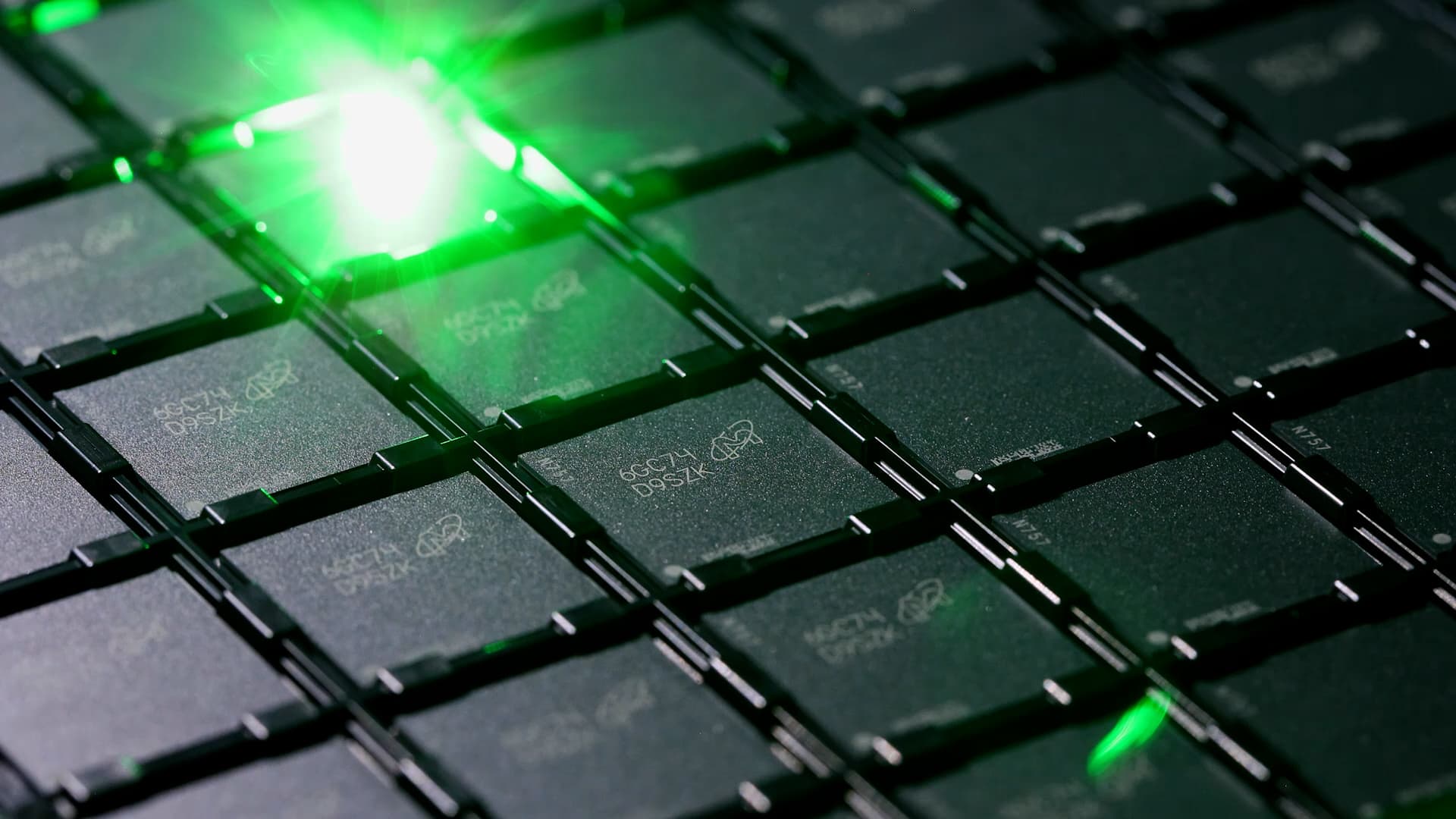

Citi predicts there is certainly potent growth in advance for memory chipmakers, driven by increasing desire for artificial intelligence programs. The Wall Street bank estimates that specialized memory and storage items intended for AI chips will claim a increased share of the complete current market, reducing volatility in the sector. Stock amounts for memory chips, these as generic DRAMs, attained multi-calendar year highs in the very first quarter of 2023. These kinds of higher inventory levels commonly drive down manufacturers’ pricing power. Citi estimates inventories have last but not least bottomed out following slipping by a third due to the fact the start out of last 12 months. The expenditure financial institution now expects earnings at chipmakers to rise as the current market recovers and diversifies to deliver extra bigger-conclude and advanced chips for AI programs. “We hope memory items to come to be semi-customized as AI memory products and solutions lead to elevated item diversification and complexity likely ahead,” said Citi analysts led by Peter Lee in a be aware to clientele on Jan. 1. “As these kinds of, the memory market place will likely develop in the path of higher product or service optimization in order to meet up with consumer desires, similar to the foundry current market.” Citi advised traders that the shares listed below would gain from the trend. Two specialised memory chips, superior bandwidth memory (HBM) and multi-ranked buffered DIMMs (MRDIMM), will be commonly adopted thanks to their suitability in AI purposes, in accordance to Citi. HBM delivers far more bandwidth to accelerate parallel computing, though MRDIMM supports expanded memory capability. Citi expects these chips to develop from 3.8% of whole DRAM shipments in 2024 to 8.8% in 2027. SK Hynix and Micron are equally probably to profit from expansion in these “semi-custom-made” memory chips, according to Citi. The expenditure financial institution expects SK Hynix and Micron Technological know-how shares to rise by 63% and 11%, respectively, around the subsequent 12 months. AI processing is also shifting outside of centralized server farms into consumer units like PCs and mobile telephones. Citi predicts new memory chips will arise to empower on-unit AI, presenting low energy attract and large bandwidth. Dell is also one of the most “active” providers building next-generation memory chips for slender laptops termed “Compression Connected Memory Module.” Citi expects shares of the Personal computer maker to increase by 9.8% to $84 more than the up coming 12 months, aided by this trend.