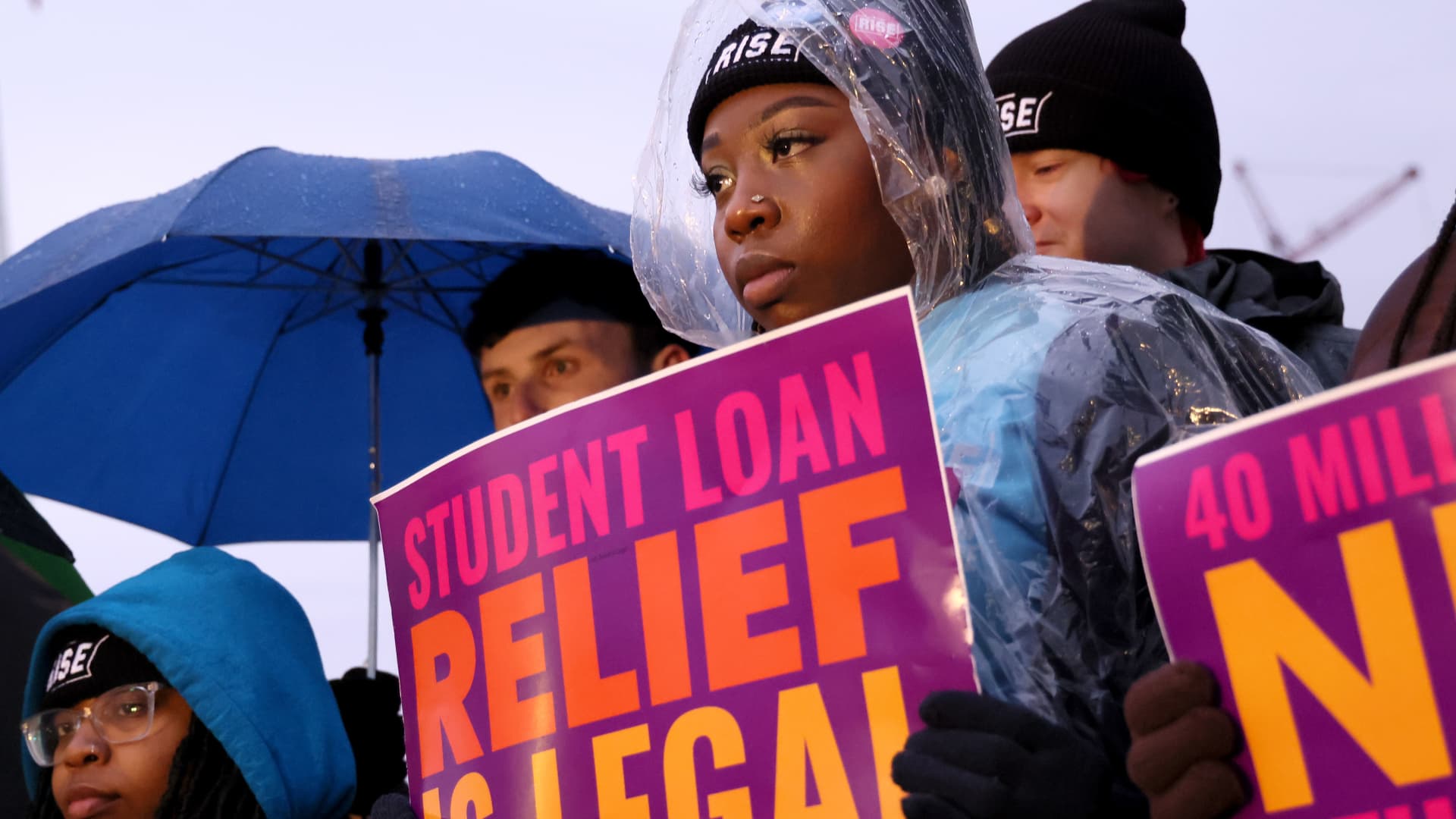

College student personal loan debtors gathered at the Supreme Court in Washington, D.C., the night in advance of the court hears two instances on the White Household pupil personal loan relief strategy.

Jemal Countess | Getty Visuals Enjoyment | Getty Pictures

WASHINGTON — On the night in advance of the Supreme Courtroom was established to hear oral arguments over the Biden administration’s university student loan forgiveness strategy, Amanda Smitley sat exterior the court on an aluminum blanket keeping an umbrella.

She didn’t know when she planned to commit the night staked outside the house the highest courtroom that it would be pouring rain, but she wasn’t discouraged.

“I’m emotion good,” mentioned Smitley, 20, who now has all around $10,000 in scholar debt as a college sophomore at PennWest California. She’ll have to choose out much more if she wants to satisfy her hopes of graduating and getting a higher university background instructor.

