The world chip shortage will carry on, and people will have to spend for it, an analyst from the Global Knowledge Company claimed.

Sasirin Pamai | Istock | Getty Photographs

The U.K. federal government has blocked the takeover of the country’s premier microchip manufacturing unit by a Chinese-owned company in excess of worries it may undermine countrywide security.

Grant Shapps, minister for business enterprise, energy and industrial strategy, on Wednesday purchased Dutch chipmaker Nexperia to market its vast majority stake in Newport Wafer Fab, the Welsh semiconductor firm it obtained for £63 million ($75 million).

Nexperia is based mostly in the Netherlands but owned by Wingtech, a partially Chinese state-backed corporation outlined in Shanghai. Nexperia done its acquisition of Newport Wafer Fab in 2021, and the company subsequently changed its identify to Nexperia Newport Confined, or NNL.

“The buy has the result of demanding Nexperia BV to promote at the very least 86% of NNL in just a specifified period and by subsequent a specified system,” the U.K.’s Division for Business, Power and Industrial Tactic claimed in a assertion.

Nexperia had to begin with owned 14% of Newport Wafer Fab but on Jul. 5, 2021, upped its stake to 100%.

A Nexperia consultant was not immediately readily available for remark when contacted by CNBC outside the house of regular enterprise several hours.

Governing administration officials and lawmakers expressed concerns that the U.K. was promoting a prized asset to a Chinese-owned organization at a time of worldwide shortages in semiconductors, which are even now ongoing and envisioned to very last right up until 2024. A nationwide stability probe into the deal was released before this calendar year.

The British government claimed Wednesday that the area of the Newport facility, aspect of a strategically crucial cluster of semiconductor experience in Wales, was ultimately a national safety problem.

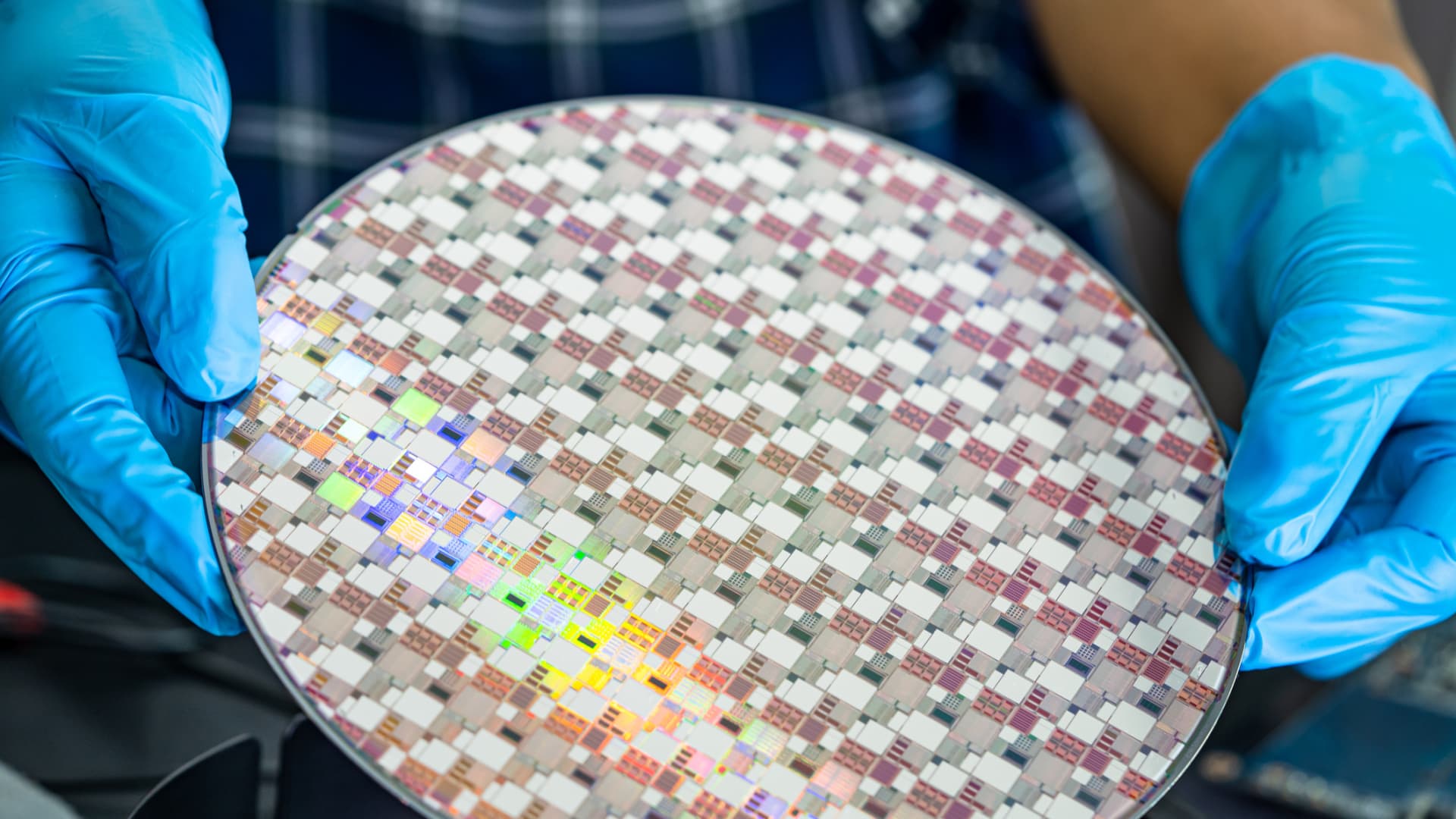

Even though not a particularly large firm, Newport Wafer Fab operates Britain’s premier chipmaking facility, making some 32,000 silicon wafers every month.

Nations are significantly searching for to claw again command of strategically crucial industries this kind of as semiconductors after prevalent offer chain disruptions exposed an overreliance on China as a world production hub.

The shift could further sour U.K.-Sino relations, which are by now at a reduced stage adhering to moves from London to ban Huawei 5G machines and grant people today in Hong Kong specific British visas that would eventually lead to citizenship.

The U.K. has previously investigated Nvidia‘s acquisition of Arm, a crucial chip layout enterprise, over national protection problems. The acquisition was shelved by the U.S. semiconductor huge in February.