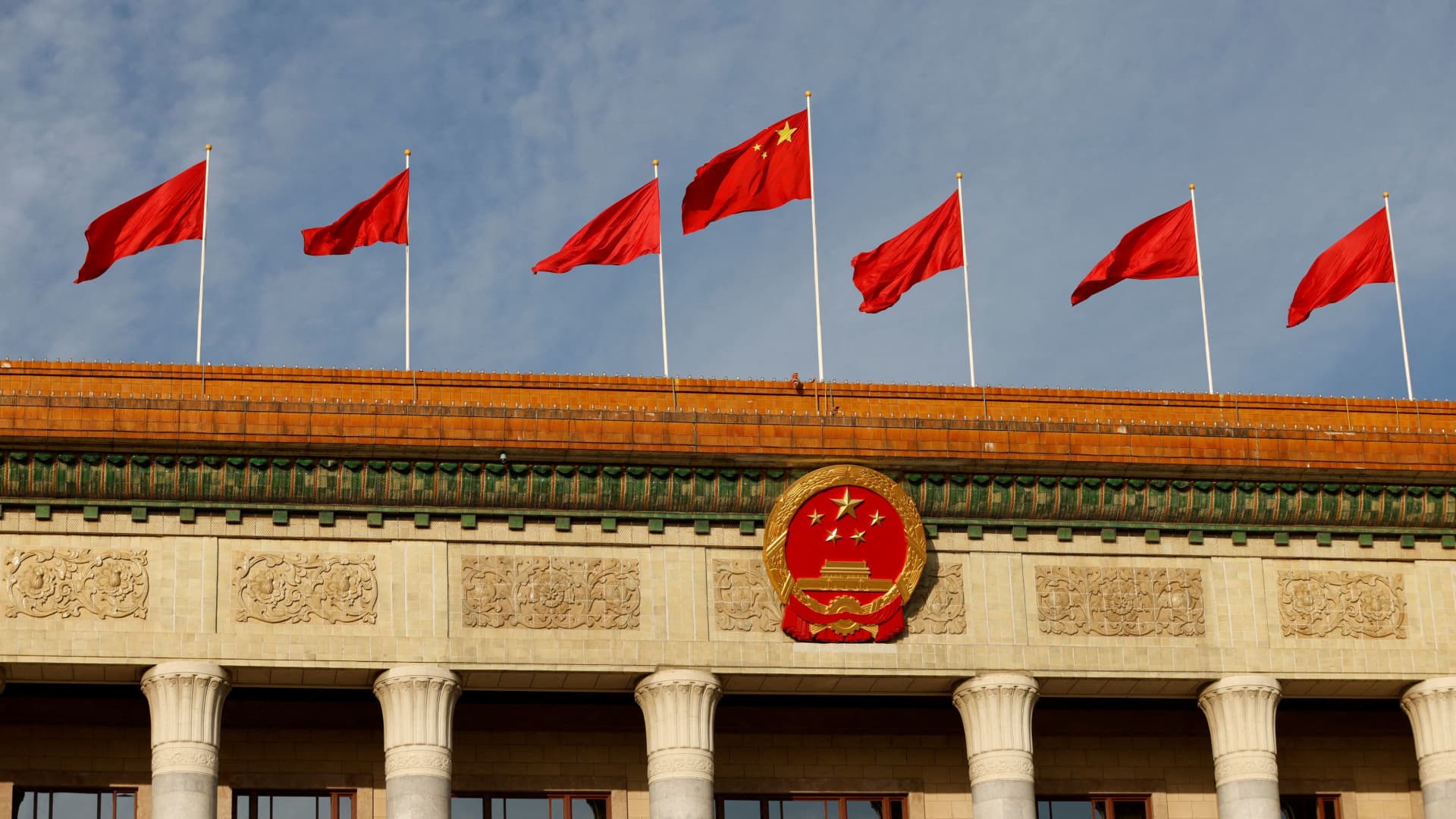

A Chinese flag flutters on prime of the Wonderful Hall of the Folks ahead of the opening ceremony of the Belt and Street Discussion board (BRF), to mark 10th anniversary of the Belt and Road Initiative, in Beijing, China Oct 18, 2023.

Edgar Su | Reuters

BEIJING — China is set this week to kick off its once-a-year parliamentary meetings, which traders are observing intently for indicators on financial stimulus.

The country’s gross domestic product grew by 5.2% in 2023, but over-all recovery from the Covid-19 pandemic was slower than quite a few experienced expected. A extended slump in the massive genuine estate marketplace and falling world-wide demand for Chinese exports have contributed to low stages of client and business sentiment.

That is all led to concerns around irrespective of whether Beijing will phase in with massive-scale support. So significantly, authorities have been relatively reserved.

Beijing signaled in December that any new coverage assist would be “correct,” explained Wang Jun, chief economist at Huatai Asset Administration, incorporating “there’s no way” that stimulus would be as huge as it was in 2008. Which is according to a CNBC translation of his Mandarin-language remarks.

