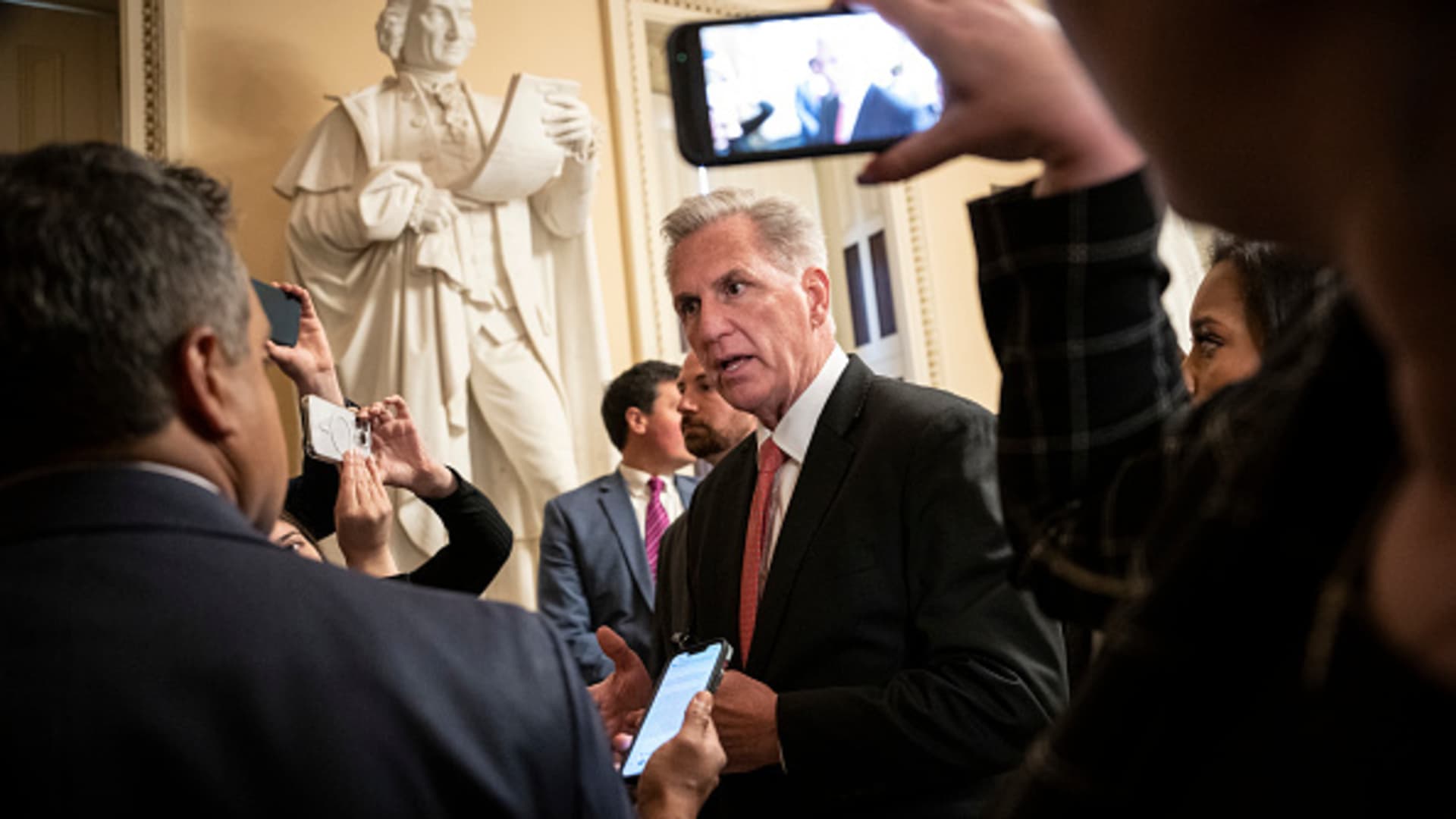

U.S. Speaker of the Household Rep. Kevin McCarthy (R-CA) speaks to reporters on his way to the Dwelling Chamber at the U.S. Capitol on May possibly 15, 2023 in Washington, DC.

