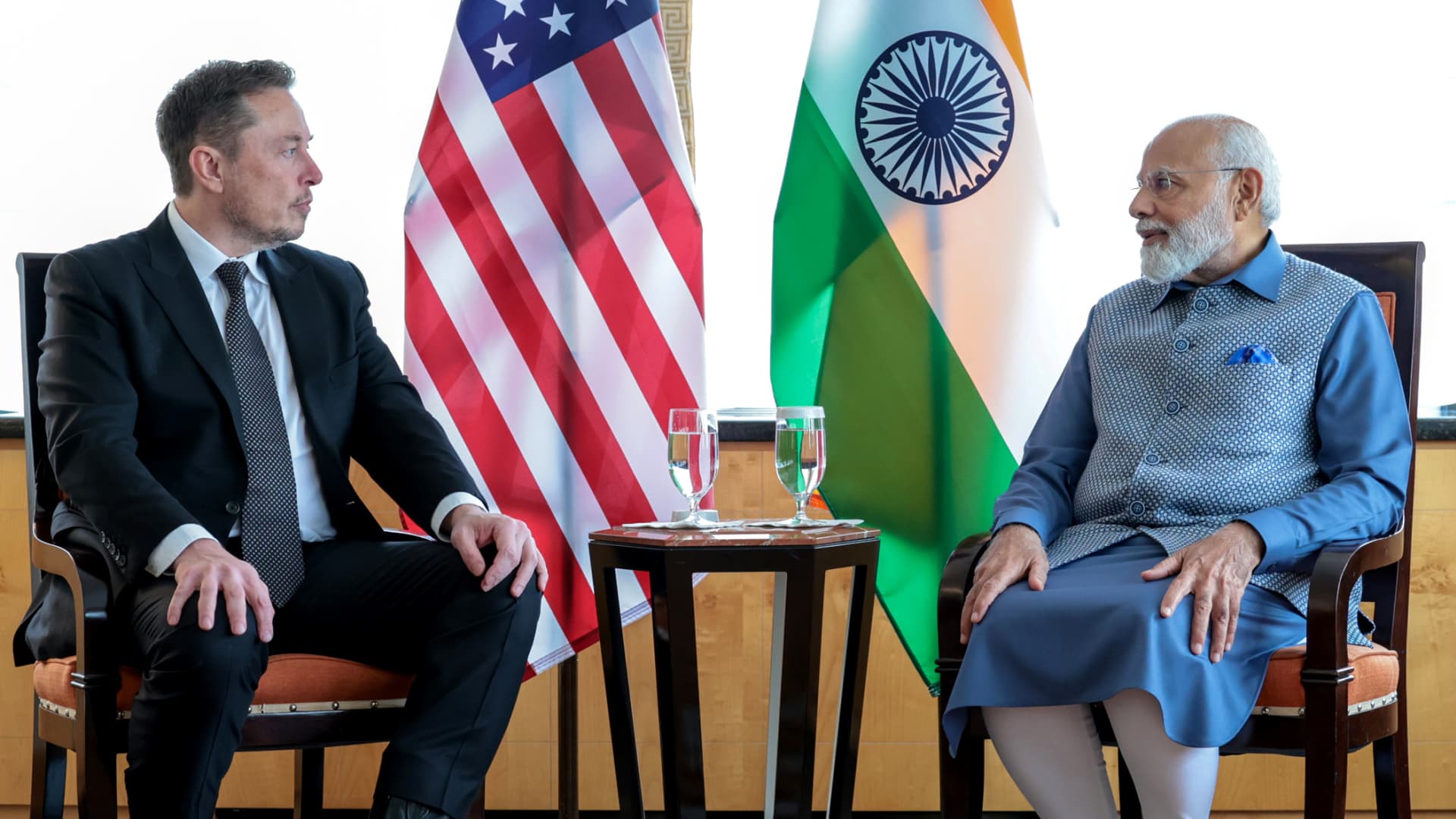

Indian Prime Minister Narendra Modi (R) satisfies with Elon Musk (L) in New York, United States on June 20, 2023.

Indian Press Info Bureau | Anadolu Agency | Getty Visuals

This report is from this week’s CNBC’s “Within India” which brings you well timed, insightful information and market place commentary on the emerging powerhouse and the large corporations guiding its meteoric rise. Like what you see? You can subscribe below.

The major story

Tesla chief Elon Musk is set to satisfy Indian Key Minister Narendra Modi shortly, and the timing could not be any much better.

For whom, you question? Both equally!

India is gearing up for a normal election that will be carried out above a thirty day period and a 50 percent.

The governing social gathering, BJP, is broadly predicted to earn and has pledged to attract overseas financial commitment and raise financial advancement.

