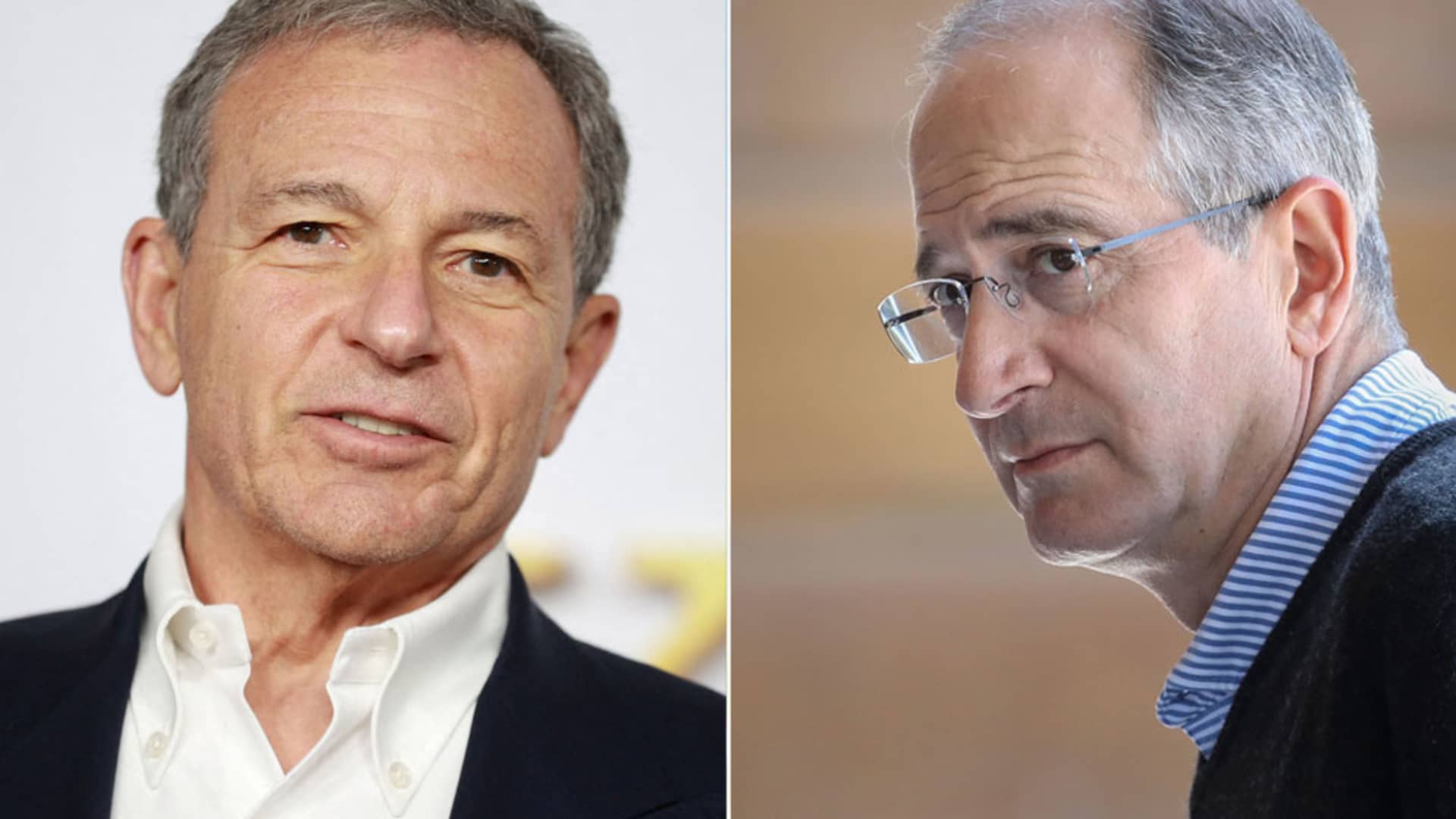

Bob Iger, CEO, Disney, and Brian Roberts of Comcast

Getty Images

Comcast and Disney have hired investment banks to value Hulu, the next step in what’s been a nearly five-year process to put the streaming service under one owner.

Comcast, which owns one-third of Hulu, has hired Morgan Stanley, and Disney, which owns the other two-thirds, has hired JPMorgan Chase. Each bank is tasked with providing a fair value for Hulu — a condition of an agreement set up in 2019 that allows either Disney or Comcast to trigger an option forcing Disney to buy Comcast’s 33% stake.

Spokespeople for Comcast, Disney, Morgan Stanley and JPMorgan declined to comment.

Nearly five years ago, Comcast and Disney set up an unusual agreement after Disney acquired the majority of Fox’s assets in a $71 billion deal, including Fox’s minority stake in Hulu. That deal gave Disney majority control over Hulu, because Disney already owned one-third of the streaming service.

Comcast didn’t want to sell its stake in Hulu to Disney right away because it believed the value of streaming video would increase between 2019 and 2024. Still, Comcast executives also understood the company would no longer have operational control over the future of the company. Consequently, Disney and Comcast worked out a deal where Comcast could participate in the assumed appreciation of the business while also setting a time where Disney could eventually unify ownership and integrate Hulu into its long-term streaming strategy.

Initially, the companies set an option strike date of January 2024. Last month, the two companies agreed to move up the deadline at which Hulu will be valued from January 2024 to Sept. 30. That deadline represents the final date at which Hulu’s valuation will be assessed by both Morgan Stanley and JPMorgan Chase.

On Nov. 1, Comcast can force Disney to acquire its 33% stake in Hulu and/or Disney can trigger its option to acquire the stake from Comcast. That’s expected to happen, Comcast CEO Brian Roberts said at the Goldman Sachs’ Communacopia conference last month.

“We are excited to get this resolved,” Roberts said at the conference. “The company is way more valuable today than it was [in 2019]. And we are looking forward to seeing how that process [plays out].”

Once the option is triggered, Morgan Stanley and JPMorgan will begin their assessments of Hulu’s value. If the two banks’ final valuations are within 10% of each other, the average of the two banks’ determinations will be the price at which Hulu is valued. Disney would then pay Comcast 33% of that value for its stake. The 2019 deal set a floor valuation for Hulu at $27.5 billion.

Rafael Henrique | SOPA Images | LightRocket | Getty Images

If the two banks’ assessments aren’t within a 10% range of each other, then Disney and Comcast would agree to hire a third investment bank to make another valuation conclusion. To set the sale price, that third valuation would then be averaged with the previous assessment that’s closest to it.

The valuation calculation process isn’t straightforward. Hulu has 48.3 million subscribers. A pure-play streaming service at its scale has never been sold before. Roberts argued during the Goldman conference that a fair appraisal would also have to include synergy value. Disney’s ownership of Hulu helps prop up Disney+ and ESPN+ subscribers because Disney bundles all three streaming services together.

There is no timetable for how long the valuation process will take or when a deal will get done, but Roberts acknowledged Disney and Comcast both want a resolution sooner rather than later, which is why they agreed to move the option strike date forward several months.

“It will take a little time for this to play out,” Roberts said. “But both companies wanted to get it behind us. So we pulled the date forward.”

Roberts said at the conference Comcast plans to return proceeds from a sale to shareholders.

Disclosure: Comcast is the parent company of NBCUniversal, which owns CNBC.

WATCH: Disney streaming growth with Hulu is a promising opportunity, Bernstein analyst says