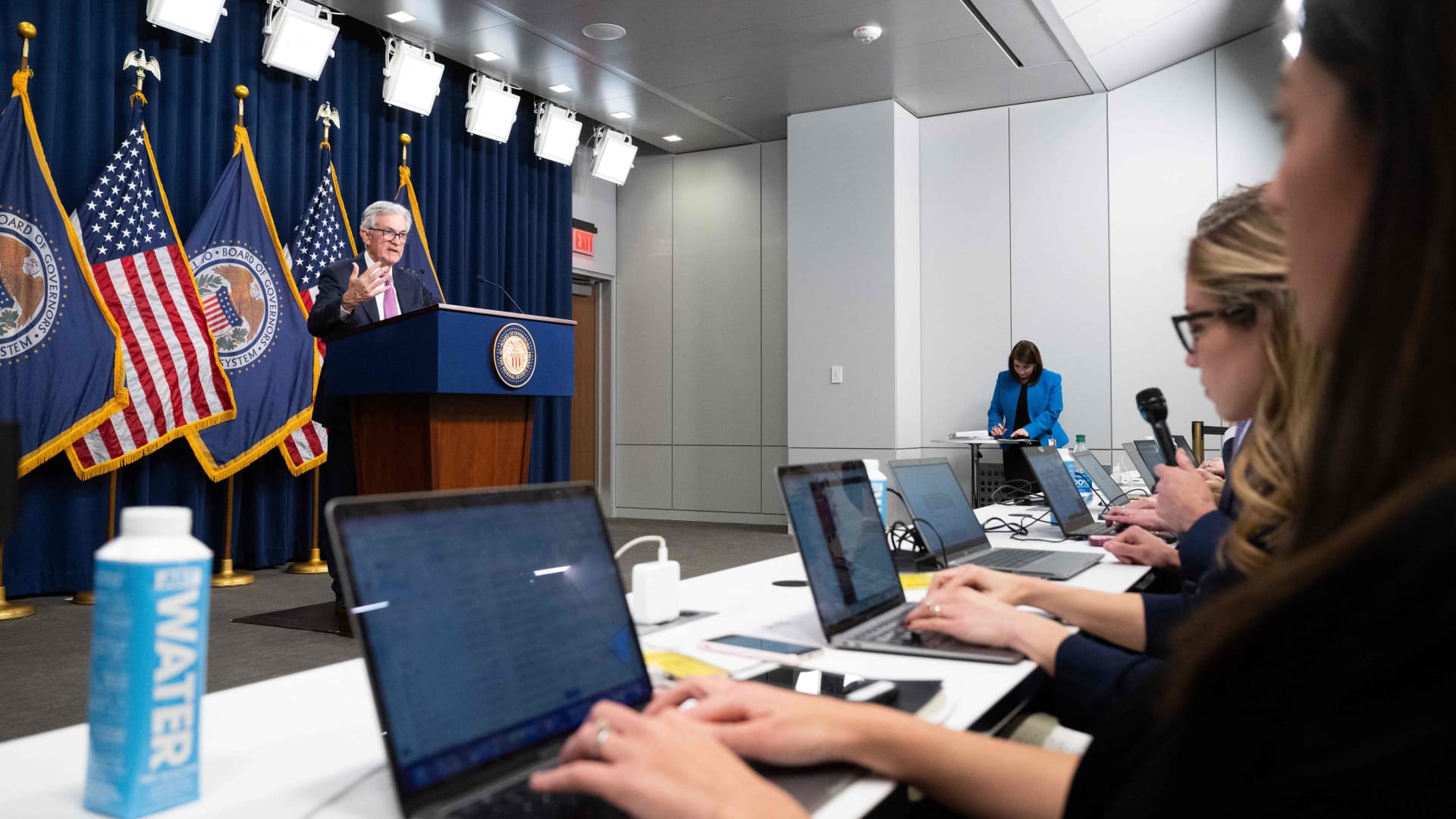

Federal Reserve Board Chair Jerome Powell speaks throughout a news conference at the Federal Reserve in Washington, DC, on February 1, 2023.

Saul Loeb | Afp | Getty Visuals

This report is from present-day CNBC Each day Open, our new, global markets newsletter. CNBC Every day Open brings buyers up to pace on almost everything they have to have to know, no subject where they are. Like what you see? You can subscribe in this article.

Fed Chair Powell will discuss later on nowadays. Marketplaces don’t know what to count on.

What you need to know nowadays

- U.S. Federal Reserve Chair Jerome Powell will testify right before Congress as a week packed with economic information releases lies forward. That features February’s work opportunities report, which will present whether the Fed’s intense fee hikes are commencing to amazing the financial state – especially immediately after January’s scorching report.

- Shares in the U.S. had been a mixed photograph as traders braced for additional hawkish commentary from Powell – the Dow Jones Industrial Regular rose somewhat by .12% while the Nasdaq Composite dipped .11%. In Europe, the Stoxx 600 ended its session flat with mining stocks main losses.

- Iran suggests 8.5 million tons of lithium have been discovered in 1 of its western provinces. The steel, regarded as “white gold” for the electrical automobile industry, has found selling prices skyrocketing in the past 12 months on higher need just before viewing a drop in EV revenue and slower business enterprise.

- China’s conservative advancement goal, produced about the weekend, shows the governing administration is recognizing that there are extra headwinds for the financial state forward.

- Professional For the previous ten years, these a few shares are the only ones in the MSCI Environment Index to have viewed good annually returns, in accordance to screening accomplished by CNBC Professional.

The base line

Very good morning. This is Jihye Lee composing to you from Singapore. I’m sitting in now for Yeo Boon Ping, who is on go away.

All eyes will be on Powell testifying now and Wednesday. What he suggests will manual traders as nicely as lawmakers on how the U.S. central bank is viewing the point out of inflation and how far its marketing campaign of intense hikes has come – and most importantly, wherever markets go from in this article.

Treasury yields rose a little, just after peaking earlier mentioned 4% final week.

Powell is almost sure to facial area challenging issues from Congress. He’ll probable be asked how poorly large fascination charges have hurt the financial state, as world markets deal with a slowing business environment.

Iran claims it can be discovered the world’s next-greatest recognised lithium holdings, just after Chile’s. Iran states it observed a deposit of 8.5 million tons of the metallic. But whether the EV business will reward from that assert is very significantly in issue. Even though a deposit that huge could travel down lithium charges, bringing that commodity to market would count on Iran’s ability to export. The country’s financial state has been crushed by significant sanctions and a plunging currency.

And finally, we glance in advance to International Women’s Day. Moody’s Analytics in a modern report claimed it may well acquire 132 a long time for the environment to shut the gender fork out gap. And when it does, the environment will see an financial boost of $7 trillion – which is an further 7% to the world’s GDP of untapped potential.

Subscribe in this article to get this report despatched instantly to your inbox every single early morning in advance of marketplaces open.