Drew Angerer | Getty Pictures News | Getty Illustrations or photos

This report is from modern CNBC Day by day Open, our new worldwide markets e-newsletter. CNBC Everyday Open brings traders up to pace on anything they have to have to know, no subject wherever they are. Like what you see? You can subscribe right here.

Washington’s brinkmanship over the country’s personal debt ceiling carries on for a different working day.

What you will need to know these days

- U.S. stocks rose Monday as all a few major indexes closed a little increased. Asia-Pacific markets primarily traded bigger Tuesday. Japan’s Topix Index — viewed as extra representative of the Japanese industry than the Nikkei 225 — climbed .54% to strike its optimum level because August 1990.

- China’s financial recovery is even now rocky, the latest information demonstrates. Industrial generation rose 5.6% and retail profits improved 18.4% 12 months around yr, but the two figures had been down below economists’ expectations. Domestic use may well gradual down more: The unemployment level among persons aged 16 to 24 strike a history large of 20.4%.

- The atmosphere for international investment in China has grown uncertain, as well. Around the past two months, China investigated the consulting corporations Capvision Partners, Mintz and Bain & Co, triggering concerns about China’s company surroundings from the American and European chambers of commerce.

- In Elon Musk information, the Tesla CEO mentioned in an email “no 1 can be a part of Tesla, even as a contractor,” right before the selecting request is accepted by him. Separately, Musk was issued a subpoena by the U.S. Virgin Islands in relation to its lawsuit from JPMorgan Chase. The U.S. territory demanded Musk turn in excess of files showing conversation involving him, JPMorgan and Jeffrey Epstein.

- Professional Warren Buffett’s Berkshire Hathaway has made improvements to its inventory portfolio, a new regulatory filing confirmed. Among the highlights: It built a new stake in Money One Economical, offered off U.S. Bancorp and enhanced its holdings of Apple.

The base line

Washington’s brinkmanship about the country’s personal debt ceiling carries on for one more working day, even as Treasury Secretary Janet Yellen reiterated in a take note Monday that the U.S. could default on its financial debt “as early as June 1.”

Nevertheless, there were signs that progress was getting designed. Yellen claimed, in an interview with The Wall Road Journal on Saturday, she’s hopeful and was “told [lawmakers] have located some places of settlement.” President Joe Biden, similarly, expressed optimism that a deal with Republicans to elevate or suspend the financial debt ceiling could be attained.

Nonetheless, Property Speaker Kevin McCarthy was not as hopeful. He instructed NBC Information that Democrats are not getting major about negotiations. “It would not feel to me nevertheless that they want a deal,” reported McCarthy.

In quick, the back again-and-forth tussle stays. “It’s sort of a waiting activity,” stated Globalt Investments’ Keith Buchanan. “Just about every working day that goes by, and each individual postponement, each individual day there’s not a progress … I think it will grow additional and a lot more hard for the markets to genuinely get any traction.”

In truth, even while main indexes all rose Monday, they created only small moves. The S&P 500 extra .3%, the Dow Jones Industrial Regular received .14% to snap a five-day losing streak and the Nasdaq Composite rose .66%.

We see the very same sample of constructive moves on minimal investing quantity in regional lender shares. For instance, Zions Bancorp jumped 8.5% and Comerica climbed 7.3%, though their investing quantity was underneath their 30-day normal. That is not necessarily a negative detail, of class — any gains in regional financial institution stocks will be welcome news, amid uncertainty in the sector.

One particular spot that company America looks far more selected of is inflation. Only 278 S&P 500 organizations talked about inflation in their very first-quarter earnings phone calls, in accordance to FactSet facts. “This is the most affordable quantity of S&P 500 providers citing ‘inflation’ on earnings calls likely back again to Q2 2021,” John Butters, vice president and senior earnings analyst at FactSet, wrote in a Monday take note.

Biden will satisfy congressional leaders currently to keep on talks about the financial debt ceiling. Buyers are hoping U.S. lawmakers can quell that lingering concern.

Subscribe in this article to get this report despatched immediately to your inbox just about every morning prior to markets open.