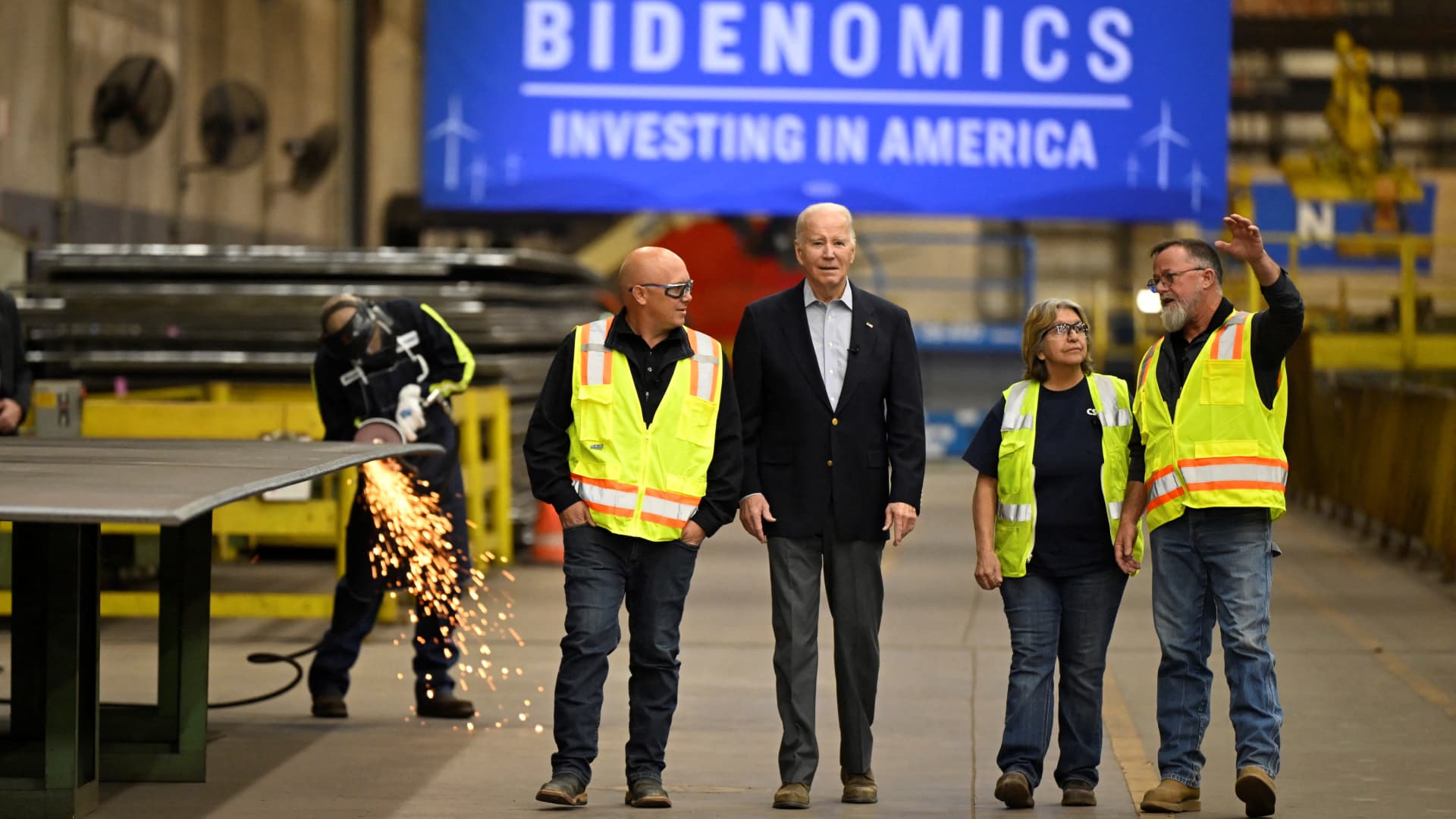

U.S. President Joe Biden speaks with personnel though browsing CS Wind, the biggest wind tower company in the globe, in Pueblo, Colorado, U.S., November 29, 2023.

Andrew Caballero-Reynolds | AFP | Getty Images

This report is from present day CNBC Everyday Open, our worldwide marketplaces e-newsletter. CNBC Everyday Open brings buyers up to pace on every thing they will need to know, no make a difference exactly where they are. Like what you see? You can subscribe in this article.

What you want to know nowadays

Shares stop larger

All three U.S. indexes finished in the environmentally friendly on Thursday after solid U.S. fourth-quarter GDP information, which beat Wall Street anticipations. The Dow Jones Industrial Average climbed .6%, while the S&P 500 rose .5% to a new all-time closing document. The tech-heavy Nasdaq Composite, inched up about .2%, weighed down by a offer-off in Tesla.

Tesla shares plunge 12%

Shares of electrical automobile maker Tesla plunged 12%, their biggest fall in around a year. The go arrived a day following the company’s earnings missed expectations and it warned of a slowdown in 2024. Tesla’s inventory also came less than tension from various brokers, who diminished their selling price targets for the business.

Apple opens Iphone keep in Europe

Apple plans to open up its Apple iphone Application Store in Europe to competition. This transfer opens up cracks in the company’s famous “walled yard,” with which it controls application distribution on its products. This was in reaction to a new European law, the Digital Markets Act, which forces massive tech businesses to open up their platforms by March of this 12 months.

Lagarde responds to scathing study

Christine Lagarde stated she was “happy and honored” to direct the European Central Financial institution, after her management was criticized in a union-run survey of team. Lagarde went on to say that the ECB’s possess surveys proposed men and women have been pleased to perform at the central financial institution and experienced a feeling of mission.

[PRO] Buy or avoid China?

Is it time to get into China markets? Some investors have been wary due to the fact Beijing has been battling with a assets personal debt crisis that has activated economic challenges throughout the broader economy. The Pro analysts give their take.

The base line

What economic downturn?

The U.S. economy grew at an accelerated pace in the closing a few months of 2023, capping the yr on a strong be aware.

And the economic downturn that so lots of forecasters experienced predicted by no means transpired.

The most recent GDP knowledge showed the economic climate grew at a rate of 3.3% in the fourth quarter, significantly bigger than Wall Street’s estimates.

The quantities underlined the U.S. economy’s amazing resilience in the confront of sustained initiatives from the Fed to aggressively hike interest fees to battle inflation.

The Biden administration wasted no time in trying to declare credit rating. U.S. Treasury Secretary Janet Yellen reported authorities insurance policies helped strengthen the financial state.

“While some forecasters assumed a economic downturn past 12 months was inescapable, President Biden and I did not,” Yellen claimed in a speech.” Instead of contracting, the overall economy has continued to improve, pushed by American staff and President Biden’s financial system.”

“Put only, it really is been the fairest restoration on document,” Yellen additional.

Thursday’s report also involved great news on the inflation front. The core particular intake expenditures price tag index posted a quarterly get of 2%, excluding food items and energy — a key gauge the Fed makes use of when examining inflation. Headline inflation improved just 1.7%.

With all the knowledge pointing in the ideal way, it appears to be like like the economy could be inching close to the substantially talked about tender landing, if it has not now.

— CNBC’s Jeff Cox contributed to this report.