Cloud stocks are slipping on Tuesday, after one of the more distinguished ones, Datadog, decreased its whole-year earnings advice as organizations stay engaged in value-saving routines.

A person cloud-oriented trade-traded fund, the WisdomTree Cloud Computing Fund, tumbled 3% for the working day, on rate for its fifth day of declines in the previous six investing periods.

A lot of cloud-computing businesses relished larger desire following Covid prompted corporations, governments and educational facilities to switch on much more cloud solutions as workers worked from dwelling. Then inflation hit, central bankers elevated curiosity charges, and buyers started advertising holdings in quick-increasing cloud stocks and rotating into safer investments that could extra constantly give returns.

As well as, some sections of the economic climate, these kinds of as real estate, have started to flag mainly because of higher prices, foremost administration teams to look for places to help you save dollars on cloud infrastructure and other technological innovation.

Executives at a lot of cloud organizations responded by lowering overhead, sometimes in the kind of layoffs. In the previous quite a few months, the rise of generative synthetic intelligence expert services these kinds of as startup OpenAI’s ChatGPT chatbot have made investors additional interested in adopting similar technologies and further equipment to enable with the shift. Cloud stocks began to rebound, but numerous, which includes Datadog, have nevertheless to trade earlier mentioned their document highs from 2021.

Now some of the speediest-increasing businesses are no for a longer period looking so warm.

Datadog’s revenue grew virtually 83% 12 months above 12 months in the to start with quarter of 2022. Early on Tuesday Datadog, which delivers cloud-centered infrastructure monitoring, said it expects full-yr revenue to come in among $2.05 billion and $2.06 billion, down from the vary of $2.08 billion to $2.10 billion that it furnished in Could. That indicates Datadog sees fourth-quarter profits rising just 15%, in comparison with a forecast of almost 23% ahead of. Analysts polled by Refinitiv experienced expected $2.081 billion in income for the total yr.

