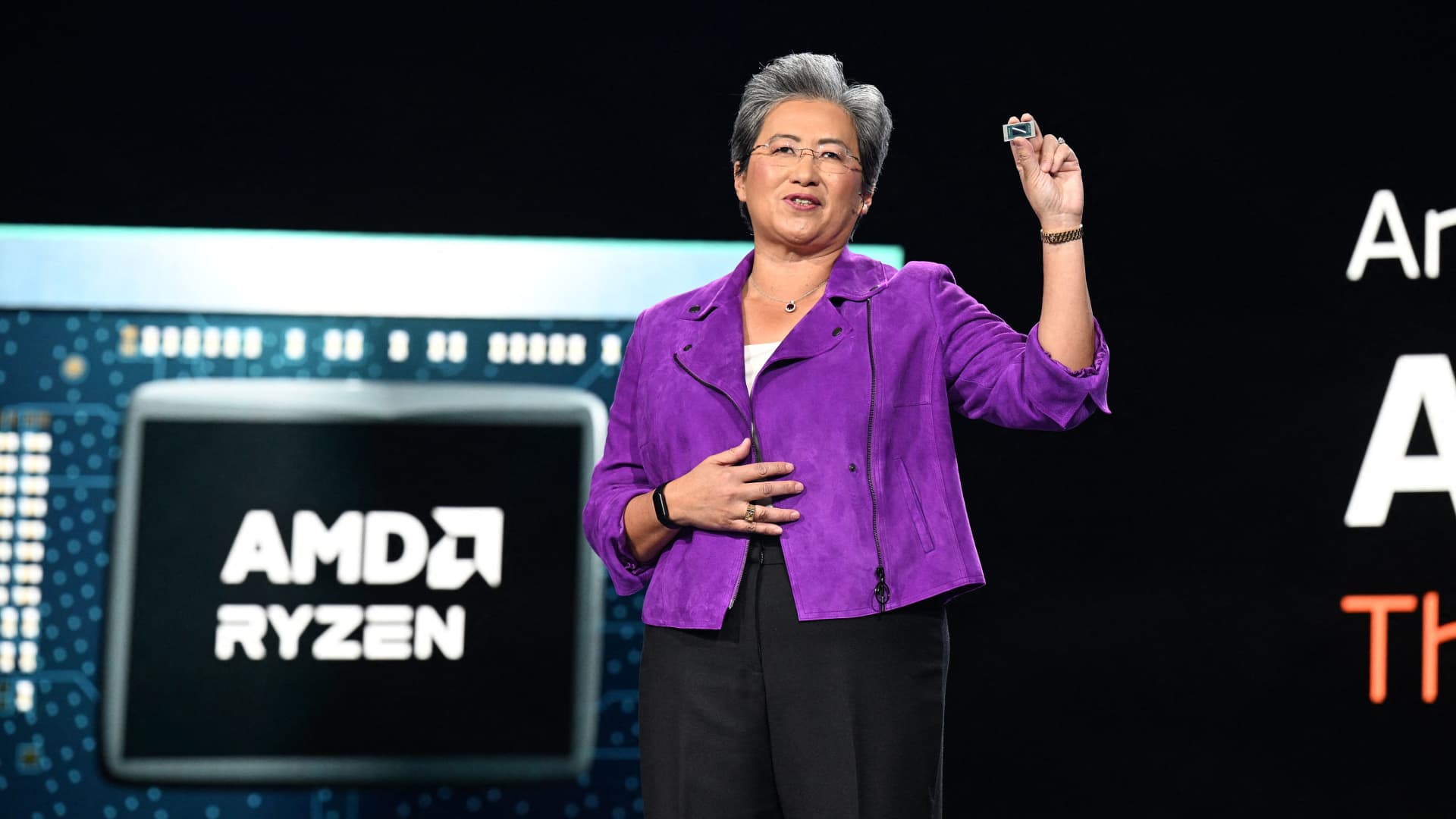

AMD Chair and CEO Lisa Su speaks at the AMD Keynote address through the Purchaser Electronics Clearly show (CES) on January 4, 2023 in Las Vegas, Nevada.

Robyn Beck | AFP | Getty Illustrations or photos

Semiconductor stocks rose on Wednesday on the back of AMD’s sturdy earnings report and following the Federal Reserve’s determination to boost the federal money level by .25 proportion position.

Despite the fact that the Fed said it expects ongoing fee will increase, it also stated that inflation has eased somewhat, resulting in a rally in riskier stocks this sort of as chipmakers.

AMD stock acquired above 12% on Wednesday. Nvidia sophisticated 8%, Qualcomm rose underneath 4%, and Broadcom attained 3%. Intel, which reported disappointing earnings previous thirty day period, rose much less than 3%. GlobalFoundries, an independent chip company, rose around 6%.

The VanEck Semiconductor ETF, which tracks a basket of chip shares, was up 4.7% on Wednesday.

On Tuesday, AMD noted December quarter earnings that defeat expectations. The company indicated a weak outlook for the January quarter, nevertheless was additional optimistic about demand from customers in the next fifty percent of 2023.

However, AMD’s report experienced a a lot rosier outlook on the general semiconductor industry than Intel’s earnings report in January, which prompt collapsing demand from customers for its goods.

The semiconductor marketplace is dealing with quite a few complications at the moment, together with a glut of added components at Computer and server makers, and slipping costs for certain parts like memory and central processors.