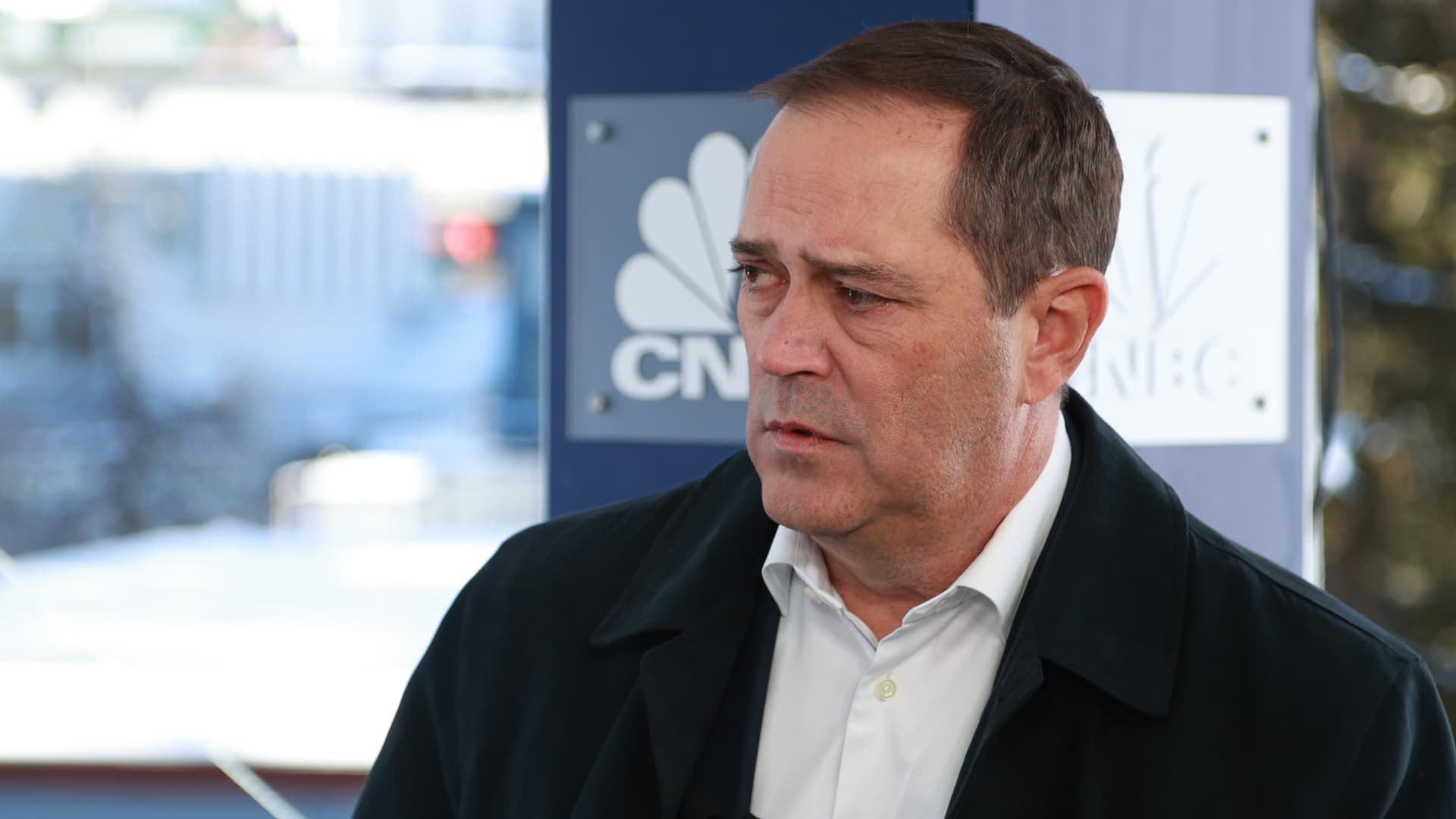

Chuck Robbins, CEO & Chairman of Cisco, speaking on Squawk Box at the WEF in Davos, Switzerland on Jan. 18th, 2023.

Adam Galica | CNBC

Cisco shares have been down as considerably as 13% in prolonged buying and selling on Wednesday after the networking hardware maker issued a glum forecast for the present-day quarter and the total fiscal calendar year.

Here’s how the firm did, compared to the consensus between analysts surveyed by LSEG, previously acknowledged as Refinitiv:

- Earnings: $1.11 for every share, modified, vs. $1.03 for every share predicted

- Earnings: $14.67 billion vs. $14.61 billion expected

Revenue greater by 7.6% in the fiscal to start with quarter, whcih finished on Oct. 28, according to a statement. Internet cash flow, at $3.64 billion, or 89 cents for each share, rose from $2.67 billion, or 65 cents for each share, in the calendar year-in the past quarter.

For the duration of the quarter new item orders slowed down, primarily since purchasers are busy putting in and utilizing products and solutions soon after potent shipping and delivery in the a few prior quarter, Cisco stated in the statement. The company is projecting that a person or two quarters of delivered merchandise are waiting around to be implemented.

With respect to steering, Cisco named for 82 cents to 84 cents in altered earnings per share on $12.6 billion to $12.8 billion in the fiscal second quarter. That indicates a 6.6% profits decrease. Analysts polled by LSEG had anticipated 99 cents in adjusted earnings for each share on $14.19 billion.

Cisco reduced its comprehensive-calendar year forecast for revenue but bumped up its watch for earnings. The business now sees $3.87 to $3.93 in altered earnings per share on $53.8 billion to $55.0 billion in revenue. In August, it was searching for $3.19 to $3.32 in altered earnings for every share and $57. billion to $58.2 billion in profits. Analysts surveyed by Refinitiv had expected $4.05 in adjusted earnings per share and revenue of $57.76 billion.

Executives will explore the results with analysts on a conference phone setting up at 4:30 p.m. ET.

Notwithstanding the just after-hrs go, Cisco share have climbed 12% so much this yr, trailing the S&P 500 index, which is up 17% in excess of the similar period of time.

Check out: Cisco earnings on the deck: This is what to look at