeper, or additional prolonged if geopolitical, local climate alter or power transition connected supply disruptions are greater than anticipated,” he extra.

Absence of investments

The world’s pursuit of a net-zero carbon potential is fueling need for energy transition metals these as copper and nickel, Bloxham pointed out.

Having said that, there are inadequate investments allocated to procuring these significant minerals, top to a sharper provide squeeze on electrical power transition metals — in unique copper, aluminum and nickel, he said.

As vitality transition ramps up, markets could be looking at a scarcity of a slew of metals like graphite, cobalt, copper, nickel and lithium in the following 10 years, the Energy Transitions Commission stated in a report in July.

At the recent COP28 local climate transform conference, additional than 60 countries backed a system to triple world-wide renewable electricity capacity by 2030, in what is mostly deemed as a step forward for power transition and a further enhance in demand from customers for metals necessary for that changeover.

“Big-scale mining initiatives can acquire 15-20 decades, and the very last 10 years has witnessed a lack of financial commitment in exploration and production for critical strength changeover resources,” the report said.

Once-a-year money investments in these metals averaged $45 billion in the final two decades, and must increase to all-around $70 billion each and every year by to 2030 to guarantee an enough stream of supply, according to the Etc report.

Commodities are notoriously volatile asset courses, with a prolonged historical past that is inclined to a short squeeze and the latest landscape factors to more of the exact same.

Brian Luke

S&P Dow Jones Indices

Without a lot more financial investment in new capacities, offer will be constrained, HSBC’s Bloxham said, incorporating that “for any presented sum of desire,” it must be anticipated that commodity charges will keep far more elevated than in the past.

“That looks to be taking part in out throughout quite a few of the commodities at the instant.”

Technologies could also be a gamechanger if a advancement arrived along and created it a lot less difficult to extract the metals made use of in the battery room, Bloxham additional.

Iron ore site in Australia.

Ian Waldie | Bloomberg via Getty Pictures

He did not say how extensive it will just take international commodity markets to transfer out of the squeeze, but a single way out of it — which would also press commodity costs decrease — is a “even bigger and further [economic] downturn globally,” he said.

“Commodities are notoriously unstable asset classes, with a long record that is prone to a quick squeeze and the recent landscape points to more of the very same,” stated Brian Luke, senior director and head of commodities at S&P Dow Jones Indices. He highlighted that severe weather conditions gatherings and geopolitics have also impacted the agricultural and electrical power commodity baskets.

Metals most impacted

Analysts say metals will probably see the most upside.

Bloxham noted that aside from thoroughly clean strength metals, iron ore was also on his listing owing to falling inventory and a absence of investments into growing potential.

Iron ore has viewed a price tag leap of around 24% in the previous yr, in accordance to facts from FactSet. The benchmark 62%-grade iron ore last traded at $135.48 per ton.

“The motive why [iron ore] has a sudden squeeze-up is mainly because stock has been really minimal,” said Lender of The united states Securities’ head of Asia -Pacific simple resources, Matty Zhao.

She noted that in spite of China’s home crisis, steel manufacturing has ongoing, fueling demand from customers for iron ore and coking coal, which are integral to steelmaking.

China, which can make around 55% of the world’s metal, created 874.7 million tons of steel in the 1st 10 months of 2023 — up 1.4% throughout the very same time period in 2022.

What squeeze?

Even though threats keep on being, one analyst is of the look at that commodity markets are continue to “adequately supplied” for the most portion.

“The commodity marketplaces are now focused on slumping demand due to the sluggish worldwide economic system. As these types of, there’s not much too significantly concern about supplies,” said Arlan Suderman, main commodities economist at economical solutions business StoneX.

Oil, for a single, observed an maximize in international oil inventories in 2023.

Some are nonetheless hoping that a rebound in Chinese demand will .

“A resurgence from Asia will go a prolonged way in determining if commodities will have a breakout 12 months,” stated S&P’s Luke, adding that 2023 observed a yr of unfulfilled demand from customers from China which weighed closely on commodity markets.