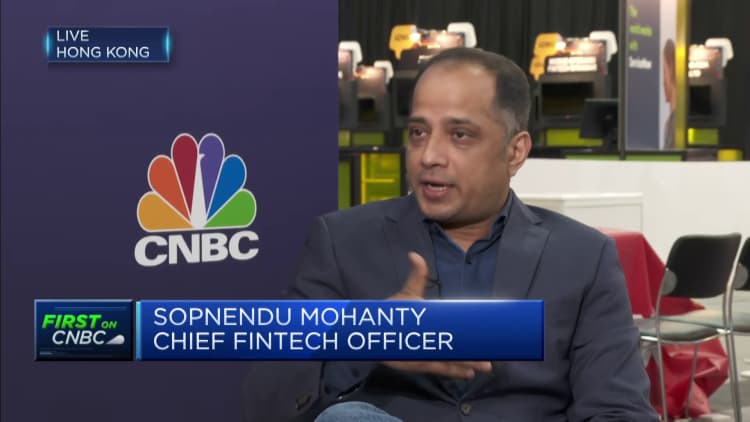

Brian Armstrong, co-founder and CEO of Coinbase chats with Sopnendu Mohanty, main fintech officer of the Financial Authority of Singapore (MAS) all through the Singapore Fintech Festival, in Singapore, on Friday, Nov. 4, 2022.

Bloomberg | Bloomberg | Getty Visuals

SINGAPORE – Co-founder and CEO of U.S.-based mostly crypto trade system Coinbase, Brian Armstrong, explained that Singapore desires to be a forward-searching regulator, but is not welcoming towards crypto trading.

The city-point out has frequently warned that cryptocurrencies are remarkably speculative and unstable soon after several retail buyers shed substantial chunks of their price savings. It has also banned crypto promoting in community regions and on social media.

“Singapore wants to be a Web3 hub, and then concurrently say: ‘Oh, we’re not actually heading to let retail buying and selling or self-hosted wallets to be readily available,” reported Armstrong at the Singapore FinTech Competition 2022. He was talking along with Sopnendu Mohanty, main fintech officer of the Financial Authority of Singapore.

“All those two matters are incompatible in my mind, and I would like to see Singapore embrace retail investing and self-hosted wallets,” Armstrong added.

It comes right after Coinbase acquired in-basic principle approval from MAS to present digital payment token companies in the metropolis-state.

So significantly, Singapore has only handed out 17 in-theory approvals and licenses following a stringent assortment approach pursuing 180 apps. Binance reportedly withdrew its application to run in the town-state earlier this year soon after getting in regulatory limbo for months.

In reaction, the Monetary Authority of Singapore’s Mohanty stated that retail buyers these days had been “exposed to dangers they do not have an understanding of they are taking.”

“We consider that World-wide-web 3. is the long term and what we want to do is to make certain that the income which can transact on this ecosystem is regarded as a safe asset, safe currency. As long as that is the path, we are Ok,” extra Mohanty.

Mohanty went on to obstacle Armstrong to title polices he felt need to be reviewed.

“For centralized exchanges and custodians [like Coinbase], I imagine they should be treated just like other financial services corporations. There should really be anti-cash-laundering protections. There really should be audits that they require to entire, no commingling of cash, correct disclosures to buyers,” reported Armstrong.

“Crypto should not be handled at a drawback they must be dealt with similarly with other fiscal assistance rules.”

In response, Mohanty gave an analogy of a shopper working with a banking application.

“We, as the regulator, never worry about web protocols. We only care about the shoppers who went to the financial institution. The bank is responsible to be certain that they protect their prospects,” he added.

CNBC has attained out to MAS and Coinbase for even further remark.