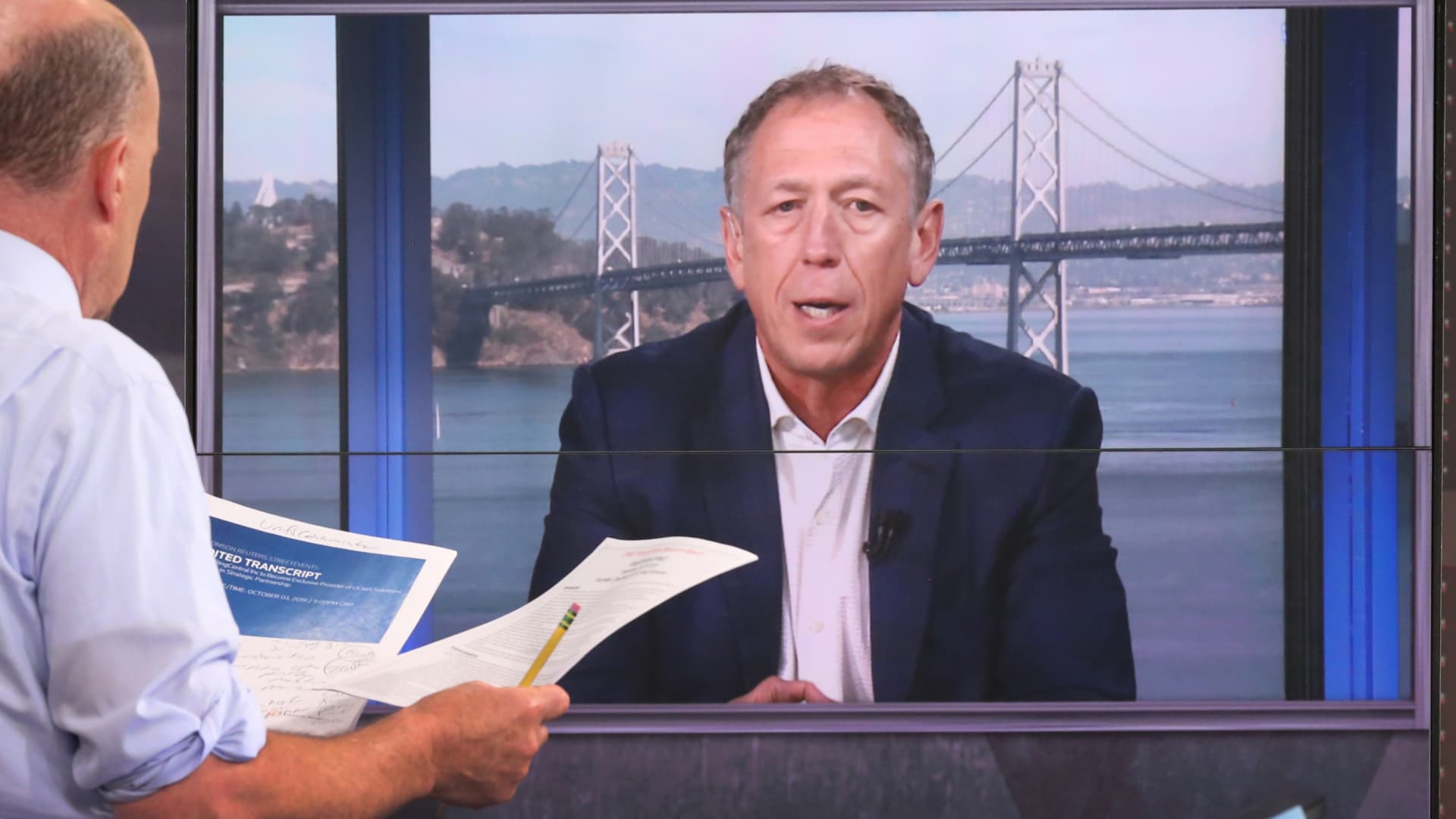

“We saw use advancement for current consumers that was a bit reduce than it had been in past quarters,” Olivier Pomel, Datadog’s cofounder and CEO, explained on a convention phone with analysts. “We continue on to see shoppers greater expending shoppers scrutinize costs.”

Datadog’s guidance of $521 million to $525 million in income for the 3rd quarter underwhelmed analysts. They had predicted $533 million, in accordance to Refinitiv. Then all over again, Pomel stated for the duration of the call that he and his colleagues have included conservatism into their outlook.

“For a company exactly where progress has been a person component making it so interesting, it is probably not astonishing that the inventory is down sharply in the pre-sector,” Bernstein Investigate analysts led by Peter Weed, with the equivalent of a get score on Datadog stock, wrote in a note distributed to clientele. They haven’t soured on the inventory completely, even though. They analysts wrote that they anticipate progress to return as organization expending budgets recover and undertaking capitalists begin pouring large swimming pools of revenue into startups once again.

Datadog shares, which debuted on the Nasdaq in 2019, were being on observe for their sharpest solitary-day pullback considering the fact that March 2020, as Covid emerged in the U.S. They had been down as a great deal as 21% on Tuesday.

Most shares in WisdomTree’s cloud fund had been down on Tuesday. But it was not all Datadog’s fault.

Late on Monday cloud communications program maker RingCentral claimed Hewlett Packard Enterprise’s finance chief, Tarek Robbiati, will swap co-founder Vlad Shmunis as CEO later on this month. Shares of RingCentral had been down as substantially as 18%. Shmunis will continue being on RingCentral’s board and will get the title of govt chairman.

“Revenue cycles continue to be elevated vs . previous year, and client obtaining conclusions proceed to go by additional levels of acceptance,” RingCentral’s main economical officer, Sonalee Parekh, said on a conference phone with analysts. “We are also looking at fewer upsell inside our present base as customers have slowed using the services of and rationalized their employee counts.”

Like Datadog, Everbridge, whose application aids corporations answer to emergencies, reduced its growth anticipations for the complete year on Tuesday. It now sees a larger sized reduction than it had termed for three months in the past.

A weaker overall economy has led to “slower revenue of large discounts,” finance main Patrick Brickley mentioned on a conference connect with with analysts. Shares experienced slid nearly 24% when the stock strike a session lower of $22.17 for every share.

Enfusion, Snowflake, Monday.com, Domo, SentinelOne, Smartsheet, Elastic, Zscaler and GitLab have been all down at the very least 5% in Tuesday’s trading session, in addition to Datadog, Everbridge and RingCentral.

Look at: Cramer’s Mad Dash on Datadog: The sector has no appetite for a firm like that