Production attributes prominently in its manifesto released previously this week. So it is really no surprise that the incumbent wishes to display off Musk’s existence in India. Soon after all, the Tesla manager employs around 140,000 people today globally and manufactures 1 of the most sophisticated automobiles in the globe.

For Musk, a battered stock and a world slowdown in car revenue are obvious motivators for his stop by to booming India. Investors would welcome any information that the world’s premier EV maker was going to enter the 3rd-most significant car market.

To make things less difficult, India lowered the barrier to entry for foreign automakers before this calendar year, just as China did in the past decade. Import tariffs on overseas autos have been slice from 100% to 15% for autos higher than $35,000 — a shift that is been mooted as a immediate energy to draw in Tesla.

The lowered tariffs are also conditional on automakers investing $500 million in 3 yrs to manufacture autos regionally. Right until then, they will never be permitted to offer more than 8,000 cars per year and advantage from the less costly import tax rate.

It can make India appear like an apparent wager for Tesla — if just one ignores specified hazards.

Will Tesla proceed to advantage from governing administration plan if the electoral benefits toss up a surprise, for instance? And is it even really worth investing a reported $2 billion to established up a manufacturing facility in India?

EV income designed up 2% of the 4.1 million vehicles offered in the place in 2023, in accordance to Financial institution of The united states. In the meantime, a very similar amount of motor vehicles are bought in China each individual two or three months irrespective of the financial slowdown there, with EVs making up practically a third of those people volumes.

Telsa will also obtain competing on value challenging. All around 70% of India’s auto current market is dominated by Tata Motors, which sells automobiles for among $10,000 and $20,000. Even Tesla’s rumored less expensive Design 2, which is predicted to be manufactured in India, will cost more than this.

Even if India would make feeling as a production base to export cheaper autos, demand from customers for EVs is slowing in a huge way. Tesla has slice about 14,000 jobs globally to cut down expenses as margins get squeezed by inadequate income figures.

In any scenario, Tesla’s probable arrival in India would undoubtedly give work creation a increase — some thing Modi is eager to force. In that case, the authentic winners could be India’s young and growing populace keen for work and far better cars and trucks.

What took place in the marketplaces?

The Indian inventory sector indexes Sensex and Nifty 50 are owning a brutal 7 days and have missing about 2.4% so significantly many thanks to geopolitics, negative inflation and strong shopper expending data. The benchmarks are up by .34% and 1.22% so significantly this 12 months, respectively.

The 10-year Indian govt bond produce has risen alongside international bond markets this week to 7.18%. The buck has obtained in opposition to the Indian currency and now alterations for 83.54 rupees a dollar.

For equity buyers, the iShares MSCI India ETF has lost 2.3% so much this 7 days, underperforming the iShares All Place Planet Index ETF, which is also down 1.3%. The India ETF is up by 4.75% this yr.

On CNBC Tv this week, Severe Modi at JPMorgan talked about the alternatives in India’s banking sector and explained that their asset top quality is “one of the cleanest” in the Asia-Pacific area.

We also had a debate on expenditure tastes amongst China and India. Alexander Cousley of Russell Investments shared why he prefers the China industry in excess of the India industry on a valuation foundation. But Bhaskar Laxminaryan of Julius Baer contrasted that the India industry is a tale that is just having begun.

What else happened?

Indians head to the polls in the world’s largest democratic election. You probably really don’t have to have a reminder but elections get started Friday and will pan out in seven phases more than the upcoming six months. Voters will decide who fills the seats of the Lok Sabha, which is the decreased house of Parliament, for the future 5 years.

IMF raises progress prediction for this calendar year. Amid a flurry of reports and remarks from the Global Financial Fund this week, India was presented a .3 proportion stage raise on its GDP level this yr — now at 6.8% — from its January update. It mentioned the robustness reflected “continuing power in domestic demand from customers and a increasing functioning-age inhabitants.”

The charge to trip on India’s luxury trains may possibly shock you. Our vacation team unveiled the pricing for these luxurious trains which blend historic class with contemporary comforts. These trains had been released to endorse tourism in the nation and give tourists with an opulent way to expertise India.

These are the top 5 corporations to function for in India. CNBC Make It took a seem at a new LinkedIn checklist which shows businesses that are prioritizing their employees’ practical experience and advancement. Tata Consultancy Services arrived out on major, but here’s the full list.

What’s taking place subsequent 7 days?

Aside from the election, we’ll have the FPO of the Indian mobile network operator Vodafone Strategy.

An FPO, or stick to-on offering, is a further community featuring that happens after the firm’s IPO. In this circumstance it’s a opportunity for Vodafone Strategy to elevate more cash to broaden its services. It opens Thursday and closes Monday with the listing on April 25.