“I actually, seriously care about college student debt, not even just for myself,” Smitley explained. “I want to are living in a environment wherever my long run college students and probably long term little ones will not likely have to worry about getting into thousands in debt just since they want to more their education.”

University student mortgage borrower Amanda Smitley, 20, joined the college student personal loan debtors collected at Supreme Court on Feb. 27, 2023, the evening prior to the court docket hears two conditions on pupil loan forgiveness.

Annie Nova | CNBC

Court docket will listen to two instances in opposition to forgiveness

In spite of the cold, borrowers collected outside the Supreme Court docket on Monday to display in favor of the Biden administration’s forgiveness strategy. Additional than 35 million pupil loan debtors could benefit from the coverage, and have up to $20,000 of their credit card debt forgiven. If applied, an approximated $400 billion in debt would be wiped out.

But the system has been on hold given that the tumble, when a federal appeals courtroom panel in St. Louis issued a momentary injunction barring it from having outcome. The Supreme Court docket has kept that injunction in spot as it considers worries to the program, and the govt on its have accord stopped using applications for the method in November.

The Supreme Court docket is hearing two independent scenarios Tuesday on President Joe Biden’s credit card debt aid approach.

A lot more from Private Finance:

A closer appear at the 2 instances from student mortgage forgiveness headed to the Supreme Courtroom

Federal student loan payments could restart in roughly 2 months — or 6. What to know

Falling at the rear of on federal college student financial loans can direct to other significant fiscal complications

The to start with, initially lodged by 6 Republican-led states in federal courtroom in Missouri, statements the Biden administration did not have the lawful proper to cancel student financial loan debts without congressional authorization.

The next lawsuit, submitted by Myra Brown and Alexander Taylor, in U.S. District Court in Texas, argues that they and other associates of the general public have been improperly denied the appropriate under federal techniques to formally remark on the credit card debt relief system, which may well have affected its design before it was place in influence.

The Career Creators Community Basis, a conservative advocacy team, is backing the plaintiffs in that scenario.

Industry experts say the financial debt aid strategy is most likely to be ruled illegal by the court’s 6-justice supermajority if that bloc finds that one or a lot more of the plaintiffs in the two circumstances has the requisite lawful proper, recognised as standing, to file a accommodate tough the method.

‘For numerous persons, this is daily life and death’

College student mortgage borrower John Runningen was also among the those people who prepared to sleep outside the house the Supreme Courtroom on Monday night time. He attends Minnesota Condition Local community and Complex Higher education and owes $5,000.

That personal debt has previously made his life extra tricky.

“It’s stopped me from having a car, from moving out of my parents’ property and aiding my parents with the worry of their costs,” explained Runningen, 22.

As a to start with-generation college university student, he hoped to crack the cycle of poverty and support his mothers and fathers. His stepfather is a farmer and his mom performs at a fuel station. With a $175 regular monthly university student personal loan invoice, while, he won’t be equipped to aid them.

Pupil bank loan debtors gathered outside the house the U.S. Supreme Court docket on Feb. 27, 2023, the evening ahead of the court docket hears two instances on pupil bank loan forgiveness.

Annie Nova | CNBC

“To some people today it might not appear like a good deal of revenue, but for rural communities or those that are poverty-stricken, it’s going to be the difference in between me staying in a position to give my relatives meals or [being] capable to pay for an electricity bill,” Runningen reported.

In just three months of the software method remaining opened, the Biden administration claimed that much more than 26 million people today applied for the aid, with 16 million requests accredited.

There is certainly no precedent in U.S. background for the variety of sweeping financial debt forgiveness that the White Dwelling has promised to produce, although customer advocates issue out that huge firms and banks have been bailed out by the govt soon after going through their individual crises. And they say that canceling a substantial share of instruction personal debt is important to relieve the quite a few borrowers battling from a damaged lending method.

Student bank loan debtors were being having complications repaying their credit card debt right before Covid. Only about 50 % of borrowers were in compensation in 2019, in accordance to an estimate by bigger education professional Mark Kantrowitz. A quarter — or far more than 10 million individuals — ended up in delinquency or default, and the rest experienced applied for short-term relief steps for struggling debtors, these kinds of as deferments or forbearances.

These grim figures led to comparisons to the 2008 mortgage crisis and created force on Biden to produce aid.

“For a lot of individuals, this is lifetime and demise,” reported Thomas Gokey, co-founder of the Debt Collective, a national union of debtors. “What’s at stake is currently being pressured to pick out amongst spending for college student financial loans or remaining equipped to obtain groceries, make rent and fork out health-related expenses.”

— Annie Nova documented from Washington, D.C., and Dan Mangan documented from New York.