China’s financial coverage is normally set at an annual assembly in December by leaders within the ruling Communist Get together of China.

The meetings this thirty day period, acknowledged as the “Two Sessions,” are at the govt, alternatively of get together, stage and typically launch extra information on policy plans, these as the GDP concentrate on for the year.

Wang mentioned he is looking at for responses on authorities’ programs for the true estate sector, funds markets and local govt finances.

Back in 2008, when the earth was reeling from the economic disaster, China unleashed a huge stimulus deal to maintain expansion with better demand. Although the financial system rebounded, the steps drew criticism for a ensuing surge in area governing administration financial debt.

Beijing in new several years has emphasised the will need to stem fiscal hazards and clamped down on authentic estate developers’ large reliance on credit card debt for development, an problem tied to community authorities finances. This time close to, China’s monetary policy also faces constraints on how far it can deviate from the U.S. Federal Reserve’s interest rate path.

GDP and other economic targets

The Chinese People’s Political Consultative Convention, an advisory physique, is established to kick off its annual assembly on Monday.

The following working day the National People’s Congress legislature is due to commence its assembly. Tuesday is also when the country’s premier is envisioned to share the year’s targets for GDP, employment and other financial indicators in what’s called the “Government Work Report.”

“The concentrate on will most likely remain reasonably superior,” stated Lender of China’s main researcher Zong Liang, noting GDP grew by 5.2% final yr. Which is according to a CNBC translation of his Mandarin-language remarks.

He expects the goal for the fiscal deficit will be around 3.5% and that financial coverage will also be reasonably loose.

China in Oct made a scarce announcement that it was elevating the fiscal deficit to 3.8%, from 3%.

“We count on the on-spending budget deficit – which excludes special bonds, policy bank bonds, and local federal government funding vehicle (LGFV) financial debt – to be set at 3.%-3.5% of GDP, narrowing from past year’s 3.8% of GDP,” Louise Bathroom, lead economist at Oxford Economics, said in a report Thursday.

“We expect a modest action-up in the local govt unique bonds (LGSB) quota, to RMB4.0tn from RMB3.8tn previous yr,” Loo said. “Authorities may also lastly set pen to paper on the noted RMB1tn in planned central government special bonds (CGSBs), reflecting the rising job of central coffers amid a continued personal debt cleanup process among the nearby governing administration entities this yr.”

“On stability, the added fiscal impulse this 12 months, assuming a bazooka-like fiscal package deal is not forthcoming, is not likely to be specifically massive.”

Watching for comments on genuine estate and tech

The Two Classes is also a period of time for releasing the budget and for delegates to go over wanted plan improvements and designs.

“Speeches by best policymakers will be critical to enjoy, like interviews of key ministers, these types of as Minister of Industry and Data Engineering, Minister of Science and Technological innovation, and Minister of Housing and City-Rural Development. These essential ministers will talk about a variety of guidelines in far more element,” Goldman Sachs analysts said in a report.

During the parliamentary conferences, Chinese officers will likely also go over plans to bolster tech and innovation, in line with a new substantial-stage contact to bolster “new successful forces.”

China’s international minister and leading typically maintain press conferences in the course of the parliamentary conferences, which frequently conclude in mid-March. The advisory body is established to conclude its annual assembly on Sunday, March 10, in accordance to an formal announcement. The Nationwide People’s Congress usually ends one particular working day later, but no day has been confirmed however.

Lender of China’s Zong expects that policymakers will send out indicators on opening up borders or other business possibilities to foreigners, as nicely as improving the environment for non-point out-owned enterprises.

Nevertheless, specific implementation aspects are usually remaining to specific ministries to announce, pursuing large-amount directives from Beijing.

Any direct guidance for use is unlikely, but broader moves to increase the social security web would be of note.

“On the demand facet, the delayed Third Plenum [of the Chinese Communist Party’s Central Committee] (initially set for December) implies that for a longer time expression demand procedures – which include on fiscal, tax, and pensions reforms – may possibly continue to be in initial stages of dialogue, but could nonetheless warrant a mention right here,” Loo said.

The macro context

This year’s Two Periods adhere to regular leadership reshuffles that have strengthened the ruling Communist Get together of China’s management of the govt.

At the parliamentary meeting final calendar year, Beijing announced an overhaul of finance and tech regulation by creating occasion-led commissions to oversee the two sectors. Chinese President Xi Jinping, who is also the party’s common secretary, attained an unparalleled 3rd term as president.

No key Chinese authorities or party management positions are scheduled to improve this yr, though the U.S. is established to keep its presidential election in November.

Considering that very last summer, Chinese authorities have presently announced a slew of guidelines to bolster growth and acknowledged the want to enhance self-confidence. Critics say the steps are comparatively piecemeal.

New financial info releases point to a blended picture for expansion, with some enhancement in producing but actual estate at finest only stabilizing.

Huatai’s Wang expects the economy will get better steadily this calendar year, and that in contrast to previous 12 months, nominal GDP will be superior than serious GDP. That suggests the perceived advancement this calendar year will be far more tangible for consumers and corporations.